India Strategy : Earnings cuts give way to earnings raises by Motilal Oswal Financial Services Ltd

STRATEGY Earnings-20251223-MOSL-SU-PG012.pdf

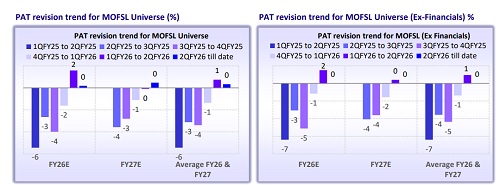

First instance of aggregate earnings upgrade in five quarters

* Our analysis of recent earnings revisions for MOFSL universe reveals that the past trend of easing earnings cuts’ intensity has gradually given way to earnings raises. For the three months ending 2QFY26 earnings season, the aggregate FY26 PAT estimate of MOFSL universe was raised by 2% – the first instance of an upgrade since the end of 1QFY25 earnings season – comparing favorably to the earlier readings of -6%/-3%/-4%/-2% for the three months ending with earnings season of 2QFY25/3QFY25/ 4QFY25/1QFY26. Mid-caps posted maximum earnings upgrades at 3.1%, while large-caps were also strong at ~2%. Small-caps were the laggards, with continuing downgrades of 5.5%. This momentum has continued post the 2QFY26 earnings season as well. FY27 PAT estimates for the MOFSL universe were albeit flat in 2QFY26 (but raised by 0.5% post 2QFY26). Nonetheless, the trend of easing intensity of earnings cuts has been evident for FY27 estimates as well, with readings of -4%/-3%/-1%/0% in 3QFY25/ 4QFY25/1QFY26/2QFY26.

* Earnings revision trends in the past four months beat our expectations. In an earlier note in Sep’25 (Link), we highlighted that the intensity of earnings cuts had been moderating and posited that a large part of the cuts was already behind, with a stable earnings floor likely to lend support to the equity market. In fact, our expectations have been exceeded, with the recent round of overall FY26 MOFSL PAT rise of 2% and various Indian benchmark indices rising between 1%-4% during this period. Even after the end of 2QFY26 earnings season, upgrades to MOFSL PAT estimates have continued – albeit at an understandably modest level of 0.2%/0.5% for aggregate FY26/FY27 PAT est.

* Positive breadth in bigger sectors. On an overall basis, the sectoral breadth of earnings revision has been more favorable within larger sectors. Key sectors driving positive revisions were Oil & Gas (+13%), Telecom (+30%), PSU Banks (+5%), Insurance (+3%), and NBFC-non lending (+2%), while Utilities was the biggest drag (-8%), followed by Autos (-3%, but mainly owing to TAMO; excluding TAMO, Autos’ PAT was in fact revised upwards by 3%) and Healthcare (-3%). However, among the smaller sectors, more sectors saw higher aggregate downgrades vs. upgrades, led by Chemicals (-6%), Media (-9%), Staffing (-5%), and Cement (-4%). Within large-cap stocks, sectors with >1% aggregate earnings raise equaled those with earnings cut of <-1% by a ratio of 7:7, with PSU Banks, Insurance, Oil & Gas, Telecom, and Autos (ex-TAMO) posting meaningful upgrades, while the biggest drags were Utilities (-9%%), Real Estate (-5%) and Cons Durables (-3%). For mid-cap stocks too, the sectoral revision breadth was balanced at 8:9, but small-cap sectors languished the most with revision ratio of 2:17 and large cuts seen in Pvt Banks (-24%), Insurance (-18%), Retail (-15%), and EMS (-10%).

* Will this trend of earnings upgrade sustain? The backdrop for earnings has improved vs. last year, engineered by a series of stimulative fiscal and monetary measures. This has contributed to improved earnings revision outcomes over the past two quarters, culminating in an aggregate earnings upgrade in the past few months. Looking ahead, we currently forecast FY26/FY27 earnings growth of 12%/15% YoY and 15%/16% YoY for Nifty/MOFSL, which appears reasonably well poised, and revisions in either direction should not be too sharp from here, barring possibly for Nifty-50 FY26 PAT.

* Sub-10% nominal GDP growth not necessarily a very big concern for earnings. In this note, we also attempt to provide some perspective around a top-of-themind question for several investors: ‘Can corporate earnings grow at mid-teens when nominal GDP growth is expected to be sub-10%?’ Our analysis of the past two decades of annual growth data reveals that nominal GDP growth, while important for corporate activities, does not fully explain annual corporate profit growth. There is modest explanatory power of nominal GDP growth for the broader MOFSL universe’s annual PAT growth. Even for a narrower, large-cap universe, i.e. Nifty-50, nominal GDP growth explains ~20% of the profit growth for the observed period, as corporate profits get influenced by multiple other factors, like leverage, pricing power, cost pressures, irrational competition, etc. Even in a stretch case, the nominal GDP growth explains less than one-third of corporate profit growth. Hence, we believe that one should look beyond the GDP growth trajectory to assess corporate PAT growth.

* Share of corporate profits in GDP is not too high: Corporate profits’ share of GDP is not too high in India. In FY24 and FY25, Nifty-500 PAT was 4.7% of GDP, while overall corporate profits (listed + unlisted) stood at 7.3% of GDP, rendering corporate profits more cyclical compared to the steadier GDP growth trajectory. Moreover, the base effect has a greater impact on corporate profits. With FY25 MOFSL PAT growth at 6% YoY, there is a higher likelihood of midteens growth in PAT, even as nominal GDP grows at sub-10%.

* The US economy also displays limited correlation. We carried out this analysis for the US economy and observed that despite corporate profits forming a higher % of GDP in the US (averaging 11% for CY20-24), the explanatory power of GDP growth for corporate PAT growth was limited in the US as well. In fact, for a developed market like the US, this number was surprisingly low, clearly hinting at multiple other factors determining corporate profit growth.

* Our view: We have a positive outlook on Indian equities and believe that Indian markets are well poised to retrace the underperformance of CY2025, supported by better earnings prospects, supportive domestic macros, and improved geopolitical situation. Valuations, particularly for large-caps, are not demanding (Nifty PE at 21.3x vs. LT average of 20.8x), while earnings appear well poised to deliver mid-teens growth over FY26/27. The prevalent concerns of lower nominal GDP materially affecting corporate profit growth appear overblown to us, as corporate earnings are influenced by multiple factors beyond broad economic growth, which possesses limited explanatory power for corporate earnings growth. India could also benefit from the abatement of overexuberance of global AI stocks, which can prompt country rotation towards India within FII portfolios. A lower USDINR level may further offer an attractive entry point. Our key overweight sectors are Diversified Financials, Automobiles, Capital Goods, IT Services, and Telecom, while our key underweight sectors are Energy, Metals, Utilities, and Staples.

* Top Picks: Our top large-cap picks are Bharti, ICICI Bank, SBI, Infosys, L&T, M&M, Titan, Eternal, BEL, Indigo, TVS Motors, Tech M, and Indian Hotels. Our top midcap picks are: Swiggy, Dixon, Suzlon, Jindal Stainless, Coforge, Kaynes, Radico Khaitan, V-Mart, VIP Ind.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty Index Opens Gap Up by 150 Points, Rallies 340 Points - Motilal O...