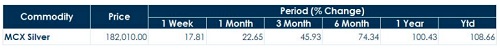

Silver Report On 02 December 2025 by Kedia Advisory

Fundamentals

Silver Skyrockets on Supply Crunch, ETF Surge and Strong Fed Cut Expectations

Silver has delivered a landmark 2025, doubling in value as a series of powerful catalysts aligned—starting with its US critical-mineral designation and tariff fears, repeated global short squeezes, decade-low Shanghai inventories, tight London vaults near 26,254 tonnes, and massive SLV inflows of 324 tonnes. Weak US data and rising Fed-cut expectations further fuelled momentum. With a strong cup-and-handle breakout above Rs 1,73,965, silver now appears firmly on track to test the Rs 2-lakh mark in 2025 if party continious.

Key Highlights

* Silver doubled in 2025 driven by powerful macro and structural catalysts.

* US critical-mineral designation triggered tariff fears and aggressive global hedging.

* London and Shanghai inventories hit decade-low levels, intensifying supply tightness.

* SLV ETF added 324 tonnes, signalling strong institutional accumulation momentum.

* Cup-and-handle breakout suggests silver may approach Rs 2 lakh near-term.

Silver has delivered one of its most extraordinary yearly performances in modern market history, doubling in value through 2025. MCX Silver surged nearly 20% in just 10 days, touching Rs 1,84,000/kg, while global spot silver rallied 21% over the same period. This explosive rise is the result of multiple high-impact triggers—US critical-mineral designation, tariff fears, repeated short squeezes, chronic global supply tightness, and powerful ETF inflows, all occurring in quick succession. The rally gained further steam as technical charts confirmed a cup-and-handle breakout, signaling sustained bullish momentum.

The primary drivers include institutional investors, ETF participants, industrial consumers, and global hedge funds reacting to sudden supply constraints. The iShares Silver Trust (SLV) alone added 324 tonnes this week, marking its heaviest inflow since July and pushing SLV’s holdings to 47.5% of all silver stored in London’s vault network. Traders on COMEX, Shanghai Futures Exchange, and MCX have aggressively increased exposure amid tightening global inventories and rising tariff risks.

The sharpest acceleration began soon after the US Geological Survey added silver to the official Critical Minerals List, triggering expectations of future tariffs, export controls, and strategic stockpiling. This policy-driven spark aligned with ongoing supply stress—London’s recent squeeze, tightness around 26,254 tonnes, and Shanghai inventories hitting decade lows. Weak US economic data further strengthened expectations of a December Fed rate cut, lifting non-yielding assets like silver.

But the trigger came after Physical tightness is evident across all major hubs:

* London : Vault stocks remain strained despite a 54-million-ounce inflow

* Shanghai : Inventories hit their lowest since 2015, rebounding only 5.2% from decade lows.

* COMEX (US) : Nearly 75 million ounces have left vaults since October, but traders hesitate to ship metal due to tariff-risk premiums.

These pressures have pushed domestic premiums higher and tightened spot–futures spreads globally.

Technical Outlook: Silver Positioned for a Powerful Continuation Rally

Silver’s technical structure has turned decisively bullish after confirming a major Cup-and-Handle breakout above the critical neckline at Rs 1,73,965. This breakout is supported by strong volume expansion, indicating commitment from institutional as well as momentum-driven traders. The pattern itself is highly reliable in precious metals, and the clean breach of resistance suggests the initiation of a new trend leg. From a measured-move perspective, the breakout projection comfortably points toward Rs 1,93,800 as the next immediate target, followed by an extended objective approaching Rs 2,06,000 if global conditions continue to align.

Momentum indicators also reinforce the bullish trend. The MACD has crossed above the zero line with a strong positive crossover—one of the clearest confirmations of trend acceleration in metals. This signals that upside momentum is not just intact but strengthening. The RSI at 79.14 does indicate overbought conditions, which could lead to intermittent profit-booking; however, in strong breakout phases RSI tends to remain elevated for extended periods without reversing the trend.

The Choppiness Index suggests heightened volatility, which is typical during major pattern breakouts and often precedes sustained directional moves. As long as silver holds above Rs 1,73,965, the broader setup remains firmly bullish, keeping the metal on track toward the Rs 2-lakh mark within the next month if macro tailwinds persist.

Silver’s breakout above Rs 1,73,965 confirms a powerful "Cup-and-Handle" pattern, projecting a near-term upside toward Rs 1,93,800 and possibly Rs 2,06,000 if momentum persists. RSI at 79.14 warns of short-term overbought conditions, but underlying structure remains strong with MACD above zero and a positive crossover supporting continued bullish traction. Choppiness Index indicates elevated volatility—typical during major trend expansions. As long as silver sustains above Rs 1,73,965, the rally remains firmly intact with a realistic path toward the Rs 2-lakh mark within a month.

Above views are of the author and not of the website kindly read disclaimer