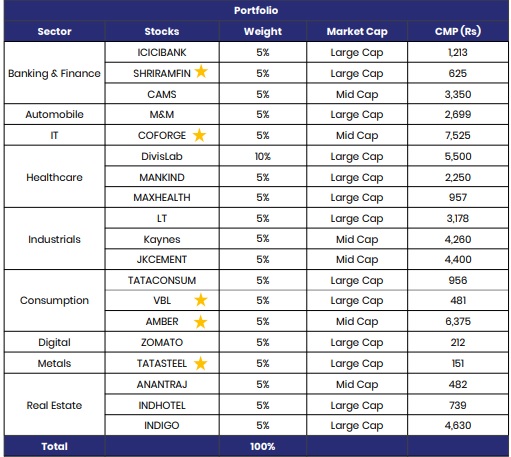

MOst Signature Model Portfolio March 2025 by Motilal Oswal Wealth Management Ltd

ICICI Bank

Key Rationales

• ICICI Bank is expanding its digital ecosystem and managing rising unsecured loan delinquencies. It maintains a stable deposit base, with a CASA ratio of 39%, ensuring liquidity strength

• In Q3, Advances rose 13.9% YoY, led by retail and corporate segments, while deposits grew modestly at 14.1% YoY. It maintained a strong contingency buffer of INR131b (1% of loans).

• We estimate ~17% loan CAGR over FY24-27E & With steady RoA/RoE projections of 2.2%/16.8% for FY27 along with stable NIMs and investment in technology, ICICI Bank remains a top pick for its resilient performance and growth potential.

Shriram Finance

Key Rationales

• SHFL is well-positioned to capitalize on the recovery in vehicle finance, particularly as demand for commercial and passenger vehicles gains momentum.

• With a diversified lending portfolio, the company is set to benefit from lower borrowing costs, which will enhance net interest margins and profitability.

• Diversified product suite helped it mitigate the CV business cyclicality. Its strong focus on asset quality & collection efficiency suggests that it is well-prepared to navigate the evolving credit environment. We expect 18%/19% AUM/PAT CAGR over FY24-27.

CAMS

Key Rationales

• Management targeting a 30%+ growth rate in Non-MF business led by robust products such as CAMSPay, KRA and AIF. Recent correction gives an opportunity to buy given its duopoly nature, high entry barriers, low risk of mar. share loss and high cust. ownership.

• We expect revenue/PAT CAGR of 18%/23% over FY24- 27E but factor in near-term yield compression. CAMS recently formed a JV with KFin Technologies to operate MF Central, a unified platform for mutual fund investors.

• This JV, with a 50:50 revenue split, aims to enhance operational efficiency. With a duopoly market position and rising Non-MF contributions, we reiterate a BUY.

Coforge

Key Rationales

• Coforge strong growth momentum is likely to sustain, driven by ServiceNow & Microsoft partnerships, "Quasa" AI platform, & hyperscale & AI rising demand. The USD2b revenue mark is progressing at a rapid pace.

• Recent deal win engine remains the best-in-class, with a 2nd consecutive quarter of USD500m+ deal wins. Performance was strong across verticals, geographies, & service lines.

• We believe COFORGE's strong executable order book and a rebound in BFS client spending bode well for its organic business. We expect 4QFY25 YoY growth of 52%/ 48.5% in revenue/PAT. Reiterating our BUY rating, reflecting confidence in its industry-leading growth trajectory

Mahindra and Mahindra

KeyRationales

• M&M, a leader in automotive and farm equipment, benefits from strong rural demand & new product launches. It maintains a solid presence in passenger vehicles, light commercial vehicles, & tractors.

• Auto volumes rose 17% YoY, while tractors posted a strong 20% YoY recovery in 3Q. While it exceeded its FY24 RoE target of 18%, management remains committed to 15-20% EPS growth and sustained profitability.

• The budget's focus on electric vehicles (EVs) supports M&M’s EV initiatives, while increased agri spending & rural push could drive tractor demand, benefiting its farm equipment seg. We estimate M&M to post a ~13%/16%/15.5% CAGR in revenue/EBITDA/PAT over FY24- 27E.

Divi's Laboratories

Key Rationales

• DIVI gained market share in APIs and is focusing on backward integration and DMF filings for upcoming patent expiries, targeting a 10.2% revenue CAGR to INR44b in generics over FY25-27.

• CS sales grew 50.4% YoY in 9MFY25 to INR35b, driven by new orders from innovator pharma companies. DIVI’s capabilities in peptides and contrast media position it well for a 24.5% CS sales CAGR over FY25-27.

• With INR36b cash and Unit 3 freeing capacity, growth prospects are robust. We estimate 25% earnings CAGR over FY25-27, citing capex plans & capacity expansions in GLP-1.

Mankind Pharma

Key Rationales

• Mankind Pharma’s diversified portfolio, which includes chronic therapies, consumer health, and exports, positions it for strong growth despite challenges in the prescription business.

• Consumer Healthcare sales grew 14.7% YoY in 9MFY25, supported by modern trade, e-commerce, and strategic launches like Manforce Epic. BSV’s Rx business restructuring is ongoing, with single-digit growth expected in FY25 and 15%+ growth in FY26.

• We expect a 20% earnings CAGR over FY25-27, supported by its strong focus on chronic therapies (niche) and exports.

Max Healthcare

Key Rationales

• Max Healthcare (MAXH) is a leading hospital chain with strong market presence, focusing on multispecialty tertiary care & diagnostics. It is expanding aggressively through brownfield and greenfield projects.

• MAXH plans to add over 3,600 beds in the next 3-4 years. Acquired Jaypee Hospital to enhance its North India footprint.

• Increased govt funding for medical infra, insurance penetration & PLI scheme for medical devices will drive public-private partnerships (PPP), enhance patient volumes, & reduce equipment costs. We expect a 17% revenue CAGR over FY25-27.

Larsen and Turbo

Key Rationales

• LT’s core order book grew 19% YoY, with 60% YoY growth in inflows to INR963b. Infrastructure prospects stand at INR4t, driven by transportation, water, and heavy civil projects.

• LT is progressing on green hydrogen (INR3b PLI incentives) and semiconductor designs, with potential in-house fab manufacturing in the long term. Post state elections, capex has picked up which alleviated concerns about domestic weakness.

• LT raised its FY25 guidance, with INR 987b inflows and a robust INR 5.5t order pipeline boosting revenue visibility. We maintain a BUY rating, supported by a strong order pipeline and NWC improvements.

Kaynes Tech India

Key Rationales

• KAYNES is expanding into North America, Europe, and South Asia, focusing on ODM and high-margin businesses. Capex of INR23b for semiconductor projects is supported by government subsidies.

• Orders from industrials, EVs, aerospace, and automotive sectors are expected to materialize from 4QFY26. Smart Meters, Railways, and Semiconductor projects (OSAT, HDIPCB) are key growth drivers, with significant revenue contributions from FY26 onwards.

• With a projected 56%/62%/68% CAGR in revenue/EBITDA/PAT over FY24-27, we reiterate BUY, citing margin expansion led by increased traction in high-margin verticals.

JK Cement

Key Rationales

• JKCE acquired a 60% stake in Saifco Cement (0.42mtpa capacity) for INR1.74b, targeting operational efficiency improvements and EBITDA/t increase by INR400. SGST benefits till 2031 and mining reserves till 2046 add long-term value.

• FY25/26 capex of INR19b/INR17b focuses on Panna expansion (3.3mtpa clinker) and new grinding units. Fujairah plant EBITDA improved to INR240m in 3QFY25, with white cement diversification mitigating Asian Paints’ competition.

• We forecast a 12%/26%/33% revenue/EBITDA/PAT CAGR over FY25-27, with margins improving to 16-17% by FY27. Despite rising net debt, we reiterate BUY (11x Dec'26E EV/EBITDA), citing demand recovery, cost efficiency and pricing initiatives.

TATA Consumer Products

Key Rationales

• TATACONS maintains competitive pricing with calibrated hikes covering 40% of cost increases, balancing volume and value growth while prioritizing long-term competitiveness in the Indian tea market.

• E-commerce grew 59% YoY, now contributing ~15% of revenue, slightly above Modern Trade (14% growth). New channels in Food Services and Pharmacies are progressing well.

• Margin expansion in the UK, Canada, and US has driven strong performance in the International business, supported by structural changes. We reiterate BUY, expecting 10%/9%/13% revenue/EBITDA/PAT CAGR over FY24-27.

Varun Beverages

Key Rationales

• The upcoming summer season is expected to be a significant driver of Varun Beverages' volume growth. The recent stock price correction makes the valuation attractive & risk-reward favorable.

• The Indian beverage market remains largely untapped & continues to grow, with VBL's growth trajectory unaffected by rising competition. Increased competition will strengthen & expand this market segment.

• VBL is poised to sustain its earnings growth, with 17% PAT CAGR over FY24-26 driven by increased penetration in new African markets, stable domestic growth, continued expansion in distribution and growing refrigeration in rural areas.

Indigo

Key Rationales

• India’s domestic PAXS grew 11% YOY in Jan’25 to 14.6m. INDIGO reported a strong performance, carrying 9.5m passengers, reflecting a 20% YoY increase and showcasing its expanding reach and growing demand.

• INDIGO further strengthened its leadership with a market share of 65.2% rising 490bps YoY. It has maintained 60% share since the collapse of GoFirst, benefiting from sustained capacity expansion.

• INDIGO expanded its network, adding 4 international and 2 domestic destinations, working relentlessly to enhance its international presence and adjusting schedules to reassure customers Ancillary revenue, including cargo, continues to grow. Trading at ~17x FY26E EPS, we remain bullish, citing s tremendous potential in Indian aviation

Amber Enterprises India

Key Rationales

• Amber Enterprises is a leading Indian contract manufacturer for RAC and components, with growing capabilities in EMS. It benefits from strong client additions and industry demand tailwinds.

• Q3FY25 revenue grew 65% YoY, driven by RAC & electronics. Future growth is supported by capacity expansion. Amber is expanding its EMS segment, investing INR 6.5B in Ascent Circuit, and participating in India’s component PLI via a JV with Korea Circuit.

• Govt push for domestic manufacturing and potential incentives for electronics could benefit Amber. We estimate a revenue/EBITDA/PAT CAGR of 26%/33%/62% over FY24-27.

Zomato

Key Rationales

• Zomato's food delivery business remains stable, while Blinkit represents a transformative opportunity to disrupt industries like retail, grocery, and e-commerce.

• While profitability may face near-term pressure due to QC expansion, Blinkit’s growth potential highlights a significant opportunity.

• Zomato is well-positioned to capitalize on this by expanding its customer base, increasing order volumes and values, and enhancing unit economics and profitability over the long term. It is expected to achieve PAT margins of 3.5%/6.8%/9.9% in FY25E/FY26E/FY27E, respectively

TATA Steel

Key Rationales

• Tata Steel's long-term outlook remains strong despite lower realizations. Recent budgeted consumption push, should benefit steel industry. Also, China’s plan to cut steel production can benefit large Indian players.

• The India business delivered a decent 3QFY25 performance, supported by cost efficiencies and strong volumes, while European operations showed reduced losses.

• We estimate EBITDA/APAT at INR260b/INR60b in FY25, improving to INR380b/INR120b by FY27 as European restructuring progresses and domestic demand strengthens. While NSR pressure persists, lower coking coal costs and cost optimization should aid profitability

Anant Raj Ltd

Key Rationales

• ARCP is transforming three tech parks into cuttingedge DCs, targeting 300MW capacity over 4-5 years. DC revenue is projected to grow from 6MW in FY24 to 307MW by FY32, with cloud services expanding to 77MW, driving EBITDA margins to 77% by FY30.

• The residential segment remains on track, with Navya-4 and The Estate Apartments launching in 4QFY25. ARCP’s residential business is expected to deliver 14msf over FY25-30, generating a cumulative NOPAT of INR75.3b, valued at INR380/share.

• It’s shift to Data Centre leverages India’s digital transformation & data localization trends. Reiterate buy, reflecting growth in DC & residential segments.

IHCL

KeyRationales

• Management expects double-digit revenue growth in FY25, supported by strong demand from weddings, tourism, and MICE segments.

• Indian Hotels delivered robust 3QFY25 results with consolidated revenue up 29% YoY, driven by 15% RevPAR growth, improved occupancy rates & strong metro city traction.

• With a robust pipeline of room additions and scaling new brands, IH is well-positioned for sustained growth. We expect revenue/EBITDA/PAT CAGR of 31%/34%/26% over FY24-27. We reiterate BUY, citing strong operational momentum and favourable demandsupply dynamics.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Aviation Sector Update : Air traffic rises MoM in Jan?26; IndiGo share dips YoY By Motilal ...

More News

Nifty immediate support is at 22950 then 22800 zones while resistance at 23350 then 23500 zo...