Market are likely to open gap down following an additional 25% US tariff announcement - ICICI Direct

Nifty :24967

Technical Outlook

Day that was…

Indian equity benchmark ended on a positive note and settled at 24967 up 0.39%, tracking strong gains in US markets after optimism around the Federal Reserve’s policy stance. Both midcap and small cap indices lagged behind the benchmark, ending mixed with midcap up 0.12% while small cap slipped 0.04%. Sectorally, IT, Realty and Metals indices outperformed, whereas PSU bank, FMCG, and rest other indices were the laggards.

Technical Outlook:

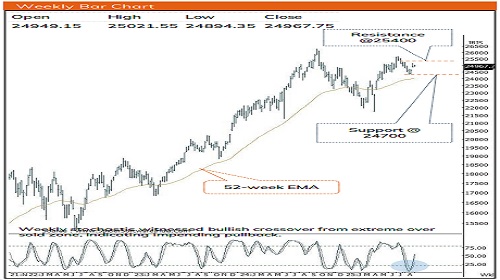

* The daily price action of Nifty witnessed an inside bar and closed above the 50-day EMA for the sixth consecutive session, indicating ongoing strength and consolidation within an uptrend, while sustaining above the key moving average reaffirms positive momentum.

* Market are likely to open gap down following an additional 25% US tariff announcement. Key point to highlight is that, going ahead Nifty’s prior two-session high (25154) will be a key level to watch, and a decisive breakout above this level will open the next leg of up move towards 25400. However unable to cross this level will led to an consolidation phase in the range of 24400- 25000.

* However, in the upcoming truncated week we expect volatility to pick up tracking tariff development (27th August is the tariff deadline), monthly expiry and GDP numbers. Hence, focus should be on accumulating quality stocks backed by strong earnings, especially those poised to benefit from next-generation GST reforms and upcoming festive season as we believe strong support threshold is at 24700-24500 zone.

* On the structural front, market appears to be absorbing host of negative news around tariff as well as geopolitical issues coupled with FII’s continuous sell-off, wherein Nifty has managed to defend 24500 on a weekly closing basis (over past 3 months), highlighting strong higher base formation that bodes well for next leg of up move.

* On the market breadth front the % of stocks above 50 days SMA (Nifty 500 Universe) has bounced to 39% from past two weeks reading of 25%. Historically, buying in such scenario has garnered decent returns in subsequent months.

Key monitorable to watch out for in current volatile scenario:

a) Development of Bilateral trade deal neg

Nifty Bank : 55139

Day that was:

Bank Nifty traded lackluster on Monday and settled almost unchanged at 55,139 (-0.02%). Nifty Pvt Bank index mirrored the benchmark, ending the day at 26,696 (-0.02%).

Technical Outlook:

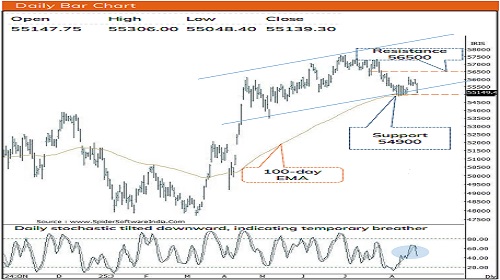

The index traded in a narrow intraday range of 258 points and remained in a phase of consolidation, as the day’s price action formed a small-bodied candle with wicks on both ends, highlighting a balanced session with lack of directional conviction.

* The Nifty Bank Index is currently positioned at a critical “triple confluence” support zone, defined by the alignment of a long-term trendline, the 100-day EMA, and the previous swing low at 54,900. Sustaining above this level could set the stage for a potential rebound, opening the possibility of a recovery toward previous week high 54800 in the near term. Going forward, a decisive move and follow-through strength above this level would further strengthen momentum and pave the way for the next leg of the uptrend towards the 56,400-56600 mark. Notably, the weekly stochastic oscillator has registered a bullish crossover from the oversold zone, reinforcing prospects of a near-term trend reversal.

* Going forward, the upcoming GDP prints from both India and the US will remain the key sentiment drivers. However, given the prevailing volatility, a breach below this level cannot be ruled out. In such a scenario, the next support is seen near 53,500, coinciding with the 200- day EMA. Hence, any extended correction towards these support zones should be viewed as an accumulation opportunity from a medium-term perspective

* Structurally Since April, intermediate corrections have remained shallow while the index has consistently held above its 100-day EMA. Moreover, over the past eleven weeks, the index has retraced 50% of the preceding up move from 51863 to 57614 (11%) in the previous six weeks, indicating a slower pace of retracement with a robust price structure, that augurs well for the next leg of the uptrend.

* PSU Bank Index has mirrored the benchmark and closed lower. Moreover, the index has formed a sequence of higher highs (as per Dow-theory) over the past twelve sessions. The index has retraced close to the 38.2% level of its preceding 20% rally from 6,052 to 7,250 and rebounded above 7,000 mark, suggesting renewed strength, while the Bank Nifty consolidates within 3% of its all-time high, PSU Banks continue to lag significantly, trading 12% below their peak. This presents a potential catch-up opportunity for the sector

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Quote on Market Wrap from Mr. Ajit Mishra - SVP, Research, Religare Broking Ltd