Macro Shots : US Labor Market - Moderation Under the Hood By Sreejith Balasubramanian, Senior Vice President & Economist – Fixed Income, Bandhan AMC

US Labor Market: Moderation Under the Hood

US labor market data has continued to belie expectations of a meaningful slowdown driven by fading economic exceptionalism, immigration and tariff policies. Non-Farm Payroll (NFP) addition was again above consensus, in May, albeit marginally. However, there are growing signs the labor market is gradually weakening, under the buoyant hood of healthy payroll and a steady unemployment rate.

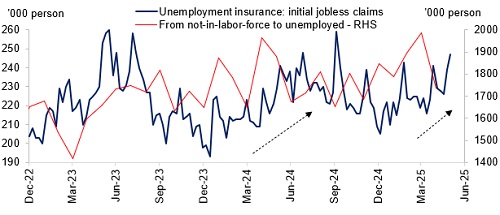

1) Rising trend in unemployment insurance claims - Initial claims have been rising since January, despite weekly data volatility, and continued claims have inched up more recently.

2) Multiple downward revisions to previous NFP additions - April data was revised down by 30,000 and March by 108,000. Total addition from January to April 2025 has been revised down by 219,000 so far.

3) Narrower incremental job gains - 61% of the jobs added in January-May were in Education & Health Services, vs. 43% in the previous five months. Government job additions are negligible since February. Moderating overall job additions are thus becoming less broad-based across sectors.

4) Flow from ‘Not in labor force’ to ‘unemployed’ moving up - This indicates more people are looking for work, which is typical of a moderating labor market.

5) Flow from ‘employed’ to ‘not in labor force’ picked up sharply by 1mn in May - This is likely because of the recent measures on immigration control. If this trend continues, unavailability of labor (who are also part of total demand) can lead to lower output. The employment-population ratio has also moderated, from 60.1% in January, to 59.7% in May. This bears watching.

6) The Quarterly Census of Employment and Wages (QCEW) suggests fewer jobs added and the gap with NFP is rising - This is because QCEW uses unemployment insurance data, which is more accurate, while the NFP overestimates due to the adjustment it makes to jobs added/lost from opening/closing firms. So, NFP will very likely be revised down, when the annual benchmarking to QCEW is done.

Why does this matter?

We believe the direct and indirect impact of US fiscal policies (tariffs, immigration, etc.) on growth will eventually lower US treasury bond yields and cause the USD to drag further. Expectation of rate cuts by the Fed could rise if hard data deteriorates. In this context, the labor market needs to be watched closely.

Above views are of the author and not of the website kindly read disclaimer