India Strategy : Fundraising`24-25: Bigger, broader, and still accelerating! by Motilal Oswal Financial Services Ltd

Fundraising’24-25: Bigger, broader, and still accelerating!

Sparks and blips of the IPO juggernaut!

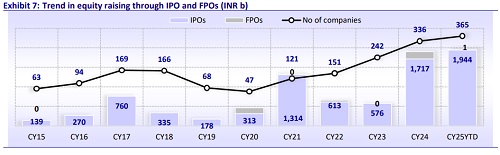

* The blockbuster years of fundraising through IPOs (2024-25): The Indian IPO market has experienced another blockbuster year in 2025, raising INR1.95t through more than 365 IPOs to date – at an all-time high. This achievement follows an impressive 2024, when the Indian IPO market flourished with issuances totaling INR1.90t across 336 IPOs. Notably, the main board’s contribution to total IPOs remains high at 94% in 2025 vs. 94.8% in 2024.

* Opportunities abound: This remarkable growth can largely be attributed to the evolving nature of Indian equities, which are introducing new dimensions to the investment landscape, underpinned by robust fund inflows. Over the past 24 months, IPOs have emerged from companies across a diverse range of sectors, rather than being confined to a select few or primarily emerging sectors, as was common in previous years. This diversification is, in our opinion, a positive indicator for the Indian capital markets, as it offers investors multiple opportunities to participate in India's growth narrative.

* In this report, we conduct an in-depth analysis of IPO, QIP, and OFS issuances over the past two years, examining their performance relative to their listing and offer prices.

The IPO story – a sneak peek: Mainboard leads

* During CY24-CY25YTD, the Indian primary market has recorded a fundraise of ~INR3.8t through 701 IPOs, compared to ~INR3.2t raised over CY19-23 via 629 IPOs.

* CY25 has been another impressive year for the Indian primary market, with INR1.95t raised through more than 365 IPOs to date, surpassing the previous record high of INR1.90t raised by 336 IPOs in CY24.

* During CY25, 106 of the 365 IPOs were listed on the main board, while 259 IPOs were listed through SMEs. The capital raised through mainboard IPOs amounted to INR1.83t vs. INR1.80t collected in the previous year. Notably, the contribution of the mainboard to total IPOs was 94% in CY25 vs. 94.8% in CY24. Over the last two years, mainboard IPOs dominated, raising INR3.6t (~94.4%) from just 198 companies out of a total of 701 companies.

* CY25 marked the fourth-largest IPO issue in India, with Tata Capital raising INR155.1b in Oct’25. The previous record was set by Hyundai in Oct’24 with a size of INR278.6b, followed by LIC in May'22 with a size of INR205.6b, and One 97 Comm. with a size of INR183b in Nov'21. Additionally, CY24 witnessed the largest FPO to date, with Vodafone Idea raising INR180b in Apr’24. This was preceded by Yes Bank's INR150b FPO in Jul’20 and ONGC's INR106.9b issue in Mar’04.

* The top-5 sectors accounted for more than 50% of the total IPO issuances in both years. However, the sector contributions varied each year. In CY25, NBFCs (26.6%), Capital Goods (9.5%), Technology (9.2%), Healthcare (6.4%), and Consumer Durables (6%) dominated the new listings. In contrast, CY24 was dominated by Automobiles (19.3%), Telecom (11.8%), Capital Goods (9%), Retail (8.7%), and ECommerce (7.6%).

* Interestingly, despite contributing nearly 18% of total capital raised in CY24, the Telecom, Utilities, and Private Banking sectors reported zero fundraising activity in CY25.

* IPOs by age and size – catch ’em young!... We analyzed IPOs by company age on an aggregate basis over the last two years and observed that young companies under 20 years of age contributed ~53% (INR2t) of the INR3.8t total IPO funds raised across India in the last two years, representing 508 listings.

* …and small: We categorized the stocks based on market capitalization into large-cap, mid-cap, and small-cap segments according to the capital raised through IPOs: above INR90k – large-cap; INR30-90k – mid-cap; below INR30k – small-cap companies. Notably, over the last two years, the capital raised by large-cap companies amounted to INR1,070b (27.8% of the total, from just seven companies); mid-cap companies raised INR788b (20.5%, from 13 companies); and small-cap companies raised INR1,978b (51.5%, from 676 companies).

* The contribution of new listings through IPOs to the Indian market capitalization remained strong at 3.1%, down from 3.3% in CY24. However, this contribution remains marked below the highs recorded in CY17 (3.7%) and CY21 (3.4%).

Overall IPO oversubscription at ~26.6x during CY24-CY25YTD

* On an aggregate basis, IPOs have been oversubscribed ~26.6x during the last two years, raising INR102.4t vs. the offer size of INR3.8t.

* Notably, mainboard IPOs experienced an oversubscription of 21.5x vs. SME oversubscription of 113.2x. In addition, large-cap, mid-cap, and small-cap stocks witnessed an oversubscription of 12.4x, 20.9x, and 36.7x, respectively.

* Sectors that experienced significant subscription levels against their offer sizes included Capital Goods (INR16.7t vs. offer size of INR355b), NBFCs (INR14.9t vs. offer size of INR635b), Healthcare (INR11t vs. offer size of INR234b), Technology (INR6.7t vs. offer size of INR238b), E-Commerce (INR5.6t vs. offer size of INR199b), Consumer Durables (INR5.2t vs. offer size of INR128b), and Automobiles (INR5.2t vs. offer size of INR463b) – refer to Exhibit 4.

* Of the total IPOs, 226 received an overwhelming response, with more than 100x oversubscription. Of these, 203 were from the SME space.

* Of the top 20 companies by size, two experienced more than 50x oversubscription, while one witnessed a response of less than 2x.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Credit market share of PSBs declined by around 4% between FY21 and FY25: Motilal Oswal Finan...