MCX Natural gas Oct is expected to rise towards Rs 298 level as long as it stays above Rs 279 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to extend its rally towards $3875 level on weak dollar and lower U.S treasury yields across curve. Further, expectation of sluggish growth in US job markets would also support the bullions to trade higher. Additionally, the risk of government shutdown ahead of October 1 funding deadline would provide support to the bullions. Geopolitical concerns and tariff uncertainty and increasing ETF inflows would also push the yellow metal to scale new highs. Meanwhile, investors will eye on speeches from the US Fed members to get more clarity on quantum of rate cuts in this year.

• MCX Gold December is expected to rise towards Rs 117,500 level as long as it stays above Rs 115,200 level

• MCX Silver Dec is expected to rise towards Rs145,500 level. Key support for the December futures exist near Rs 141,700 level.

Base Metal Outlook

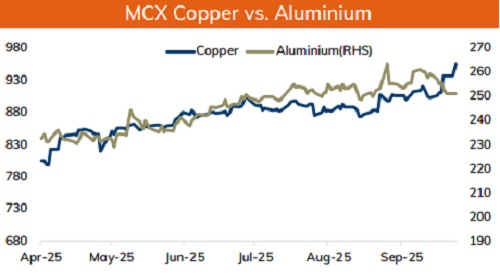

• Copper prices are expected to trade with a positive bias amid concerns over supply disruption in Mines and persistent decline in inventories at LME registered warehouses. Freeport-McMoRan has slashed its Indonesian mine production forecast and expects the mine could return to pre-accident operating rates in 2027. Prices would also get support amid soft dollar and growing bets of further monetary policy easing from the US Fed. Meanwhile, contraction in manufacturing activity in China and tariff concerns would hurt market sentiments.

• MCX Copper Oct is expected to hold its gains and rise back towards Rs 964 level as long as it stays above Rs 950 level. A move above Rs 964 it would open the doors towards Rs 970 level

• MCX Aluminum Oct is expected to rise towards Rs 260 level as long as it stays above Rs 254 level.

• MCX Zinc Oct looks to consolidate in the band of Rs 282 and Rs 288. A move above Rs 288 would extend its rally towards Rs 292 mark.

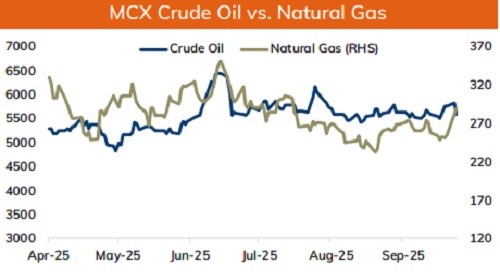

Energy Outlook

• Crude oil is likely to remain under pressure on expectation of another output hike form OPEC+ from November. Further, improving outlook for higher production of Iraq would also increase global supplies. The resumption of oil supplies from the Kurdish region via a pipeline to Turkey, which has been halted for past two years would improve supplies. Additionally, fears over US Govt. shutdown and expectation of sluggish job growth numbers would likely to weigh on oil prices. On the other hand, supply concerns from Russia on fears over sanction from NATO nations could limit its downside.

• MCX Crude oil Oct is likely to dip towards Rs 5500 level as long as it stays under Rs 5750 level. NYMEX crude oil is likely to slip towards $61, as long as it trades under $65 per barrel mark. Fresh addition of OI in ATM and OTM call strike suggest restricted upside.

• MCX Natural gas Oct is expected to rise towards Rs 298 level as long as it stays above Rs 279 level. Increasing electricity demand on forecast of warmer US temperature would support prices.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631