Life Insurance Sector Update: Growth subdued; GST exemption to be a drag by Shreya Khandelwal, Vice President -Institutional Research PL Capital

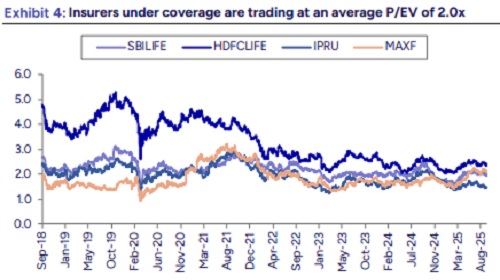

Private life insurers have seen tepid growth in 5MFY25 (8% YoY); expect Sep25 volumes to remain subdued till the period of GST exemption kicks in. We expect the share of ULIP to keep moderating as demand shifts to the non-linked segment. Expect 2QFY26E VNB margins to be range-bound as we await clarity on the impact of GST exemption. Valuations continue to remain undemanding. Maintain BUY on Max FS (TP of Rs 1,850 at 2.0x FY27E P/EV) and HDFC Life (TP of Rs 900 at 2.6x FY27E P/EV). Key monitorable from 2QFY26E results are: (1) Growth guidance for FY26/ FY27E (2) Margin outlook and impact of GST exemption.

Private life insurers have seen weak APE growth (+8% YoY YTD Aug‘25) due to (1) higher volatility in equity markets impacting ULIP and (2) tepid credit protect volumes in the home loan/ MFI segment. While we expect growth in September to remain subdued, Oct-25 is likely to see a spillover effect of GST exemption as pent-up demand kicks in. While the share of ULIP was elevated in Q1, we expect to see a gradual reduction over subsequent quarters. Strong traction in retail protection, steady NPAR volume and a growing Annuity business to drive growth in H2.

* HDFC Life has reported an APE growth of 12% YoY on YTD basis; we expect ~10% in Q2. Expect the share of ULIP to moderate sequentially with a pick-up in PAR/ NPAR. Company has guided for a stable VNB margin at ~25% in FY26; we factor in a little weakness at 24.5% due to the impact of GST exemption.

* IPRU Life has seen a de-growth (-10% YoY YTD Aug’25) impacted by a high base in H1FY25 and slowdown in ULIP. We expect Sep-25 volumes to remain subdued. Q1FY26 commentary suggested a surge in non-linked demand supporting margins; we factor in the same with a VNB Margin of 23.5% for Q2.

* Max Life has been a consistent performer (APE growth of 19% YoY YTD Aug25) on the back of new launches (SWAG, STEP, SWAG Elite and SWAG Pension). Re-branding with Axis Bank has led to higher traction in tier 2/3 markets. On the margin front, we build a VNB margin of 22.5% in Q2 factoring in the impact of GST exemption.

* SBI Life: We expect 2QFY26 growth to be slow (7% YoY YTD Aug’25) due to tepid volumes in banca/ credit protect. Expect margins to remain intact, with a negligible impact of GST exemption.

GST exemption to impact EV in FY26: We expect the recent GST exemption on life insurance to impact profitability. With the benefit of input tax credit not available to insurers on their existing book, we expect a drag of 20-100 bps on FY26E Embedded Value across players. In our view, covered companies are likely to mitigate the drag with commission cuts/price hikes and we remain watchful of the same.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271