Metals and Mining Sector Update : Muted quarter; 2H earnings to trend up by JM Financial Services Ltd

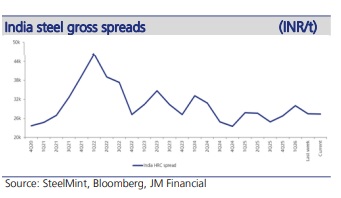

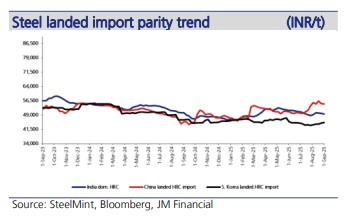

Indian steel companies are expected to witness a soft quarter in 2QFY26, driven by lower realisations – average domestic HRC prices came in at INR 49.6k/tn, down ~INR 2k/tn compared to 1Q while longs declined significantly to average ~INR 48.6k/tn in 2Q, down ~INR 7k/tn sequentially. Volumes are expected to remain soft given a seasonally weak quarter (JPC consumption data shows a marginal 1% MoM decline in Jul’25). This is expected to be partially offset by USD 5-10/tn reduction in P&L coking coal consumption cost, as guided by major companies. NMDC announced a price cut of INR 500/tn and a price hike of INR 400/tn in Jul’25 and Aug’25 respectively. Consequently, Indian ferrous players are likely to witness an EBITDA/tn contraction to the tune of ~INR 3.5k/tn in 2Q given lower realisations partially offset by lower coking coal costs. Chinese exports continue unabated, up 10% YoY at 77.5mn tonnes CYTD, even as the Indian market remains ring-fenced with 12% safeguard duty. We anticipate a jump in 2H spreads driven by a) USD 20/tn rebound in China domestic HRC prices in 2Q compared to 1Q, b) Indian government plugging loopholes in safeguard duty, c) increased visibility on import duty from 200 days to 3 years, and d) 2H being a seasonally strong period consumption-wise. Non-ferrous India business is expected to witness margin expansion in 2Q with average LME Aluminium at ~USD 2.6k/tn, up ~USD 140/tn compared to 1Q. JSPL (lowest leverage, highest volume growth over the next few years), Hindalco (non-ferrous) and TATA remain our top picks in the metals space.

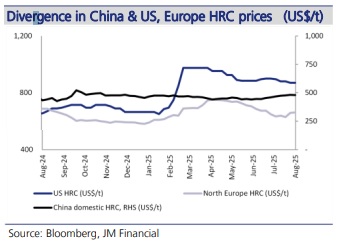

* China steel prices trend upwards in 2Q: China domestic HRC prices witnessed an uptrend in 2Q with spot prices at USD 468/tn, higher by USD 20/tn compared to 1Q driven by anticipation of policy support. China rebar prices corrected to USD 457/tn after trending up in Aug’25 (averaging USD 478/tn), down USD 9/tn compared to 1Q. China’s steel exports for CY24 surged to 111mn tonnes (up ~22% YoY) and exports for Jan-Aug’25 came in at 77.5mn tonnes (+10% YoY), thereby further weighing on global steel prices. China recently announced a domestic steel production cut; any meaningful implementation of this measure could support prices. Global steel-making raw materials witnessed an uptrend with coking coal prices currently trading at USD 185/tn, marginally up compared to 1Q average of USD 184/tn. Iron ore CFR prices surged to USD 97/tn currently, up 6% compared to 1Q average. ? Indian steel players likely to witness lower spreads in 2Q: Realisations of Indian steel players are expected to witness a downtrend in 2Q on the back of falling steel prices. Average domestic HRC prices came in at INR 49.6k/tn, down ~INR 2k/tn compared to 1Q. Longs prices declined significantly to average ~INR 48.6k/tn in 2Q, down ~INR 7k/tn sequentially. NMDC announced a price cut of INR 500/tn and a price hike of INR 400/tn in Jul’25 and Aug’25 respectively. Steel companies have guided for a ~USD 5-10/tn decline in coking coal consumption cost for 2Q. Consequently, Indian ferrous players are likely to witness an EBITDA/tn contraction to the tune of ~INR 3.5k/tn in 2Q given lower realisations partially offset by lower coking coal costs. Working capital requirements is likely to offer some relief as steel / raw material prices trend down leading to better chances of net debt reduction. JSPL (low leverage, high volume growth over the next few years). Hindalco and Tata Steel remain our top picks in the space.

* Non-ferrous India business expected to witness margin expansion: Non-ferrous players are expected to witness margin expansion in 2Q with LME prices witnessing an uptrend compared to 1Q. Average LME Aluminium came in at USD 2.6k/tn, up ~USD 140/tn vs. 1Q. Hindustan Zinc is also expected to witness better margins on the back of higher LME zinc prices during the quarter (up ~USD 120/tn QoQ in 2Q).

* Spot spreads to witness uptrend in 2H: We anticipate a jump in 2H spreads driven by a) USD 20/tn rebound in China domestic HRC prices in 2Q compared to 1Q, b) Indian government plugging loopholes in safeguard duty, c) increased visibility on import duty from 200 days to 3 years, and d) 2H being a seasonally strong period consumption-wise.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361