Macro Shots: FOMC: Time To Pause and Ponder by Sreejith Balasubramanian, Senior Economist, Bandhan AMC

The FOMC decided to cut rates again by 25bps (to 3.50%-3.75%) yesterday, a total of 175bps since September last year. The odds of a cut, which initially fell as the Fed Chair said that a rate cut in December is not a foregone conclusion, had risen recently after the New York Fed President said that he still sees room for further near-term adjustment. All said, it was a close call as nine members voted to cut by 25bps, two to hold and one to cut by 50bps. The Fed will also start purchasing shorter-term treasury securities (USD 40bn in the first month and could remain elevated) to maintain ample reserves.

What stood out - The Fed Chair said job gains data is likely overstated and that higher-than-target inflation is driven by the one-time effect of tariffs. Median projections for 2026 implied stronger growth (driven by robust productivity, stronger consumer spending and supportive fiscal policy), no change in the Unemployment Rate and a mild drop in inflation.

While the rate cut was likely driven by near-term shift in balance of risks towards a weaker labor market, the growthinflation-labor mix implies ‘insurance’ cuts are likely over for now. With impact of the 75bps cut this year playing out, a lot of data lined up before the January meeting and rates now closer to broad estimates of ‘neutral, the Fed can afford to wait and watch barring a sharp turn of data/events.

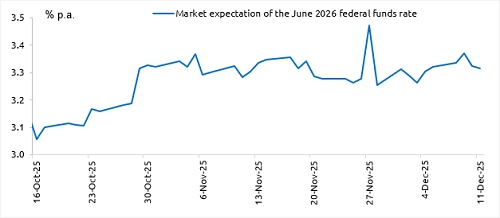

While the median projection continues to be for one more cut in 2026, the dot-plot reveals a more divided Committee. Markets are currently pricing a full 25bps cut only by mid-2026, reflecting this (figure below).

Above views are of the author and not of the website kindly read disclaimer

Tag News

Invesco Asset Management (India) announces change to OPA