Quote on Fed Policy by Mr. Umesh Sharma, CIO Debt, The Wealth Company Mutual fund

Below the Quote on Fed Policy by Mr. Umesh Sharma, CIO Debt, The Wealth Company Mutual fund

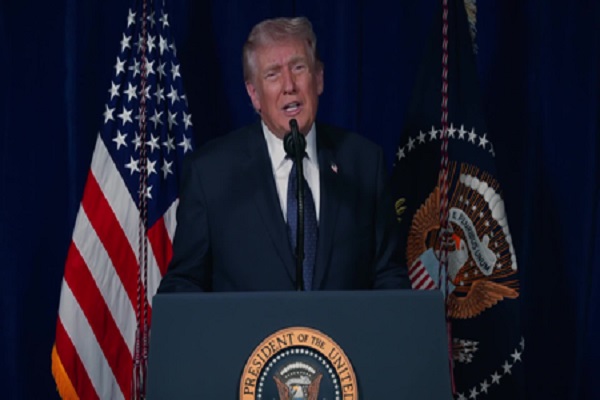

The FOMC reduced policy rates by 25 bps and announced the end of Quantitative Tightening effective December, both widely anticipated by markets. However, in the post-meeting press conference, Fed Chair Jerome Powell struck a hawkish tone, emphasizing that a December rate cut is not a foregone conclusion given inflation remains above target and labor-market uncertainties persist. He noted that a balance between lower labor supply and moderating labor demand is still evolving, suggesting the Committee may prefer to pause in December while assessing incoming data.

Following Powell’s remarks, market expectations of a December rate cut fell from over 90% to around 60%, prompting a rise in U.S. Treasury yields and a stronger dollar.

Domestically, Indian bond yields have edged higher in line with global moves. The RBI MPC, in its recent policy, indicated that policy space has opened up to support growth if needed. By the next meeting, more clarity is expected on tariffs and the impact of prior fiscal and monetary actions. Given benign headline and core inflation amidst growth concerns, we continue to expect a 25-bps policy rate cut in the upcoming review. For investors, shorter to intermediate duration funds remain preferable, while long-end positions suit only experienced, non-risk-averse investors.

Above views are of the author and not of the website kindly read disclaimer