F & O Rollover Report 21st November 2025 by Axis Securities

HIGHLIGHTS

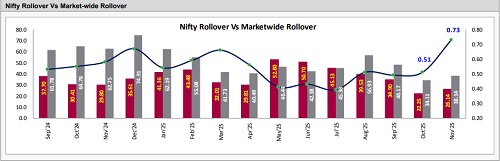

Nifty Rollover: The Nifty November rollover volume, recorded at 26.1% on Thursday, shows an increase compared to the 22.3% observed on the corresponding day of the preceding expiry. However, this rollover figure remains subdued as it trails both the three-month average of 32.2% and the six-month average of 40.8%. The higher month-on-month activity suggests a renewed, though selective, interest in carrying forward positions, yet the overall below-average levels indicate a broad cautious or subdued sentiment among derivative market participants regarding the benchmark index's near-term directional conviction.

Bank Nifty Rollover: The Bank Nifty November rollover is at 26.3% on Thursday, which is a decrease from the 32.7% seen on the same day last month. Furthermore, this current activity is meaningfully below its three-month average of 31.3% and its six-month average of 33.6%. The significantly lower carry-forward rate for the banking benchmark, both sequentially and against historical data, signals a clear reduction in conviction and a cautious outlook within the financial sector derivatives, suggesting greater position-unwinding or profit-booking.

Market wide Rollover: Market wide November rollover stands at 38.1% this Thursday, demonstrating an uptick from the 34.1% posted on the same day of the last expiry cycle. Despite this positive sequential movement, the current rate is significantly lower than the three-month average of 46.4% and the six-month average of 45.6%. The modest rise in overall market continuation, juxtaposed with the historical softness, points toward a measured approach by traders who are rolling over slightly more compared to the last expiry but are less aggressive than recent historical norms, suggesting a preference for keeping positions light.

Rollover Cost: The rollover cost for the November series is marked at 0.73% on Thursday, a notable jump from the 0.51% registered on the equivalent day of the previous expiry. This higher cost of carry suggests that bullish rollovers are occurring at a relatively greater premium, implying stronger demand to initiate or maintain long positions in the subsequent month compared to the preceding cycle, an indicator of subtly improving sentiment.

Stock-Level Rollover Gains: NMDC, PGEL, UPL, COALINDIA and NATIONALUM experienced a higher proportion of positions being carried forward this Thursday compared to the prior expiry. This elevated rollover activity in these specific names underscores stronger positional conviction and potential bullish interest accumulating in the next series for these stocks.

Stock-Level Rollover Declines: SAIL, RBLBANK, UNOMINDA, IEX and DALBHARAT witnessed a decline in futures rollover when compared to the corresponding day of the previous expiry. The reduced continuity suggests either a significant unwinding of existing positions (like profit booking or cutting loss) or a deterioration of short-term conviction among traders in these particular counters.

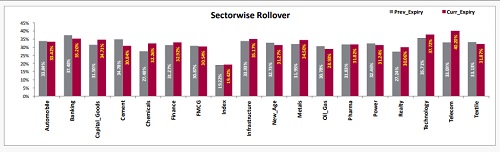

Sector-Level Rollover: On a sectoral front, Telecom, Chemicals, Realty, Capital Goods and Metals saw enhanced rollover volumes, indicating that traders are actively maintaining or building positions in these groups for the upcoming month, reflecting sustained market interest and potentially bullish structural momentum. In contrast, Cement, Banking, Oil & Gas, New Age and Textile sectors recorded lower rollover activity compared to the last expiry. This weaker continuity implies a relative lack of fresh conviction or a tendency to lighten existing exposure in these segments, signaling a more cautious or subdued outlook for the immediate term

NIFTY HIGHLIGHTS

Nifty November rollover is 26.1% on Thursday, up from 22.3% last expiry but below the three-month average of 32.2% and six-month average of 40.8%, showing cautious sentiment despite selective interest. Bank Nifty rollover is 26.3%, down from 32.7% last month and below the three-month average of 31.3% and six-month average of 33.6%, signaling reduced conviction and profit-booking in financials. Rollover cost is 0.73%, up from 0.51% last expiry, indicating bullish rollovers at a higher premium and subtly improving sentiment. The Market-wide rollover is 38.1%, higher than 34.1% last expiry but below the three-month average of 46.4% and six-month average of 45.6%, reflecting a measured approach with lighter positions. The option data for the November series indicates a strong Call Open Interest (OI) at the 26,200-strike price, followed by 26,500. In contrast, a substantial concentration of Put OI is observed at 26,000, with additional levels at 25,900. This suggests the likely range for the current expiry is between 25,900 and 26,200

Stock & Sector Highlights

- NMDC, PGEL, UPL, COALINDIA and NATIONALUM saw higher rollover on Thursday compared to same day of previous expiry.

- SAIL, RBLBANK, UNOMINDA, IEX and DALBHARAT saw lower rollover on Thursday compared to same day of previous expiry.

- Highest rollover in current expiry for the day is seen in WIPRO, NMDC, LTIM, HINDALCO and INFY.

- Lowest rollover in current expiry for the day is seen in SAIL, UNOMINDA, PATANJALI, ALKEM and BRITANNIA.

Above views are of the author and not of the website kindly read disclaimer