Derivative Rollover Note 29th October 2025 by Motilal Oswal Wealth Mangement

Short Covering Paves Way for Fresh Longs In November

Nifty index began the October series on a firm and optimistic note, maintaining its upward trajectory throughout the month with a sustained rally of about 1500 points. It managed to surpass the 26100 mark and moved closer to its all-time high territory, finally settling near the upper end of the range. On an expiry-to-expiry basis, Nifty formed a strong bullish candle, reflecting renewed confidence and a decisive comeback by the bulls, supported by active participation across key sectors and positive market sentiment.

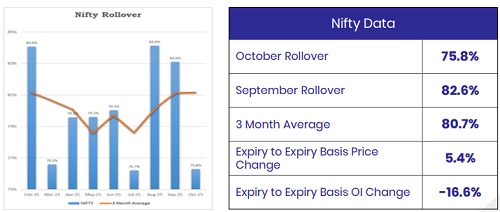

In the October series, open interest fell by 16.6% while the index rose by 5.4% on an expiry-to-expiry basis, suggesting short covering which could lead to fresh longs adding in the November series. Rollover of Nifty stood at 75.8%, which is lower than its quarterly average of 80.7%.

On option front, Maximum Call OI is at 26000 then 26500 strike while Maximum Put OI is at 26000 then 25500 strike. Call writing is seen at 26000 then 26100 strike while Put writing is seen at 26000 then 26100 strike. Option data suggests a broader trading range in between 25000 to 27000 zones while an immediate range between 25500 to 26500 levels.

Nifty closed at 25900 zones and At The Money Straddle (November Monthly 25900 Call and 25900 Put) is trading at net premium of around 660 Points, giving a broader range of 25300 to 26500 levels. Considering overall derivatives activity, we are expecting Nifty to trade with positive bias in the November series with some volatile swings. Positional support can be seen at 25500 and 25300 zones while on the upside momentum can be seen towards at 26277 and 26500 zones.

October’s market breadth was mixed to positive, while the sectoral trend remained firmly bullish. Barring a slight decline in the Media sector, almost all other sectoral indices ended the month on a strong positive note. The PSU Bank, Realty, and Metal indices led the charge, emerging as the top performers of the month.

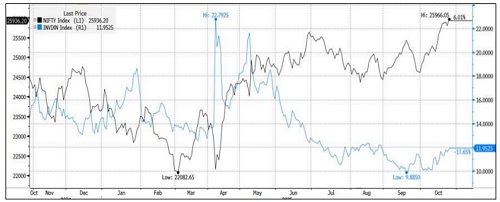

India VIX increased by 8.05% from 11.06 to 11.95 levels in the October series. It briefly crossed 12.7 levels, sparking short-term swings and intraday volatility. Despite these intermittent upticks, the overall subdued volatility range continues to offer comfort to the bulls, suggesting a relatively stable market sentiment ahead.

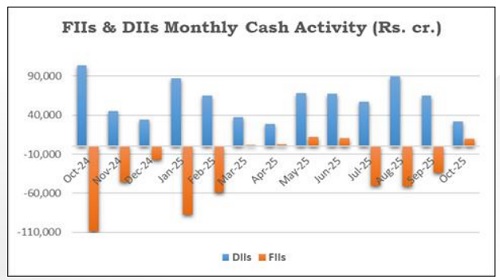

FIIs broke their selling streak of the last three months and bought worth Rs 9947 crores in the October month so far. DIIs continued their buying stance of the last twenty nine months and bought to the tune of Rs 31854 crores in October till date. The FIIs ‘Long Short Ratio’ in index futures improved for most part of the series and ranged in between 6.73% to 25.69% to close near its higher band.

Bank Nifty index opened the new series on a strong footing, scaling a fresh record high of 58577 and extending its leadership over the broader market. The upward momentum was well supported by buying interest across both PSU and Private Banking names which together lifted the rate-sensitive index. On an expiry-to-expiry basis it concluded the period with a bullish candle, reflecting sustained optimism and firm undertones across the banking space.

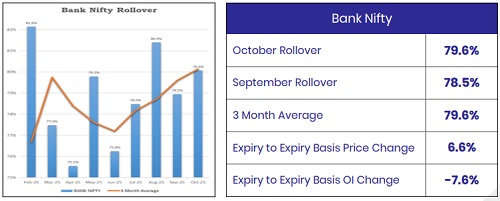

Bank Nifty ended the October series with a gains of 6.6% with a decrease in open interest by 7.6% indicating short covering in the index. Rollover in Bank Nifty stood at 79.6%, which is in line with its quarterly average of 79.6%. Now Bank Nifty has to hold 57500 zones for an up move towards 59000 zones and then 59500 zones while major positional support can be seen at 57000 zones.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty future closed positive with gains of 0.52% at 24820 levels by Mo...