Evening Track : Gold stays firm near peak as investors seek safety, Crude Oil Gets a boost from Aramco by Kotak Securities Ltd

Comex gold futures trading steady below the all-time highs near $2,880 per ounce, driven by haven demand amid escalating economic and geopolitical uncertainties. President Donald Trump’s comments regarding Gaza and Iran, along with an anticipated U.S. plan to address the Russia-Ukraine conflict, fueled safe-haven buying. Concerns about the U.S.-China trade war and potential additional tariffs further bolstered gold's appeal. The metal has gained 9% this year, supported by strong central bank demand. Investors await Friday's Nonfarm Payrolls report and Thursday's jobless claims data for interest rate clues. The U.S. Treasury Secretary emphasized focusing on lowering 10-year Treasury yields rather than the Fed's short-term rate, suggesting that interest rates would adjust with reduced energy costs and deregulation.

WTI Crude Oil is holding above the previous closing at $71.35 per barrel, near the lowest this year pressured by geopolitical uncertainty and potential trade wars. Today prices are supported by Saudi Arabia's increased prices for Asian deliveries in March. This hike is attributed to growing demand from China and India, coupled with disruptions to Russian supply due to US sanctions. Potential supply risks remain due to renewed efforts to halt Iranian oil exports. However, rising US crude inventories and ongoing US-China trade tensions, particularly China's tariffs on American energy products, are putting downward pressure on prices due to concerns about global demand.

LME base metals prices rose, driven by optimism for a demand rebound in China following the Lunar New Year as market is expecting for a resurgence in manufacturing activity next week, which could trigger inventory restocking and support copper prices amid low exchange stocks. LME Copper climbed for a fourth consecutive session, gaining 1% to reach $9,327 per ton, the highest point since mid-November. This upward trend reflects anticipation of increased manufacturing and a surge in New York futures. Despite recent volatility due to US-China trade tensions, aluminum and zinc also advanced, rising 1.30% and 0.70%, respectively.

European natural gas prices surged to a 15-month high on Thursday, marking an 11% increase in 2025 fueled by rapidly dwindling inventories, uncertain supply prospects, and forecasts of prolonged cold weather across Europe. The looming threat of another cold snap later this month, coupled with global trade risks, could further tighten the market. With temperatures in northwest Europe expected to plummet in the coming days, heating demand is set to rise, exacerbating the already precarious supply situation

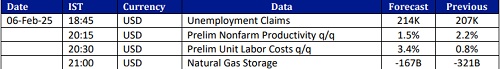

Today, investors now await U.S. Unemployment Claims for further labor market insights.

Above views are of the author and not of the website kindly read disclaimer