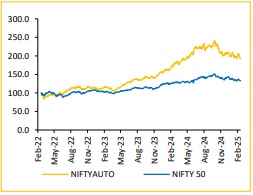

Automobile Sector Report : Automobile OEMs: PV segment drives robust performance by Choice Broking Ltd

Automobile OEMs: PV segment drives robust performance

* For Q3FY25, the OEM stocks under our coverage showed robust growth compared to last year, led by healthy growth in PV OEMs. The growth in the PV segment was supported by strong festive demand and a shift towards premiumisation. The recovery in rural demand, coupled with robust consumer sentiment, significantly contributed to the growth of the 2W industry. The CV segment faced a challenging H1FY25 but has started showing signs of recovery, led by better government capex flow in the second half of the quarter.

* 2W OEMs experienced revenue growth of 8.3% on a YoY basis and PV OEMs saw a 17.1% revenue growth on a YoY basis. On the EBITDA margin front, OEMs under our coverage saw a margin expansion of 42bps YoY and 2bps QoQ. Overall, retail sales during Q3FY25 were 1.12Mn units (+9.2% YoY) for PV, 5.90Mn units (+12.9% YoY) for 2W, and 0.21Mn units (-1.6% YoY) for CV

* Budget 2025 - Positive outlook for automobile sector driven by consumer spending and rural growth: Going forward, we expect the automobile sector to maintain strong demand, supported by increased consumer spending due to new taxation policies that encourage greater consumption. We believe increased rural demand will continue, aided by government initiatives announced in the Union Budget 2025 to boost agricultural output and the rural economy. This will be positive for the 2W segment and entry-level cars in the PV segment.

* For the CV segment, we anticipate pent-up demand to materialize in Q4FY25, driven by positive macroeconomic indicators such as rising government spending, following the slowdown in H1FY25 due to the impact of elections and the monsoon.

* Limited impact of US Reciprocal Tariffs due to minimal exposure to US market: US President Donald Trump announced on February 18, 2025 that he intends to impose auto tariffs of around 25%. We believe this development will not have any significant impact on the OEMs under our coverage, as the US is not a major export market for any of the companies under our coverage. (Please note: Tata Motors is not part of our coverage).

Positive Outlook for Auto Ancillaries: Driven by New Products and Premiumisation

* The automobile ancillaries under our coverage registered solid performance, with revenue growth of 16.3% YoY, while the EBITDA margin was down 26bps YoY but up 3bps QoQ.

* For auto ancillary space, we remain positive driven by new product launches in FY25. We expect auto ancillary companies under our coverage to continue benefiting from the trend of premiumisation, technological upgrades and the EV transition.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131