Macro shots - US FOMC - Waiting for the Tight Time to Cut by Mr. Sreejith Balasubramanian, Senior Vice President & Economist – Fixed Income, Bandhan AMC

Below the Macro shots - US FOMC - Waiting for the Tight Time to Cut by Mr. Sreejith Balasubramanian, Senior Vice President & Economist – Fixed Income, AMC

In the June FOMC meeting, 2025 forecast for growth was revised down, inflation was revised up and more members voted for no rate cuts this year. The Fed Chair reiterated its patient approach to see the price impact of higher tariffs and its job to prevent any second-round effects.

Going into yesterday’s meeting, two voting members had spoken on their preference for a rate cut, given labor market conditions and unlikely second round effects. As widely expected, the FOMC held rates at 4.25-4.50% yesterday, with two dissenting votes.

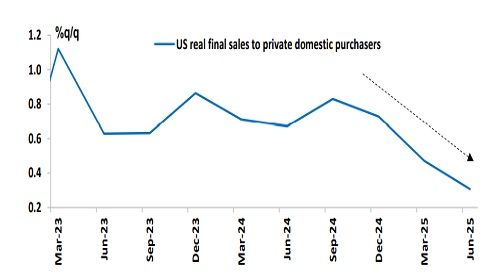

On growth, the Fed Chair in his post-meeting press conference acknowledged moderation in economic activity in H1 2025 (figure above), slowdown in consumer activity, tax cuts being made permanent likely not adding fresh stimulus, and downside risks to the labor market. The Unemployment Rate has been stable, although labor demand (payroll) has eased, because supply (immigration) has also been impacted.

On inflation, he noted most categories are back to 2%, services prices are now coming down while goods prices are going up, and that some items like insurance are showing catch-up. He said early signs of the impact of higher tariffs on some goods are visible (June CPI) and that higher tariff revenue collected is currently mostly being paid by US firms which could pass it on to consumers (as per Fed surveys). However, he said some firms maybe unable to do so and that the base case is that tariffs are a one-time effect.

We believe the labor market is weaker under the hood, undertones of which were seen in yesterday’s meeting. At a higher level, the Fed’s assessment is of weaker growth, downside risks to the labor market, progress on disinflation and likely one-time tariff effects. Given two months of data before the next FOMC meeting, the September meeting will be important. The Fed’s intention is to get the rate cut timing right but one needs to remember that monetary policy acts with lags. All said, we expect US bond yields to eventually ease reflecting the cyclical slowdown and the Fed response.

Above views are of the author and not of the website kindly read disclaimer