Bank Nifty settled the session on a negative note at 59154, down 1.04% - ICICI Direct

Nifty :25960

Technical Outlook

Day that was…

The benchmark index snapped its three-session winning streak to close at 25,900, down 0.85%, amid broad-based selling pressure as investors turned cautious ahead of this week’s FED policy decision . Market breadth weakened sharply, with the A/D ratio deteriorating to 1:5. The broader market underperformed, with the Nifty Midcap tumbling 2% and Nifty Smallcap sliding 2.6%. All sectoral indices ended in the red, with Realty and PSU Banks emerging as the key laggards

Technical Outlook:

* The index opened on a flat note, but the absence of follow-through buying above the previous session’s high triggered sustained profit booking throughout the day. Consequently, the daily price action formed a bearish candle with a lower-high, lower-low structure, reflecting selling into intraday rallies.

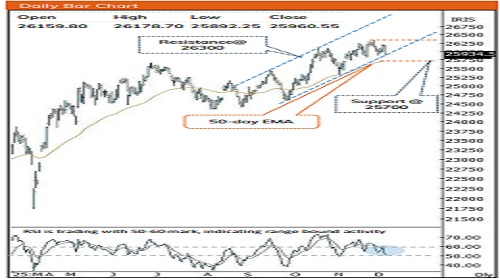

* In today’s session, Nifty is likely to witness gap down opening tracking muted global cues. Key point to highlight is that over the past three weeks, Nifty has remained locked in a high-volatility consolidation zone of 600 points (26,300– 25,700). The ongoing consolidation is predominantly driven by sharper selling in the broader markets. Going ahead, we expect prolongation of ongoing consolidation that would make market healthy wherein large caps are expected to relatively outperform.

* With the current decline Smallcap index is approaching towards its lower band of the rising channel, additionally stochastic oscillator of both Midcap and Small cap index has entered into oversold zone. In addition to that, market breadth (which gauge the market sentiment) has approached bearish extremes zone of 430-460 as currently Net of Advance-Decline reading is placed at 435 (Nifty 500 universe). Historically, such a weak breadth result into temporary bounce. Hence, a decisive close above the previous session’s high in both Nifty midcap and small cap segments is essential to arrest the corrective phase.

* Thereby, one should avoid aggressive selling at current levels and utilized dips to accumulate quality stocks as key support is placed at 25700 being 61.8% retracement of Nov-Dec rally (25318-26325) coincided with 50 days EMA

Following observations makes us reiterate our positive stance:

* Mirroring the benchmark move, Nifty midcap index has been consolidating after clocking a fresh All Time High. The ratio chart of Nifty Midcap vs Nifty 500 has formed a cup & handle pattern. Breakout would confirm outperformance of midcap stocks with Nifty 500 universe in the coming weeks.

* December Seasonality: Historical data exhibit that seasonality favour bulls with ~70% success rate wherein average returns have been to the tune of 2.5%

Key Monitorable for the next week:

* US–India Trade Talks: A visiting US trade delegation may unlock breakthroughs. A positive outcome could boost market sentiment and possibly bring FIIs back

* Fed Rate Decision

* India CPI Print

* Rupee Watch: Indian Rupee is approaching upper band of 7 years rising channel, indicating impending trend reversal which would help to revive the market sentiment

Intraday Rational:

* Trend- Consolidating in range of (26,300–25,700) from past three-weeks.

* Levels: Sell on rise near 50% retracement of yesterday’s upmove(26325- 26030)

Nifty Bank : 59777

Technical Outlook

Day that was:

Bank Nifty settled the session on a negative note at 59154, down 1.04%. Meanwhile, the Nifty PSU Bank index breached past three sessions lows indicating extended profit booking. Nifty Private bank was down 0.9% in line with benchmark index

Technical Outlook:

* The index post negative opening continued to move southwards forming lower high-lower low throughout the session. Sell-off extended in second half of the session on breach of Fridays low (59106) and ended 1.04% lower. Consequently, daily price action formed a bear candle, indicating profit booking at elevated higher levels.

* Key point to highlight is that, supportive efforts emerged from 80% retracement of last 3 days upmove(58925-59808) also coinciding with 20-day EMA around 59030. Follow through strength along with a decisive close above previous session high would confirm resumption of uptrend that would help index to challenge the All Time High and head towards 60500 in coming weeks. Failure to do so would result in extension of ongoing consolidation in 60000- 58600 range. Hence, traders should adopt buy-on-dips approach in fundamentally strong banking names, particularly those that delivered robust Q2 earnings as immediate support is placed near 58,600, which also coincides with the 50% Fibonacci retracement of the recent rally from (57157-60114)

* Historically, in the past two decades, there have been 17 instances where Bank Nifty delivered double-digit gains within four months after a decisive breakout above its previous two-month high. The current structure has once again confirmed such a breakout surpassing both the prior two-month high and the previous all-time peak (57,628), indicating a high-probability continuation setup for sustained upside momentum in the months ahead.

* The PSU Bank Index has breached past three sessions lows indicating extended profit booking. Key support is placed at psychological mark of 8070 being 50 days EMA that coincided with 16 months consolidation breakout at 8050 (as per change of polarity concept) and Resistance on higher side placed at 8400

Intraday Rational:

* Trend- Supportive efforts in the vicinity of 20-day EMA

* Levels Sell on rise near 50% retracement of previous day upmove(60110-59400)

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Quote on Market Wrap Up by Mr. Ajit Mishra - SVP, Research, Religare Broking Ltd

.jpg)