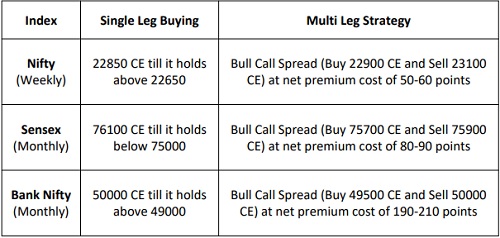

Nifty immediate support is at 22650 then 22500 zones while resistance at 23000 then 23250 zones - Motilal Oswal Wealth Management

NIFTY (CMP : 22834)

Nifty immediate support is at 22650 then 22500 zones while resistance at 23000 then 23250 zones. Now it has to hold above 22650 zones for an up move towards 23000 then 23250 zones while supports can be seen at 22650 then 22500 zones.

BANK NIFTY (CMP : 49314)

Bank Nifty support is at 49000 then 48750 zones while resistance at 49750 then 50000 zones. Now it has to hold above 49000 zones for an up move towards 49750 then 50000 levels while on the downside support is seen at 49000 then 48750 zones.

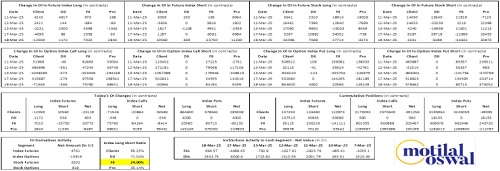

Derivative Outlook

* Nifty March future closed at 22,895.40 with a premium of 61.10 point v/s 75.55 point premium in the last session.

* Nifty Put/Call Ratio (OI) increased from 1.05 to 1.29 level.

* India VIX decreased by 1.53% to 13.21 level.

FII Cash & Derivative Activity

* FIIs on Derivatives front : Short Covering in index futures, call and put selling in index options

* In the cash market : FIIs were net Buyersto the tune of 695 Cr and DIIs were net buyers worth 2535 Cr.

* FIIs long short ratio : Increased to 24%

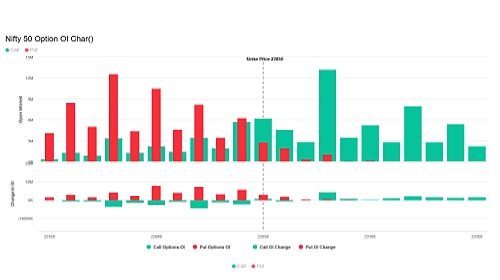

Nifty : Option Data

* Maximum Call OI is at 23000 then 23500 strike while Maximum Put OI is at 22500 then 22000 strike.

* Call writing is seen at 23200 then 23500 strike while Put writing is seen at 22800 then 22700 strike.

* Option data suggests a broader trading range in between 22300 to 23300 zones while an immediate range between 22600 to 23100 levels

Option - Buying side strategy

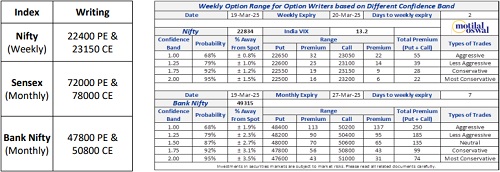

Option - Selling side strategy

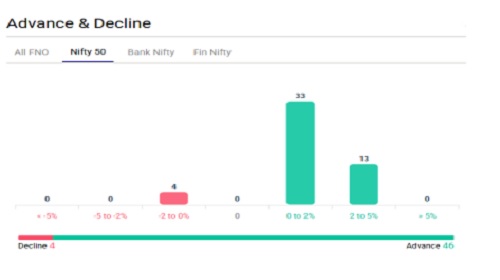

Nifty Advance Decline & Ban update

Stocks in ban : MANAPPURAM, HINDCOPPER, BSE,SAIL, INDUSINDBK

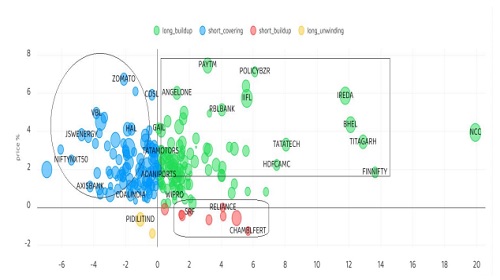

Stocks : Derivatives Outlook

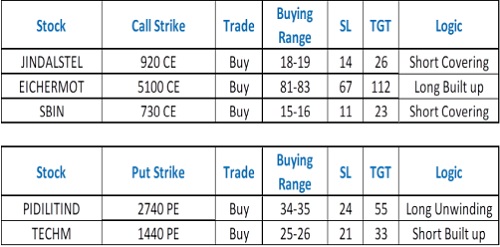

Stocks : Options on radar

Quant Intraday Sell Ideas

What is this?

Based on technical indicators this strategy gives 2 stocks that have a high likelihood to fall during the day (from open to close). This is an intraday Sell strategy which can provide a good cushioning during a black swan event.

What are the rules?

* Stock names will be given at market open (9:15 am)

* Recommended time to entry: between 9:15 to 9:30 am.

* Entry: We short 2 stocks daily (intraday)

* Exit: we will exit at 3:15 as this is an intraday call

* SL: is placed at 1% of the open.

* Book profit: At 1% fall since open.

* In special situations the book profit might be delayed if the stock is in free fall.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty opens 70 pts higher, climbs to 25,139 in first half by Motilal O...