Earnings Wrap-up and Sectoral Outlook November 21, 2025 by Choice Broking

India Q2FY26 Earnings Wrap-up

Nifty 50 Earnings Fared Marginally better than Expectations

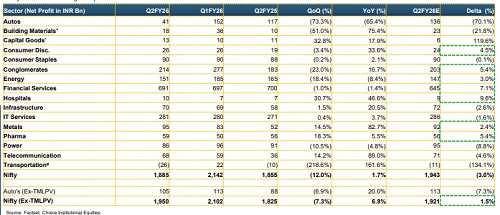

Headline Index Earnings Performance

Overall Q2FY26 earnings for Nifty 50 (Excl. Tatat Motors PV) witnessed a growth of 6.9% YoY (-7.3% QoQ), whereas it outperformed the consensus estimate marginally by 1.5%, led by improved growth traction across Consumer Discretionary, Diversified, Energy, Financial services, Hospitals, Metals and Pharma sector. Reported earnings for Nifty 50 grew marginally by 1.7% YoY (-10.5% QoQ), as it was impacted by one-off losses from continued operations in Tata Motors PV.

Among sectors, biggest earnings surprise (outperformed consensus net profit estimates) in the index was observed in Hospitals (+9.6%), Financial Services (+7.1%), Conglomerates (+5.4%), Pharma (+5.4%) and Consumer Discretionary (+4.5%). Large earnings miss (underperformed consensus net profit estimates) in the index was witnessed in Building Materials (-21.8%), Power (-8.8%) and Autos (-7.3%) [Excl. Tata Motors PV]

Earning Upgrades were Marginal for Nifty 50

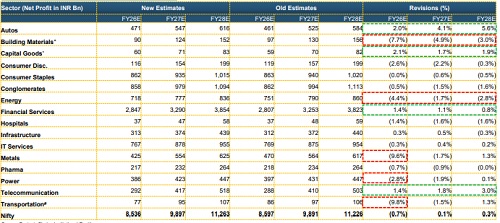

Headline Index Earnings Revision

Post Q2FY26, Nifty 50 observed marginal revisions (in consensus estimate), as aggregate net profit for FY26E/ FY27E/ FY28E was downgraded by 0.7% and upgraded by 0.1% and 0.3%, respectively. Larger upgrades (in the consensus net profit estimates) were witnessed across (a) Autos on the back of improved traction in auto sales volume, (b) Capital Goods on better expectation of private capex in 2HFY26, (c) Telecommunication led by growth in wireless ARPU driven by premiumisation and (d) Financial Services driven by higher credit growth and stabilising NIM margin. Downgrades (in the consensus net profit estimates) was observed for (a) Building Materials due to lower realisation and lower profitability; (b) Energy due to lower revenue growth, (c) Metals as a result of weaker realisation and lower domestic demand, (d) Power owing to lower power demand and weaker margin and, (e) Transportation, due to one-off forex losses.

Nifty 50 Earnings Upgrades and Downgrades (Post Q2FY26)

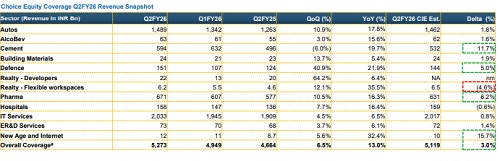

Topline Growth for Coverage Universe Surprised on the Upside

Choice Coverage Universe Revenue Performance Revenue for our coverage universe (Excl. Realty – Developers) grew 13.0% YoY (+6.5% QoQ), while it stood above our estimates by 3.0%, driven by surprises across Auto, AlcoBev, Cement, Defence, IT Services, New-age companies and Pharma sector. Among our coverage, revenue stood higher than estimate for:

* New-Age coverage, by 15.7% led by restructuring in Nazara Tech and higher realisation in IndiaMart

* Cement, by 11.7% led by higher clinker sales and one-off items including government grants

* Pharma, by 6.2% due to one-off impacts in a few companies, with Glenmark being the key contributor

* Defence, by 5.0% due to faster execution of orders

* Building Materials, by 1.9% led by higher home improvement demand

* Autos, by 1.8% led by stronger than expected volume momentum

* AlcoBev, by 1.6% led by surprise from United Spirits

* ER&D Services, by 1.4% on the back of improved execution of orderbook. Similarly, revenue estimates stood lower than estimate for Realty – Flexible workspaces by 4.6% as the seat additions for the coverage lagged behind guidance.

Bottom-line Growth for Coverage Universe Surprised on the Upside

Net profit for our coverage universe (Excl. Realty – Developers) grew 17.7% YoY (+8.6% QoQ), while it outperformed our estimate by 7.7%, driven by major surprises across Auto, Cement, Defence, Hospitals, IT Services and Pharma sector. Among our coverage, net profit stood higher than estimate for:

* Cement, by 105.4% led by one-off items including other income and income tax credit

* Pharma, by 11.1% led by major surprise from Glenmark Pharma and some one-offs observed within the coverage

* Hospitals, by 9.1% led by improved operational efficiencies for matured/existing facilities

* Realty – Flexible workspaces, by 7.2% due to cost optimisation and lower leasing/fit-out costs

* Autos, by 4.9% led by stronger volume offtake and improved operating leverage

* Defence, by 4.8% led by improved revenue growth

* AlcoBev, by 2.3% led by surprise from United Spirits. Similarly, net profit missed our estimates for:

* New-Age coverage, by 65.6% led by one-off losses in Nazara Tech and normalisation of margins in IndiaMart

* Building Materials, by 37.5% led by weaker margins ? ER&D Services, by 1.6% led by one-offs in Cyient

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Daily Derivatives Report By Axis Securities Ltd