Quote on Market post US tariff announcement by Narender Singh, Smallcase Manager & founder GrowthInvesting

Below the Quote on Market post US tariff announcement by Narender Singh, Smallcase Manager & founder GrowthInvesting

The 25% tariff hike by the U.S., along with possible penalties, is a serious setback for several of India’s key export sectors. Textiles, gems and jewellery, auto parts, and seafood—industries that together send billions of dollars’ worth of goods to the U.S.—are suddenly facing a sharp drop in competitiveness. For exporters in places like Surat and Gujarat, this move could mean cancelled orders, margin pressure, and job uncertainty.

Companies linked to Apple’s manufacturing supply chain may also feel the heat, not immediately, but through weakening demand and shifting U.S. sourcing strategies. On the bright side, pharma and energy exports seem safe for now, which offers some cushion.

Overall, this development hits at a time when India was building strong export momentum. It not only affects near-term earnings and investment plans for many mid-cap exporters, but also raises fresh questions about our long-term trade strategy. The market reaction has already turned cautious, and unless there's a policy response or a rollback, the pain could deepen in the coming quarters.

Above views are of the author and not of the website kindly read disclaimer

More News

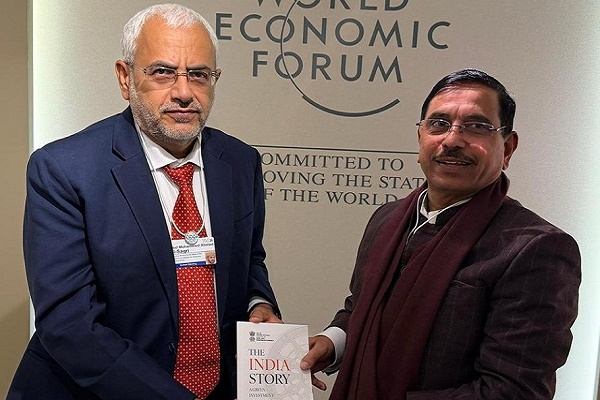

Views On US Tariffs On India By Chanchal Agarwal CIO Equirus Credence Family Office