Electronic Manufacturing Services and Capital Goods by Praveen Sahay, Research Analyst at PL Capital

Jul-Sep'25 Earnings Preview

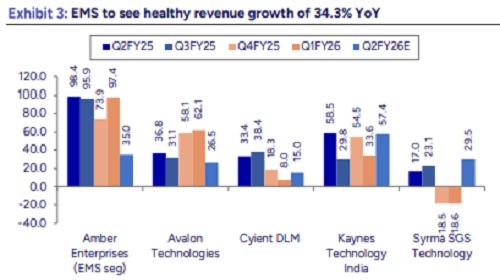

EMS continues to see strong growth, CM subdued

Electronics manufacturing services (EMS) companies under our coverage are expected to post strong YoY revenue growth in Q2FY26, due to decline in AMBER revenue. KAYNES, SYRMA and AVAL are likely to continue their strong momentum, with YoY revenue growth of 57%, 30% and 27%, respectively. Profitability is set to improve sharply, with margin expansion across the board driven by increasing exposure to high-margin segments. We estimate ~60bps YoY expansion in EBITDA margin and ~30% YoY growth in PAT for our EMS coverage universe in Q2FY26. Looking ahead, we expect pickup in order book across EMS companies, supported by their strategic focus on high-margin sectors and orders, which should further support margin expansion in the coming quarters

We expect our EMS universe to register sales/EBITDA/PAT growth of 17.9%/26.3%/29.6% YoY in Q2FY26, on the back of robust order execution and margin improvement led by cost rationalization and increased contribution from high-margin segments. We continue our positive view on EMS companies that will see healthy growth and continuously expanding opportunity market.

EMS sector maintains healthy growth; CM subdued mainly due to RAC: EMS companies, including AMBER’s Electronics segment, under our coverage universe are expected to report healthy revenue growth of 34.3% YoY in Q2FY26. AMBER revenue is expected to decline by 2.1% YoY, as revenue of its Consumer Durables segment, contributing ~70% to the topline, is likely to decline by 20% YoY due to the extended monsoon; RAC segment recorded 25.0% YoY decline. AVAL is expected to grow by ~27.0% YoY, with mobility/industrial/clean energy segments growing by 25%/30%/25% YoY. CYIENTDL is expected to post revenue growth of 15%, (Altek to contribute ~16% to the topline). KAYNES is expected to grow by 57.4% YoY, driven by Automotive and Industrial segments likely to grow by 55.0% and 67.0%, respectively. SYRMA revenue is expected to grow by 29.5% YoY, with margin expansion of 50bps due to the shift to margin-accretive segments and declining Consumer segment contribution to revenue (expecting contribution 26% vs 33% in Q2FY25).

In Q2FY26, margin of the coverage companies is expected to expand due to increased contributions from high-margin segments. CYIENTDL/KAYNES/SYRMA is expected to see margin improvements of ~40bps/150bps/50bps YoY, whereas AMBER/AVAL margin is likely to contract by ~40bps/210bps YoY.

AMBER is expected to report single-digit growth in PAT, while AVAL is likely to see 3.7% decline. KAYNES /CYIENTDL/SYRMA is expected to see PAT growth of 57.0%/ 9.2%/24.8% YoY due to margin expansion.

Key changes in ratings/TP: As we roll forward our TP to Sep’27E and introduce FY28 numbers, we upward revise our TP for all the companies and downgrade our rating for AVALON to ‘HOLD’ from ‘Accumulate’ due to uptick in the stock price and upgrade for SYRMA to ‘Accumulate’ from ‘HOLD’. while maintaining rating for all other companies.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

Tag News

Buy Larsen & Toubro Ltd for the Target Rs.4,400 by Motilal Oswal Financial Services Ltd

More News

Banking Sector Update : Jul-Sep 2025 Earnings Preview - Margins to dip QoQ but may bottom by...