Healthcare Sector Update : Diagnostics: Online players continue to toe the line by Kotak Institutional Equities

Diagnostics: Online players continue to toe the line

Diagnostics pricing trends across seven major cities continue to improve, with prominent online players such as Healthians and Redcliffe taking a steep 20-21% price hike in 2QFY26. Even Netmeds has raised prices by 4% qoq in the quarter. On the other hand, barring a few tweaks, pricing of national incumbents as well as other offline players was unchanged. We stay positive on DLPL and METROHL and continue to bake in healthy double-digit organic sales CAGRs over FY2025-28E. Reiterate ADD with unchanged FVs of Rs3,515 and Rs2,155 for DLPL and METROHL, respectively.

Minor pricing adjustments by a few incumbents in 2QFY26

Agilus has lowered prices in Delhi and Kolkata by 3% and 7% qoq, respectively. Thyrocare has also trimmed prices by 1% qoq across seven cities. We note DLPL appears to have experimented a bit with Suburban’s pricing over the past six months, with the company now completely rescinding a recent price hike taken in Mumbai and Pune in 1QFY26. Pricing of DLPL (excluding Suburban) as well as other incumbents such as METROHL, Vijaya and Suraksha stayed unchanged across markets. Over the past one year, most larger incumbents, except Thyrocare (+12% yoy), have largely maintained their pricing on KIE’s test bouquet. As highlighted at our recent Healthcare Forum, there is a distinct possibility of DLPL and METROHL taking a price hike over the next couple of quarters. Among hospitals and other offline players, Lupin has cut prices marginally in Pune, with other players holding their prices in 2QFY26.

Healthians/Redcliffe have raised prices across cities by 20/21% qoq in 2QFY26

After cutting prices in 4QFY25, Healthians has raised prices by 20% qoq in 2QFY26, reverting to 3QFY25 levels. While Redcliffe raised its prices by ~21% qoq, Netmeds raised its prices by 4% qoq in 2QFY26. After raising prices by 23% over a one-year period, Tata 1mg maintained its pricing in 2QFY26. We highlight its pricing has reverted to March 2022 levels (prior to the significant price cuts). In addition to price hikes, we had highlighted in our recent report (link) that online players have been significantly pulling back on expenses, indicating a clear emphasis on profitability. This bodes well for the incumbents. Overall, despite taking steep price hikes in 2QFY26, Healthians remains the lowest-priced alternative in all key cities, except Chennai and Hyderabad, where Tata 1mg remains the lowest-priced provider.

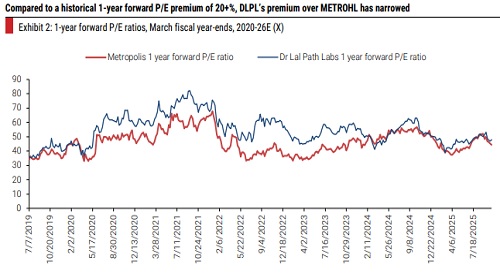

Retain ADD on DLPL and METROHL with FVs of Rs3,515 and Rs2,155

Although the intensity of price-led competition has decreased over the past 2.5 years, the pricing differential between listed incumbents and online players stays elevated at ~2X (albeit lower than in the past). While we expect the sheer higher quantum of organized competitors to still restrict a significant volume bounce back, we expect organic test volume growth for DLPL and METROHL to inch up gradually from the current 8-10% yoy. Despite a slower volume ramp-up, we still expect double-digit organic sales CAGRs over FY2025-28E for DLPL and METROHL. We maintain ADD ratings on DLPL and METROHL with unchanged FVs of Rs3,515 and Rs2,155, respectively.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137

Tag News

NBFC Sector Update : Q3FY26 preview ? Healthy growth, profitability, asset quality by Emkay ...