MCX Natural gas Jan is expected to face hurdle near Rs.360 and move lower towards Rs.327 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is expected to remain volatile amid sign of easing geopolitical tensions between Russia and Ukraine. US President Donald Trump has said peace talks with Ukrainian President have made a lot of progress, though the peace deal may take weeks. Ukrainian President Volodymyr Zelensky also agreed upon 90% of the framework and US-Ukraine security guarantee, though some key issue remain. An easing geopolitical risk could bring profit booking in the bullions. Meanwhile, For the day, spot gold is likely to remain in the band of $4470 and $4550 per ounce. Only a move below $4470 per ounce it would fall towards $4430 per ounce. MCX Gold Feb is likely to face strong resistance near Rs.140,400 and move lower towards Rs.136,800. A move below Rs.136,800, it would correct towards Rs.135,000.

* Spot International Silver is hovering near $77 per ounce after a fresh record high at $83.75. A move below the support of $75, would bring correction towards $72.50. MCX Silver March has support at Rs.230,000 level. A move below would weaken towards Rs.224,500.

Base Metal Outlook

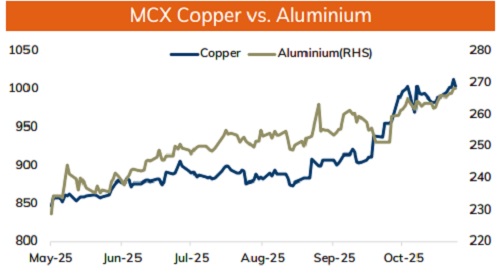

* Copper prices are expected to hold firm and trend higher, driven by acute supply tightness and robust demand from both China and the United States. A primary catalyst for this rally is the planned 10% output reduction for 2026 by China's leading copper smelters to address industry overcapacity and negative processing fees. Prices would also get support on concerns over potential US tariff reviews in 2026, which would again increase supply tightness in the global markets. Further, improved risk sentiments amid easing geopolitical risks and announcement of higher fiscal spending in the year 2026 by China would support demand outlook of the metal.

* MCX Copper January is expected to hold support near Rs.1250 and move higher towards Rs.1300 level. Only move below Rs.1250 level it may fall towards Rs.1230-Rs.1234 level.

* MCX Aluminum Jan is expected to hold support near Rs.294 and move towards Rs.305 level. Only a move below Rs.294 it would slip towards Rs.291. MCX Zinc is likely to remain the band of Rs.305 and Rs.315. Only a move above Rs.315 it would turn bullish towards Rs.320.

Energy Outlook

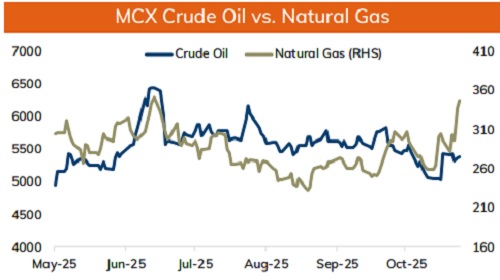

* NYMEX crude oil is expected to face hurdle near $59 per barrel and move lower towards $55 on sign of supply improvement. Easing geopolitical tension in Ukraine amid intensified efforts by US to end the war could ease restrictions on Russian oil exports. Furthermore, higher global supplies from OPEC+ and expectation of steady flows in the first quarter would limit its upside. On the other hand, expectation of strong demand from China, tension in Middle East and Venezuela could limit its downside

* On the data front, a strong put base at $55 would act as strong support. On the upside a strong call base at $60 would act as major hurdle. MCX Crude oil Jan is likely to face hurdle at Rs.5300 and move lower towards Rs.5100 level. Only move above Rs.5300 it would rise towards Rs.5380.

* MCX Natural gas Jan is expected to face hurdle near Rs.360 and move lower towards Rs. 327 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631