MOSt Advisor November 2025 by Siddhartha Khemka, Sr. Group Vice President, Head - Retail Research, Motilal Oswal Wealth Management Ltd

Siddhartha Khemka Sr. Group Vice President Head – Retail Research

Key Highlights

* Equities witness strong recovery in Oct’25

* Foreign outflows reduce while DII inflows stay resilient

* 2QFY26 progressing well, India-US negotiations key monitorable

Indian markets staged a smart comeback in Oct’25 and recorded the best MoM returns in the last seven months. Nifty 50 crossed 26k before ending 4.5% up MoM at 25,722. The broader market too saw significant gains, with Midcap 100 up +5.8% while Nifty Smallcap 100 up 4.7%, supported by renewed risk appetite and robust institutional flows. After three months of selling, FIIs outflows reduced to around Rs,2,350 crore, while the DII inflows remained resilient at Rs.52,800 crore into Indian equities. FIIs showed strong participation in the primary market (Rs.10,130 crore) during the month. On the macro front, the International Monetary Fund (IMF) raised India’s FY26 GDP growth outlook to 6.6% (from 6.4%) citing resilient consumption, investment, and policy support. Domestically, the RBI unveiled several regulatory measures aimed at strengthening financial stability – allowing banks to extend acquisition finance, lowering risk weights on infrastructure-linked NBFC loans, and permitting lending against shares – steps that should aid credit expansion and deepen financial markets. Global sentiments improved after the US Federal Reserve cut rates by 25 bps to 3.75–4.00% and announced that it would end Quantitative Tightening from Dec 1, 2025. While these steps signalled continued policy normalization and improved liquidity conditions, the Fed’s communication remained cautious, emphasizing data dependency and uncertainty around future cuts. Earnings momentum showed steady progress in 2QFY26. For the Nifty, earnings of the 27 companies that reported till 31-Oct-25, grew 5% YoY, in-line with our estimates of 6%. We expect overall Nifty PAT to grow around 6% YoY in 2QFY26 and EPS growth of 9%/16% in FY26/FY27. Across the Motilal Oswal Research coverage universe, earnings of 151 companies that had reported their numbers, grew 14% YoY, ahead of our estimate of 9%. Multiple mid-cap sectors clocked impressive growth, including PSU Banks, Real Estate, NBFCs, Technology, Cement and Metals. Overall, Indian markets appear to be in a better position vs. last year. The earnings cycle is bottoming out, supported by accommodative policy and sustained reform momentum. Further, any resolution of the India-US tariff negotiations would be a key external catalyst. The alignment of liquidity, policy, and earnings continues to provide a strong foundation for market resilience heading into second half of FY26.

Focus Investment Ideas

* “Focus Investment Ideas” highlight our Top Picks for the month.

* The report contains Investment Ideas under both large-cap and midcap space, along with their valuation summary and rationales.

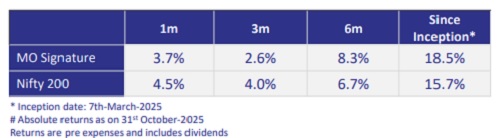

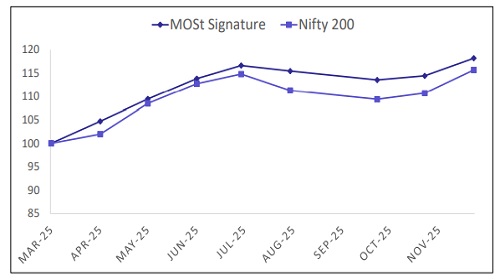

MO Signature - Model Portfolio

Portfolio Performance

NAV Performance

Equity Portfolio Review

What is Equity Portfolio Review?

Equity Portfolio Review is a comprehensive report that analyzes your client’s equity holdings and offers actionable insights. It evaluates each stock, reviews overall portfolio health, and suggests practical steps — whether to buy, hold, reduce, or exit. Think of it as a health check-up for your equity portfolio, backed by robust fundamental and quantitative research

Why Equity Portfolio Review?

* Markets evolve — and portfolios must too. This review helps you:

* Spot top and underperforming stocks

* Rebalance based on sector, stock, or market cap exposure

* Align portfolios with the client’s risk appetite

* Make informed, objective decisions

* Stay on track with long-term investment goals

How to Get Started:

* Using Equity Portfolio Review is simple:

* Login to Advisor Dashboard / Advisory Pro

* Enter the client code

* Select ‘Portfolio Review’

* Choose risk profile – Aggressive, Conservative, or Low Risk

Key Features at Your Fingertips:

* Comprehensive Portfolio Analysis – Investment, P&L, allocation by stock, sector, and market cap

* Stock-Specific Suggestions – Clear calls to buy, hold, reduce, or exit

* Backed by Rationale – Every recommendation explained

* Risk-Based Customization – Tailored to the client’s profile

* 2,500+ Stock Coverage – Research-driven, with both fundamental and quant views

Bonus Advantage

Even prospective clients can benefit—just upload their holdings from other brokers and showcase the power of the PR report. A great way to on-board with value

Do not let portfolios go unchecked. Bring clarity, control, and confidence to your client conversations with Equity Portfolio Review. Try it today—because better advice begins with better insights. Try the Equity Portfolio Review now

Pay Later (MTF)

Powering Your Capital

What is Pay Later (MTF)?

Pay Later (MTF) is a facility that allows you to invest in stocks by paying only a fraction of the total amount upfront. The remaining amount is funded by us. The stocks stay in your demat account (pledged), and you can continue to hold them by paying interest on the funded amount

Why Use Pay Later (MTF)?

* 4X Buying Power E.g., Invest Rs.4 lakh with just Rs.1 lakh

* Hold Beyond T+1 No square-off pressure like intraday trades

* Increase market exposure using the same capital

* Stocks Stay in Your Demat Account

* Access to a larger pool of 1000+ Stocks

See Pay Later (MTF) in Action:

Let’s say you have Rs.1,00,000 and want to invest in ABC stock

* With Pay Later (MTF), you can buy up to Rs.4,00,000 worth of ABC shares

* You pay Rs.1,00,000, and we fund the rest of Rs.3,00,000

* You pay interest only on the funded Rs.3,00,000

* You can hold the shares for 365+ days by maintaining minimum margin

Is Pay Later (MTF) Right for You?

Yes, if you fall in the below category:

* Are you looking to capture medium-to long-term opportunities?

* Do you want to capture market movements?

* Do you want to enhance your trading potential without deploying full capital?

Want to get started with Pay Later (MTF)?

To activate or check your eligible funding limit, connect with your advisor today. Pay Later (MTF) = More Exposure = More Flexibility = More Contro

Technical & Derivatives Outlook

* Nifty index picked up strength from the lower levels and drove past 26100 zones in October. It exhibited persistent bullish momentum throughout, showcasing a classic uptrend with strong advances. Minor dips were followed by quick rallies which pushed the index higher displaying resilience as call writers unwounded positions near resistance of 25900 to 26100 zones. October’s market breadth was mixed to positive, while the sectoral trend remained firmly bullish. Barring a slight decline in the Media sector, almost all other sectoral indices ended the month on a strong positive note. The PSU Bank, Realty, and Metal indices led the charge, emerging as the top performers of the month.

* Technically, Nifty formed a bullish candle on the monthly chart and has started to form higher highs – higher lows from the last two months. Now the index needs follow up buying to decisively hold above the 26K level mark. For October series, positional supports are seen at 25350 and then 25000 zones, while on the up side move could be seen towards 26277 then 26500 zones.

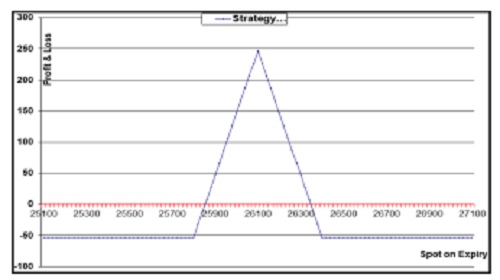

Derivative Strategy

Nifty

* Nifty index witnessed a strong rally during October and is comfortably holding at higher levels.

* It has formed a strong bullish candle on the monthly timeframe and appears poised to surpass its previous lifetime high.

* Maximum Put OI is gradually inching higher and now stands at the 26000 strike, while Call OI is concentrated near the 26500 zone.

* This setup suggests deploying a Bull Call Butterfly Spread to capitalize on the ongoing upside momentum along with a likely decline in volatility.

BUY 1 LOT OF 25800 CALL

SELL 1 LOT OF 26100 CALL

SELL 1 LOT OF 26100 CALL

BUY 1 LOT OF 26400 CALL

Margin Required : Rs. 85,000

Net Premium Paid : 50 Points (Rs. 3750)

Max Risk : 50 Points (Rs. 3750)

Max Profit: 250 Points (Rs. 18750)

Lot size : 75

Profit if it remains in between 25850 to 26350 zones

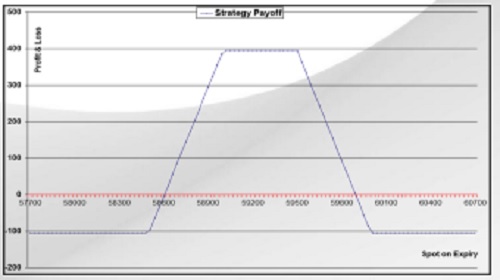

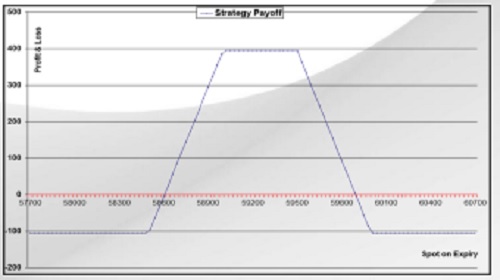

Bank Nifty

* Bank Nifty index is in strong uptrend and gave range breakout on monthly scale with strong bullish candle.

* Index is forming higher low structure on weekly scale as bigger trend is positive with overall buy on dips stance.

* Maximum Put OI is intact at 58000 levels while Call OI is at 60000 strike.

* Thus suggesting Bull Call Butterfly Spread to play the upside momentum with decline in volatility

BUY 1 LOT OF 58500 CALL

SELL 1 LOT OF 59000 CALL

SELL 1 LOT OF 59500 CALL

BUY 1 LOT OF 60000 CALL

Margin Required : Rs. 85,000 Net Premium Paid : 115 Points (Rs. 4025)

Max Risk : 115 Points (Rs. 4025)

Max Profit: 385 Points (Rs. 13475)

Lot size : 35 Profit if it remains in between 58115 to 59885 zones.

Commodities & Currency Outlook

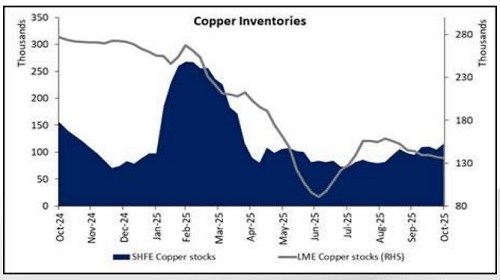

* Copper prices rallied above Rs.1000 and on LME above $11,000 supported by renewed confidence in trade negotiations and tightening supply dynamics.

* LME inventories have inched ~50% lower and SHFE is 43% lower, since the beginning of the year.

* ICSG indicated that global refined copper market posted an apparent surplus of 147,000 tons in the first eight months of 2025, down sharply from 477,000 tons a year earlier.

* 2026 forecasts still show deficit figures of 150,000 metric tons from the previously expected surplus of 209,000 tons due to slower production growth.

* World apparent refined copper usage rose 6% over the first eight months of 2025, while production grew by 4% in the same period.

* Glencore cut its 2025 output forecast to 850–875kt (from 890kt).

* Collahuasi mine issues in Chile offset strong output from Africa and Peru.

* While supply disruptions remain, some signs of weak domestic demand including diminishing Yangshan copper premium and contractionary PMI figures created some hiccups.

* Broader outlook remains bullish, with renewable energy and electrification keeping global demand strong.

* Copper prices are expected to trade in a higher range supported by constrained supply and firm demand for copper, while some dips may be seen as buying opportunity.

* MCX zinc prices rose 4.5%, supported by depleting LME inventories and growing investor sentiment.

* LME zinc stocks halved dropped to their lowest to a two year low of 38000 tonnes.

* LME Zinc Cash-3M flared out to $350 per mt this month, tightest since 1980, and continues to stay in backwardation, showing tight near term supply.

* Production outside of China has been falling with Toho Zinc's Annaka smelter in Japan and Glencore’s secondary zinc operations in Italy, shut down completely.

* A planned shutdown of Nyrstar’s Clarksville smelter in the US this October– November is expected to tighten supply further.

* Some zinc mines in northern China are expected to reduce or halt production starting in November.

* ILZSG estimated a global surplus of 85000 tonnes this year, tighter than the 185,000 MT surplus a year earlier.

* A 6.3% increase in mined zinc output this year is reported, but refined production fell by over 2% due to bottlenecks at refineries, particularly in Kazakhstan and China.

* Zinc prices are expected to trade higher supported by low inventories and tightening supply woes, while some pressure from rising DXY may cap gains.

Commodities & Currency Outlook

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty, Bank Nifty, Fin Nifty & NIFTY Midcap Expiry Report 28th October 2025 by Motilal Oswal...