Hold Nazara Technologies Ltd For Target Rs.253 by Prabhudas Liladhar Capital Ltd

Quarter marred by one-offs

Quick Pointers:

* Revaluation of NAZARA IN’s stake in Nodwin resulted in a gain of Rs10,985mn.

* Amid regulatory changes in RMG space, an impairment charge of Rs9,147mn was recorded pertaining to investment in PokerBaazi.

We cut our EPS estimates by 15%/14% for FY27E/FY28E as we re-align our depreciation assumptions. NAZARA IN’s operational performance was broadly in line with EBITDA margin of 11.8% (PLe 11.0%) though bottom line was weighed down by multiple one-offs related to Nodwin, PokerBaazi and Freaks4U. The decision to deconsolidate Nodwin reflects NAZARA IN’s renewed emphasis on profitability over scale. The plan is to now focus on highmargin core gaming portfolio supported by ongoing releases such as new season of Love Island and Big Boss, alongside strong traction in Curve Games. Expansion in offline gaming also remains a key pillar with Smaaash 2.0 slated for relaunch in FY27E and plans to scale Funky Monkeys to ~100 centres over the next few years. Considering these factors, we build in a sales CAGR of 10% over the next 3 years with EBITDA margin of 12.8%/16.0%/16.6% for FY26E/FY27E/FY28E. We retain HOLD with a SoTP-based TP of Rs253.

Revenue increased 65.1% YoY: Revenue increased 65.1% YoY to Rs5,264mn (PLe Rs5,447mn). E-sports revenue was down 51.9% YoY to Rs873mn (PLe Rs971mn) due to de-consolidation of Nodwin. Ad-Tech revenue was up 495.9% YoY to Rs1,438mn (PLe Rs1,800mn) while gaming revenue increased by 159.4% YoY to Rs2,959mn (PLe Rs2,676mn).

EBITDA margin at 11.8% but PAT impacted by one-offs: EBITDA increased 146.4% YoY to Rs620mn (PLe Rs599mn) with a margin of 11.8% (PLe of 11.0%) as compared to a margin of 7.9% in 2QFY25. Loss after MI stood at Rs294mn. Adjusted PAT after MI decreased 45.9% YoY to Rs129mn (PLe Rs260mn) with a margin of 2.4% (PLe of 4.8%) as against a margin of 7.5% in 2QFY25. Adjusted PAT has been arrived after accounting for: - i) an impairment loss in PokerBaazi worth Rs9,147mn, ii) one-time gain of Rs10,985mn pertaining to revaluation of Nodwin, iii) a provision pertaining to Freaks4U of Rs2,063mn and iv) recording Nazara’s equity share of loss in PokerBaazi at Rs175mn.

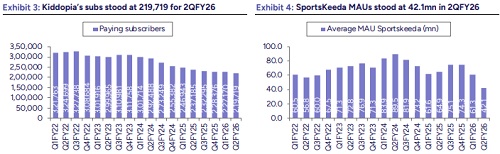

Con-call highlights: 1) 90%+ of gaming revenue comes from international markets, with strong presence in US and UK. 2) Key initiatives to strengthen the IP-led mobile portfolio includes launching Love Island Season 13, preparing Animal Jam for Roblox debut, and releasing Big Boss, India. 3) Curve Games delivered strong performance, with Human Fall Flat selling 1.25mn units in Sep’25 (+25% YoY) and Wobbly Life crossing 2mn lifetime units, while work continues over Switch 2 version. 4) Smaaash 2.0 revamp is currently underway with relaunch targeted for FY27E. 5) 3 new Funky Monkeys centres were opened in 2QFY26 with an aim to scale the count from ~14–15 centres currently to ~100 in the coming years. 6) SportsKeeda cut costs by 13% YoY in 2QFY26 and targets a further 40% reduction in 3QFY26E. 7) SportsKeeda remains the largest contributor within ASPL, accounting for ~85% of revenue and ~90% of EBITDA. 8) Core gaming business is expected to deliver 20–25% YoY growth while EBITDA margins are expected to be in the 20–25% range in the foreseeable future. 9) Nazara’s total investment in Freaks4U amounts to ~$40mn, comprising the initial $9mn for a 13.5% stake (Jan’24), a $25mn stock-swap transaction that increased ownership to 57%, and an additional $6.5–7mn in primary cash infusion

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271