Hold DCX Systems Ltd For the Target Rs. 317 by Choice Broking Ltd

Underwhelming Q3 Performance; FY26-27E Projections Downgraded

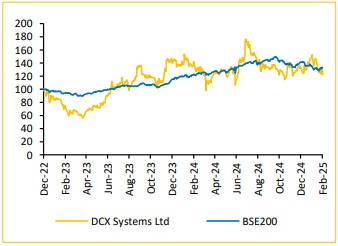

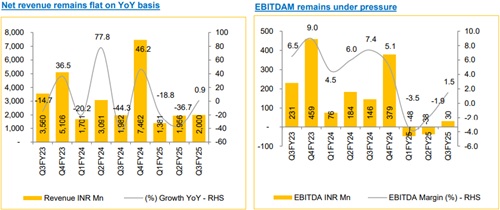

* Revenue for Q3FY25 came at INR 2,000 Mn (vs CEBPL Est. of INR 4,929 Mn), up 0.9% YoY and up 2.2% QoQ.

* EBITDA for Q3FY25 came at INR 30 Mn (vs CEBPL Est. of INR 436 Mn), down 79.6% YoY and down 178.7% QoQ. The EBITDA Margin contracted 588bps YoY, settling at 1.5% (vs CEBPL Est. of 8.9%).

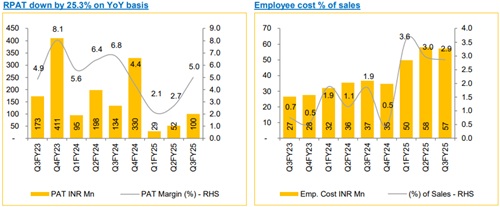

* PAT for Q3FY25 came at INR 100 Mn (vs CEBPL Est. of INR 319 Mn) down 25.3% YoY and up 91.9% QoQ. The PAT Margin contracted by 176bps YoY to settling at 5.0% (vs CEBPL Est of 6.5%).

DCXINDIA has secured contracts with multiple top-tier MNCs and holds a robust order book of INR 3,359 crore (~2.5x of TTM sales), but its recent performance raises significant concerns. Over the last three quarters, the company has faced execution challenges and failed to maintain margins, leading to inconsistent performance and potential delays in order fulfillment.

Despite a promising order pipeline, growth execution remains uncertain, and the company has yet to demonstrate sustained operational efficiency. Given current market dynamics, execution risks, and performance volatility, we are closely monitoring the situation, and we are not getting confidence in the company’s near-term prospects. While long-term opportunities exist, execution risks could impact earnings visibility and growth trajectory in the short to medium term.

View & Valuation:

Despite a decent order book of INR 3,359 crore (~2.5x of TTM sales), we remain cautious about DCXINDIA’s near-term performance due to execution challenges and market dynamics. We project the company’s Revenue, EBITDA, and PAT to grow at a CAGR of 8.0%, 7.0%, and 15.8%, respectively, over FY24–27E, leading us to revise our earnings estimates for FY26 and FY27, lowering revenue projections by 15.3% and 20.5%, and EPS projections by -26.4% and -14.7%, respectively. Given these adjustments, we downgrade our recommendation from "BUY" to "HOLD" and revise our target price to INR 317, implying a valuation of 30x FY27E EPS. While we remain cautious regarding potential performance shortfalls, we will closely monitor execution progress, and any improvement in order book execution may prompt a reassessment of our valuation.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131