Daily Derivatives Report By Axis Securities Ltd

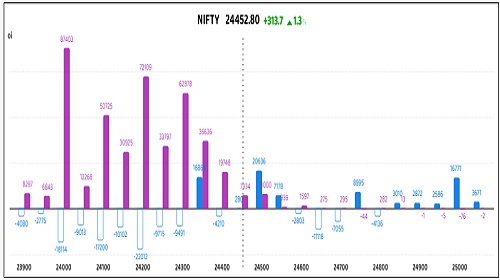

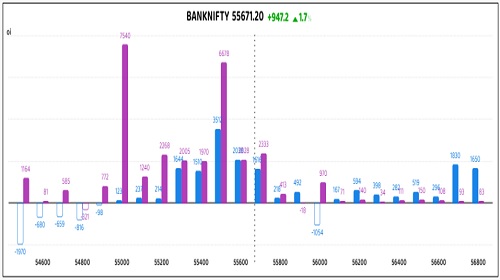

Nifty Futures: 24,452.8 (1.3%), Bank Nifty Futures: 55,671.2 (1.7%).

Nifty futures climbed on Monday by 314 points, recovering losses from the previous two sessions, buoyed by stronger-than-anticipated earnings from index heavyweight Reliance Industries and favourable global trends, which helped the markets overcome some risk-averse sentiment related to India-Pakistan tensions. Foreign investors maintained their buying streak for the ninth consecutive session, even amid heightened tensions following last week's terrorist attack in Kashmir. Additionally, optimism surrounding a potential bilateral trade agreement between India and the U.S. and India's relative immunity to tariffs compared to China kept market sentiment positive. Bank Nifty outperformed Nifty in the conclusion of the session with gains of 947 points. The rupee strengthened by 38 paise, ending at 85.03 against the US dollar on Monday, thanks to steady foreign fund inflows, declining crude oil prices, and a bullish trend in domestic markets. A positive sentiment in the broader market resulted in a 1.3% decline in the India VIX to 16.94, reflecting reduced investor anxiety. The nifty futures premium climbed from 100 to 124 points, and the Bank Nifty premium surged from 60 to 238 points.

Global Movers:

US stocks rebounded on short covering ahead of crucial corporate earnings yesterday. The S&P 500 and the Nasdaq 100 ended flat. The markets continue to be dominated by tariff-related headlines on the one hand and slowdown fears on the other, with data from yesterday showing that a widely followed measure of manufacturing dropped to its lowest reading since the COVID-19 lows. Meanwhile, Treasury Secretary Bessent said that many countries had come forward and presented some good proposals without going into the details. On China, he said that it's up to Beijing to de-escalate the trade war. Talking markets, the VIX rose 1.3% after capping a 4-day loss streak, the dollar retreated, the US 10-year treasury yield finished lower for the fifth day, bitcoin traded near $95K, gold rose and held the recent low area around $3270, while nymex oil finished near $62 as Iran related talks were in focus.

Stock Futures:

In yesterday's trading session, RBL Bank, Hindustan Aeronautics, ShriRam Finance, and Reliance Industries saw significant rises in volume alongside heightened price volatility. This suggests robust market activity and growing investor interest in these stocks.

RBL Bank saw a notable increase of 10% during trading, marking its highest one-day gain since September 2022, along with record trading volumes over the past six months. This optimistic price movement occurred despite a staggering 80% year-on-year drop in consolidated net profit for Q4FY25, primarily due to heightened credit costs that rose to 3.4% from 2.0% in Q4FY24 and 5.3% in Q3FY25. Regardless of this earnings downturn, analysts continue to favor the stock, predicting an enhanced Return on Assets (RoA) for the next fiscal year. Analysing futures data shows a Long Addition, where prices increased alongside a slight 0.4% rise in open interest, which equals only 2.89 lakh shares out of the overall 32,999 future contracts. Activity in the options market indicates increased engagement, particularly in put options, with open interest peaking at a yearly high of 9,763 contracts. As a result, the put-call ratio rose from 0.72 to 1.03, pointing to either a rise in hedging practices against potential downturns (as suggested by high put open interest) or strategic positioning by put writers.

Hindustan Aeronautics (HAL) noted a significant 5.5% intraday rise, reaching a month's peak amid considerable trading volume. This increase in the defence giant's stock price aligned with rising fears over heightened India-Pakistan tensions following a deadly attack in Pahalgam. Futures data reflects a Short Covering, indicated by price appreciation alongside a 1.8% dip in open interest, which means 1.3 lakh shares were shed from a total of 47,423 future contracts. Options open interest analysis from yesterday, featuring a stable Put-Call Ratio (PCR) and consistent implied volatility, strongly indicates a short squeeze scenario, wherein short sellers must have covered their positions due to the sharp price rise.

Shriram Finance faced another significant 4.9% intraday decrease, marking its second-largest single-day drop, alongside the highest nine-month trading volume. This sharp decrease followed the Q4 FY25 financial results announcement, which showed a 10% annual net profit growth that slightly missed market expectations. The Managing Director & CEO noted imminent margin challenges resulting from excessive liquidity, with normalization expected in the latter half of FY26 and improved demand from rural performance. Derivative analyses suggest Long Unwinding, represented by a price decline and a modest 2.5% reduction in open interest, equating to 8.2 lakh shares unwound from a total of 42,682 future contracts. Such factors reflect a bearish outlook towards the stock. However, given the stock's 11% drop from its recent peak and a simultaneous 7% rise in open interest, which indicates a short build-up, a minor technical recovery cannot be ruled out amidst the current market dynamics.

Reliance Industries witnessed a strong rally of 5.1%, its highest single-day surge since February 2024, significantly contributing to the Nifty 50's rise. This increase followed a positive Q4 earnings report, leading analysts to issue upgrades and adjust price targets upward, focusing on growth drivers in Jio, new energy ventures, and retail expansion, with a projected investment of ?1.5 trillion in these areas. Derivative analysis shows a Long Addition, defined by rising prices and a minor 1.1% increase in open interest, amounting to an addition of 12 lakh shares to the pre-existing total of 2,29,280 future contracts. Options activity reflects significant involvement on both ends, with call option open interest standing at 91,087 contracts and put option open interest at 82,826 contracts. Notably, 13,511 call option contracts and 22,460 put option contracts were introduced, raising the put-call ratio from 0.78 to 0.91. This balanced engagement indicates that traders actively participate in both call and put options, likely through writing strategies or risk management in connection with the previous session's noteworthy price increase.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR)rose to 1.22 from 0.87 points, while the Bank Nifty PCR fell from 1.03 to 1.02 points.

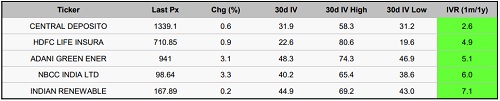

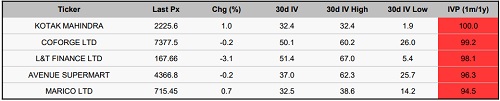

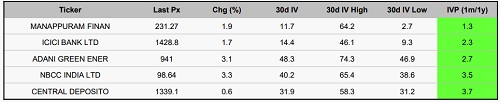

Implied Volatility:

Kotak Bank and Dixon Technologies (India) have experienced variations in their stock prices, as indicated by their high implied volatility rankings of 100 and 85. The increase in implied volatility to 32% for Kotak Bank and 46% for Dixon Technologies (India) suggests that options are becoming costlier, leading traders to explore risk management strategies to reduce price variability. In contrast, CDSL and HDFCLIFE Insurance have the lowest implied volatility standings at 3 and 5, with their IVs at 32% and 23%, respectively. This reduced volatility indicates that their options are comparatively more appealing, presenting a favourable opportunity for investors seeking to take long positions.

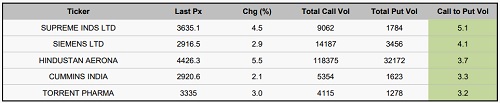

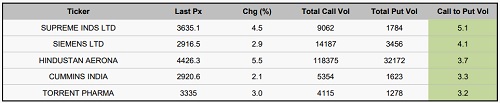

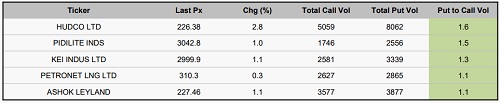

Options volume and Open Interest highlights:

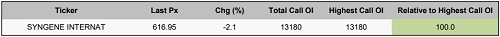

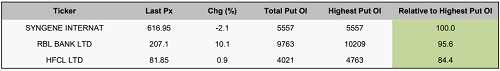

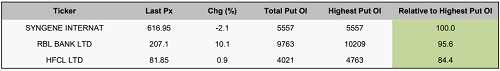

Hindustan Aeronautics Ltd and Siemens Ltd seem to share an optimistic outlook, with a call-put volume ratio of 4:1 for both companies. This ratio indicates a strong demand for call options, implying expectations for price increases. However, a high call skew might suggest possible overvaluation. Conversely, HUDCO and Pidilite Industries reveal a significant put-call volume ratio. This rise in put volume indicates a cautious sentiment related to fears of potential price drops. Nevertheless, high put volumes could indicate an oversold market, indicating potential contrarian buying opportunities. Regarding positions, Syngene International demonstrates notable open interest in both call and put options, while RBL Bank and HFCL Ltd lead in put options, emphasising possible price volatility that could either act as resistance or drive prices higher. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, a net decrease of 9,430 contracts by clients contrasts sharply with the substantial accumulation of 12,450 contracts by Foreign Institutional Investors (FIIs) and a notable addition of 8,067 contracts by proprietary traders out of a total turnover of 20,517 contracts. This divergence suggests a potentially cautious or profit-booking stance from the client segment, compared with a bullish conviction exhibited by both FIIs and proprietary desks. Conversely, stock futures witnessed a total turnover of 84,896 contracts, marked by a significant reduction of 28,744 contracts by clients and a considerable decrease of 20,067 contracts by proprietary traders. This selling pressure from domestic participants was entirely absorbed by a substantial increase of 84,896 contracts by FIIs.

Securities in Ban for Trade Date 29-April-2025:

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633