NBFC Sector Update : Golden age for gold financiers behind by Elara Capital

Per our comprehensive analysis of Reserve Bank of India (RBI) guidelines on gold lending, issued on 9 April 2025, expect significant impact on gold financiers, with potential implications for business growth, market share, operating models and compliance and risk management systems. Post these guidelines, we analyze the growth forecast scenario, the base-case of which indicates that the INR 7,100bn (FY24) organized gold lending market may grow at a 12.1% CAGR through FY24-27E, down from the earlier industry CAGR of 15% and 19.8% CAGR in FY20-24. While demand for gold loan and lower penetration (~6%) offer tailwinds, competitive intensities from the banks may flare up.

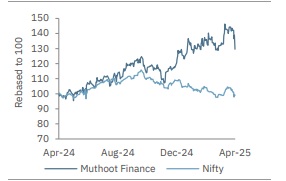

Muthoot Finance versus the Nifty

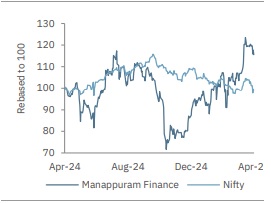

Per our comparative assessment, the impact of guidelines is more pronounced for gold loan NBFCs than for banks due to stringent LTV norms and end-use consumption limits, thus near-term disbursal constraints, compliance rejig and subsequent higher operational and credit costs. Longer term, as the market consolidates with unorganized exits, expect modest market share gains for Muthoot Finance (MUTH IN), Manappuram Finance (MGFL IN) and IIFL to the tune of 100-200bps. MUTH may navigate the waters with greater ease – just 6% impact on operating profit and a subsequent 15bps dip in RoA. MGFL may face increased compliance challenges but diversification initiatives will provide support. We expect a 9% drop in operating profit, which should drag down FY26E RoAs by 25bps for MGFL as we model in implications. But against this backdrop, we downgrade MUTH to Accumulate from Buy and reiterate Accumulate on MGFL..

Mannapuram Finance versus the Nifty

Gold loan market to evolve:

Post these guidelines, the base-case growth scenario indicates that the INR 7,100bn (FY24) organized gold lending market may grow at a 12.1% CAGR through FY24-27E, down from the earlier industry CAGR of 15% and 19.8% CAGR in FY20-24. MUTH and MGFL will continue to lead with combined market share of 40-45% due to scale & unorganized market shrinkage followed by IIFL with 4-5%.

MUTH may navigate waters with ease; challenges transient:

MUTH’s strong market presence, robust compliance history, adaptability, strong valuation and auction processes and prudency will enable it to navigate the new norms with greater ease. However, MUTH may require system enhancements and staff training to maintain LTV compliance and categorize loans based on end-use. Subsequently, we model a marginal drop in the average LTV to 60% from 63%, a dip of 6-10% in disbursals, loan growth pared to 18.5% in FY26E (15% in FY27E) and modest NIM compression assuming no near-term product diversification with 2% operational costs spike in FY26E. Subsequently, the operating profits may dip by 7%, translating into 5.0-5.2% RoAs and ~18% RoEs in FY26E-27E. With EPS being pared by ~7%, we trim our TP by 2%, valuing the core business at 2.5x FY27E P/ABV to arrive at an SoTP TP of INR 2,467 (from INR 2,551).

MGFL – Compliance requirements to weigh on near-term profits, diversification to aid:

MGFL’s reported average LTV of 60-65% might marginally be hit but stricter monitoring may limit higher volumes, with subsequent impact of 10% on disbursals and loan growth likely at 15.5% in FY26E-27E. Lower disbursals in FY26E and elevated operational and credit costs may dent operating profits by 9% and EPS by 10-11%, driving down RoAs to 3.6-3.7% and RoEs to 16% in FY26E-27E. Our TP for MGFL is unchanged at INR 250 as we value its consolidated book at 1.4x FY27E P/ABV, factoring in the positives from strategic Bain investment (refer our 20 th Mar’25 report: Turning point)

Please refer disclaimer at Report

SEBI Registration number is INH000000933