Daily Derivatives Report 26th August 2025 by Axis Securities Ltd

The Day That Was:

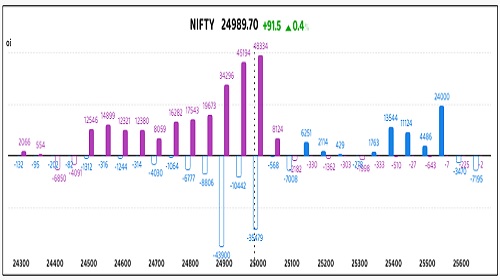

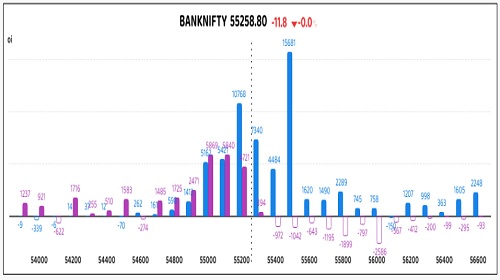

Nifty Futures: 24,989.7 (0.4%), Bank Nifty Futures: 55,258.8 (0.0%).

Nifty Futures and Bank Nifty Futures witnessed a mixed trading session, with Nifty Futures closing in positive territory despite significant intraday volatility, while Bank Nifty ended the day with losses, extending its underperformance. Nifty Futures advanced 91.5 points, reaching an open interest of 1,81,92,900 shares, reflecting a 2.8% increase of 5,03,025 shares, indicative of a long build-up. In contrast, Bank Nifty Futures declined by 11.8 points, with its open interest decreasing by 1.3% to 31,87,835 shares, a reduction of 42,980 shares, suggesting long unwinding. The Nifty futures premium narrowed to 22 points from 28, while the Bank Nifty premium decreased slightly to 120 points from 121. The initial market optimism stemmed from US Federal Reserve Chair Jerome Powell's dovish remarks at the Jackson Hole Symposium, which fueled hopes of a September interest rate cut and boosted global risk sentiment. This sentiment was particularly beneficial for the IT sector, which emerged as the day's biggest gainer. However, profit booking was a prominent theme, particularly in the banking and financial sectors. A significant domestic headwind was the uncertainty surrounding the US's looming deadline of 27th August to impose additional 25% tariffs on Indian goods, which curtailed a more sustained rally. Sectoral performance was mixed, with IT, realty, and metal shares advancing, while media, PSU Bank, and FMCG shares corrected. The India VIX, a measure of market volatility, remained stable at 11.76, a marginal increase from 11.73.

Global Movers:

US stocks fell yesterday as enthusiasm for Fed cuts faded somewhat. The S&P 500 slipped 0.4%, while the Nasdaq 100 fell 0.3%. Big tech saved the day, and all eyes will be back on the AI theme as Nvidia announces results tomorrow. In related markets, the VIX jumped 4% to 14.8 along with the dollar index and the US 10-year treasury yield. Talking commodities, Gold fell slightly as the dollar rallied but is up this morning by 0.6% to $3385/ounce as President Trump moved to remove Fed Governor Lisa Cook with immediate effect, while oil was down 0.5% at $68.50 after a four-day advance.

Stock Futures:

Jubilant FoodWorks, Zydus Lifesciences, Angel One, and Fortis Healthcare recently experienced significant intraday volatility and a surge in trading volumes, driven by fresh catalysts like quarterly earnings and strategic corporate developments that prompted investors to actively adjust their positions.

Jubilant FoodWorks Ltd. (JUBLFOOD) surged with a 4.5% gain, closing higher amid a significant short covering. This rally was fueled by improved Q2FY25 results, with notable increases in net profit and revenue, boosting investor confidence. The futures market mirrored this positive sentiment, shedding 264 contracts, bringing the total open interest to 20,601. The Put-call ratio (PCR) climbed from 0.49 to 0.63, reflecting a shift in market sentiment. With a total of 6,810 call option contracts and 4,270 put option contracts, the derivatives data points to a bullish bias, evidenced by a decrease of 221 contracts in call options and an addition of 817 in put option contracts, indicating option writers are actively selling puts, signalling confidence in the stock's upward trajectory.

Zydus Lifesciences Ltd. (ZYDUSLIFE) emerged as a top gainer in the Nifty Pharma index, registering a 3.5% surge in a classic case of long addition. This upward momentum was driven by a robust Q1FY26 performance, marked by a 3.3% rise in consolidated net profit and strong growth in its core businesses, including a 37% YoY increase in international markets and an 8% increase in its Indian formulations business. The company's futures open interest increased by 3.9%, adding 370 contracts to reach 9,794. The Put-call ratio (PCR) decreased from 0.90 to 0.82. The options market reflects this bullish sentiment with total open interest at 5,186 contracts in calls and 4,266 in puts. The addition of 1,791 call contracts and 1,205 put contracts signals a clear directional bias, as option buyers are positioning for further gains while sellers are writing puts to capitalise on the expected volatility.

Angel One Ltd. (ANGELONE) witnessed a decline, with its stock price falling by 2.8%, amid a short addition trend fueled by broader sector concerns and new regulatory developments. The futures open interest saw a significant increase of 7.3%, with 911 new contracts added, bringing the total to 13,434. The Put-call ratio (PCR) decreased to 0.58 from 0.72, suggesting a bearish sentiment. This downturn is reflected in the options market, where total open interest stands at 14,116 call contracts and 8,248 put contracts. The addition of 2,003 call contracts, contrasted by a decrease of 478 put contracts, indicates option buyers are increasingly betting on a price drop, while sellers are writing calls, signalling their belief that the stock is unlikely to rise significantly.

Fortis Healthcare Ltd. (FORTIS) experienced a 2.3% price decline, representing a profit-booking correction after hitting a 52-week high last week. This long unwinding trend was evident in the futures market, where open interest decreased by 4%, with 539 contracts unwound, bringing the total to 13,073. A significant shift in sentiment was observed as the futures transitioned from a 2.6-point premium to a -0.1-point discount to the cash price. The options market saw a symmetrical unwinding, with a total of 4,731 call contracts and 3,608 put contracts. The decrease of 282 call contracts and 444 put contracts suggests that option buyers are reducing their positions as volatility subsides, while sellers are unwinding their risk exposures in anticipation of a less directional market.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 0.88 from 0.73 points, while the Bank Nifty PCR fell from 0.59 to 0.56 points.

Implied Volatility:

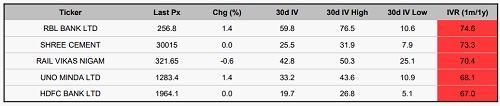

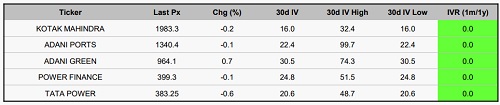

Shree Cement and RBL Bank are currently facing heightened market volatility, as indicated by their elevated implied volatility (IV) rankings of 73% for Shree Cement and 75% for RBL Bank. Their respective absolute IV levels are 26% and 60%. These high readings imply that options on these stocks are relatively expensive, reflecting increased uncertainty and the potential for significant price fluctuations. Consequently, traders should exercise caution when dealing with these stocks, as they may experience erratic price behaviour and carry higher risk. In contrast, Kotak Bank and Adani Ports exhibit much lower implied volatility, with IV levels of 16% and 22% respectively, and the lowest IV rankings among the group. This suggests more stable price movements, making their options more affordable and less prone to large swings. These conditions are favourable for straightforward directional trades such as buying calls or puts and are particularly appealing to options sellers seeking lower-risk opportunities.

Options volume and Open Interest highlights:

Cyient Ltd and Zydus Lifesciences are currently exhibiting strong upward momentum, as reflected in their elevated call-to-put volume ratios of 6:1 and 4:1, respectively. This suggests that market participants are heavily favouring bullish positions, anticipating continued gains. However, the heightened demand for call options has led to increased premiums, which may make initiating new long positions less appealing at current price levels. On the flip side, NTPC and Angel One are experiencing noticeable selling pressure, as evidenced by elevated put-to-call ratios that signal bearish sentiment. The uptick in put option activity could indicate that these stocks are nearing oversold conditions, potentially attracting contrarian buyers. Nevertheless, the dominant negative sentiment calls for a cautious stance. In terms of options activity, One 97 Communications and Amber Ltd are showing a positive outlook, with increased call buying pointing to growing investor optimism. Meanwhile, L&T Finance Ltd and Maruti Suzuki are seeing a rise in put volumes, hinting at a more defensive market stance and the possibility of heightened short-term volatility. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a net change of 2,883 contracts revealed a stark divergence in participant positioning. Retail clients significantly reduced their exposure by 1,427 contracts, indicating a bearish or cautious outlook. This was counterbalanced by a notable bullish bias from institutional players, with Foreign Institutional Investors (FIIs) adding 1,271 contracts and Proprietary traders increasing their positions by a substantial 1,612 contracts, collectively suggesting a strong institutional conviction in an upward market trajectory. Conversely, the stock futures market, with a total change of 30,047 contracts, presented a more complex picture. A broad-based reduction in risk appetite was evident among retail clients, who aggressively liquidated 27,896 contracts. This risk aversion was not universally shared, as FIIs demonstrated selective bullishness by adding 15,436 contracts, potentially targeting specific stocks. This FII accumulation partially offset the collective client and proprietary liquidation, as proprietary desks also reduced their exposure by 2,151 contracts, highlighting a cautious stance among these professional traders and contrasting with their bullish positioning in index futures.

Nifty

Bank Nifty

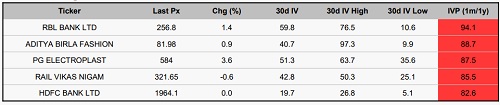

Stocks with High IVR:

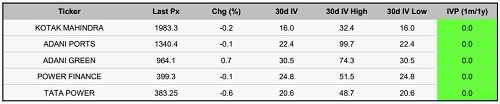

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

_Securities_(600x400).jpg)