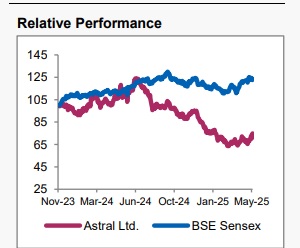

Hold Astral Ltd For Target Rs. 1,530 By Axis Securities Ltd

Est. Vs. Actual for Q4FY25: Revenue: INLINE; EBITDA (Adj.):BEAT ; PAT: BEAT

Changes in Estimates Q4FY25 Result

FY26E/FY27E: Revenue: 12%/14%; EBITDA (Adj.): 14%/17%; PAT: 7%/10%

Recommendation Rationale

Focus on new product launches: Astral is India’s first company to receive UL certification for its FirePro fittings. It has received ISI approval for O-PVC products. The company has started commercial production at its Ghiloth plant for SWR fittings and will soon begin CPVC fittings, targeting the North and East markets. It has also opened marketing offices in Dubai to target the Africa and Middle East markets for value-added products. The company has planned 12-14 new launches from the overseas plants. Astral has developed a range of channel drain products that were previously imported, enhancing cost efficiency. These developments are expected to strengthen Astral’s product offerings.

Strong margins, muted volumes: Astral’s pipe margins were ~18% as compared to the peer average of 13%-15%, led by a strong product mix and premium pricing. The company also has manufacturing facilities across different regions. It reported single-digit volume growth in its pipes business owing to fluctuations in polymer prices (down by 18% in FY25), lower government spending, and elections. The company managed to improve gross margins slightly despite a falling polymer price scenario and industry degrowth of 3%-4%. Its adhesive business delivered an EBITDA of 12%, slightly lower due to raw material price volatility and high operating costs. Going forward, the company expects ~17-18% growth. EBITDA for paints remains under pressure, but volumes are expected to pick up. The channel remains light on inventory due to a weak demand scenario. There is still no clarity on the anti-dumping duty, and BIS norms to be implemented on PVC have been postponed.

Building capacity: The company is on track for ~4,50,000 MT piping capacity by FY26, translating to a CAGR of 15% FY24-26E. The Guwahati leased facility recently commenced production of pipes after water tanks. Their greenfield plant in Kanpur with a capacity of 60,000 MT will be commissioned in phases. Brownfield expansion for pipes/DWC/valves is to be completed in FY26. The company is developing two new plants at Dahej for the production of new chemistries and solvent cement. Astral began producing SWR fittings at their Ghilot plant.

Sector Outlook : Positive

Company Outlook & Guidance: While the company reported muted volumes, their gross margins improved slightly and reported stable EBITDAM of 16.2%. The company has guided for low double-digit growth in piping volumes and is awaiting results on ADD to potentially garner high double-digit growth. End-user demand remains weak, and hence the channel remains light, awaiting any positive response to ADD.

Current Valuation: 50x FY27EPS ( Earlier: 52x H1FY27EPS)

Current TP: Rs 1,530/share ( Earlier TP: Rs 1,590/share)

Recommendation: We maintain our HOLD recommendation on the stock.

Financial Performance

Astral reported Revenue of Rs 1,681 Cr, up by 3.5% YoY, which is in line with our estimates. The overall demand scenario in the polymer industry was negative, yet Astral delivered positive growth in volume. Gross margins were slightly better, up by 98 bps YoY. The reported EBITDA stood at Rs 302 Cr, showing growth of 3.2%, with a flat YoY EBITDA margin of 18%. The company reported PAT of Rs 178 Cr, down by 2% YoY. During the year, PVC prices were highly volatile and saw corrections from Rs 92.6/kg to Rs 75.6/kg, which affected the company’s topline, but the company managed to stabilise EBITDA

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633