Daily Derivatives Report 21th November 2025 by Axis Securities Ltd

The Day That Was:

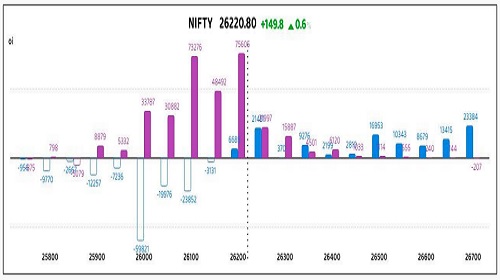

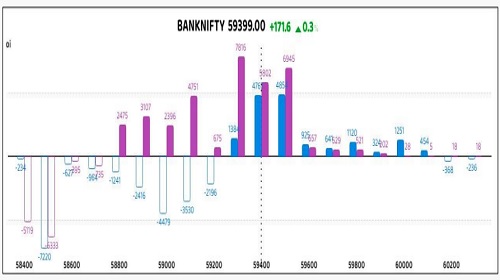

Nifty Futures: 26,220.8 (0.6%), Bank Nifty Futures: 59,399.0 (0.3%).

Nifty Futures and Bank Nifty Futures concluded the session with substantial gains, extending their rally for a second consecutive day, buoyed by positive global cues from AI leader Nvidia's robust earnings and steady FII inflows into domestic markets. Though market volatility was observed due to the weekly expiry of Sensex derivatives, both the Sensex and Nifty approached their 52-week highs, with the Nifty Bank outperforming to hit a fresh all-time high. Domestic sentiment was lifted by renewed optimism surrounding an expected India-US trade agreement, favoring export-oriented sectors, and the start of the Infosys Rs 18,000 crore share buyback, a significant positive for the IT sector; however, Nifty IT spent the day consolidating (moving sideways), suggesting traders either booked partial profits or paused after the previous day's monumental rise. Nifty Futures rose 149.8 points with a Long Build Up, reflected by its Open Interest increasing 0.7% to 1.97 crore shares (1,97,84,570), a jump of 1,30,695 shares, while its premium increased from 18 to 29 points. Similarly, Bank Nifty Futures advanced 171.6 points with a Long Build Up, as its Open Interest increased 3.8% to 21.82 lakh shares (21,81,750), a rise of 80,845 shares, and its premium increased sharply from 11 to 51 points. Sectorally, Financial Services, Oil & Gas, and Auto shares advanced, whereas Media, PSU Bank, and Consumer Durables shares declined. India VIX, the gauge for near-term volatility, advanced 1.35% to 12.14, indicating a slight uptick in expected market volatility despite the index gains. Meanwhile, the Rupee fell 23 paise to close at 88.71 against the U.S. Dollar, pressured by broad strength in the American currency and fading odds of a rate cut by the U.S. Federal Reserve.

Global Movers:

The U.S. equity markets experienced a sharp reversal after an early-session 700-point gains rally was evaporated. The initial gains, driven by strong earnings from chip giant Nvidia, faded as the tech stock itself slumped, and a mixed U.S. jobs report clouded the economic outlook. All three major benchmarks closed significantly lower for the day, snapping back from early highs. The Dow Jones Industrial Average dropped 386.51 points, or -0.84%, closing the session at 45,752.26. The bellwether S&P 500 slid -1.56% to finish at 6,538.76, its largest one-day decline in a week. The Nasdaq Composite was the session's clear laggard, tumbling -2.15% to close at 22,078.05, as heavy selling pressure hit the technology sector. The yield on the benchmark 10-year US Treasury fell, declining 0.027 percentage points to settle at 4.105%. The commodity space exhibited a mixed performance with Spot Gold traded near $4,076.94 per ounce, holding relatively firm with a slight daily drop, while Spot Silver fell, trading around $50.57 per ounce. Crude prices were stable at $63.3 due to mixed US inventory data and growing concerns about oversupply as the U.S. and allies push for a resolution to the Ukraine conflict.

Stock Futures:

Indian Energy Exchange (IEX) Ltd. advanced sharply as short-covering and bargain accumulation near 52-week lows countered regulatory headwinds, reinforced by strong Q2 FY26 results with Net Profit rising 13.9% YoY, Revenue from Operations up 10.5% YoY, and Electricity Market Volumes expanding 16.1% YoY. The stock gained 4.3% with futures open interest falling 10% to 18,613 contracts, shedding 2,063 positions. Options data showed call OI at 14,872 contracts and put OI at 9,541, with additions of 78 and 671 respectively, lifting the PCR to 0.64 from 0.60. The positioning reflects cautious optimism, where option buyers lean toward puts while writers maintain a balanced stance, signaling consolidation after the rally.

Eicher Motors Ltd. (EICHERMOT) surged to a fresh 52-week and all-time high, propelled by robust Q2 FY26 earnings and supportive policy sentiment that reinforced its dominance in premium motorcycles and commercial vehicles. The stock climbed 3.3% with futures OI inching up 0.3% to 17,820 contracts, adding 58 positions. Options activity was buoyant, with call OI at 15,666 and put OI at 13,932, registering additions of 1,932 and 3,886 respectively, pushing PCR to 0.89 from 0.73. The derivatives setup indicates aggressive put buying alongside call accumulation, suggesting option buyers anticipate continued strength while writers hedge against elevated volatility.

Biocon Ltd. extended its decline for a second session as Citibank’s downgrade from ‘Buy’ to ‘Sell’ and a reduced target price triggered heavy institutional selling. The stock fell 3.6% with futures OI rising 3.2% to 21,240 contracts, adding 654 positions, while the futures premium narrowed slightly to 2.7 points from 2.8. Options positioning showed call OI at 14,210 and put OI at 9,992, with additions of 2,603 and 644 respectively, driving PCR lower to 0.70 from 0.81, as implied volatility eased to 27.68%, down 7.52%. The derivatives profile underscores bearish sentiment, with option buyers favoring calls for hedging while writers capitalize on declining volatility.

BPCL retreated marginally by 0.2% in a profit-booking phase after touching a 52-week high, though underlying sentiment remains constructive on strong earnings and strategic capex plans, supported by rising institutional ownership in Q3 FY25. Futures OI surged 15.1% to 17,534 contracts with 2,301 additions, signaling fresh short build-up. Options data revealed call OI at 10,229 and put OI at 8,493, with call additions of 726 and a reduction of 160 in puts, pulling PCR down to 0.83 from 0.91. The positioning highlights option buyers tilting toward calls while writers reduce put exposure, reflecting expectations of sustained bullish undertones despite near-term correction.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.44 from 1.29 points, while the Bank Nifty PCR rose from 1.23 to 1.25 points.

Implied Volatility:

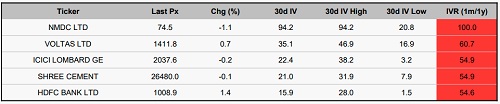

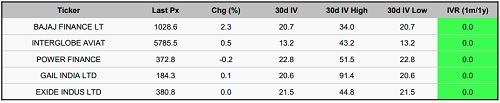

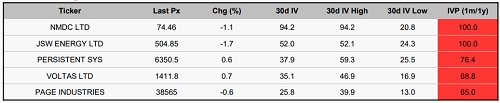

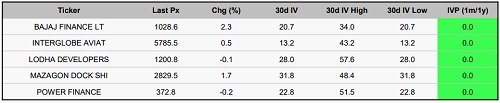

NMDC and Voltas Ltd are currently presenting opportunities for short premium strategies because their Implied Volatility Ranks (IVR) are exceptionally high (100% and 61%, respectively), indicating that their options are significantly overpriced due to an overestimation of future volatility, as evidenced by high realized implied volatilities (94% and 35%); this condition favors selling options to profit from the anticipated volatility mean reversion and the decay of inflated time value, making long premium approaches economically unattractive. In stark contrast, Bajaj Finance and Interglobe Aviation are positioned for long premium strategies as their IVR levels are at the lowest in the F&O segment, making their option contracts relatively cheap given their modest realized implied volatilities (21% and 13%); this low-volatility environment is conducive to buying options, which offers a favorable risk/reward and breakeven metric, providing an asymmetric opportunity for substantial returns driven by potential future large price movements or an expansion in volatility.

Options volume and Open Interest highlights:

Page Industries and KPIT Tech are indicating a bullish bias, evidenced by an extreme 5:1 Call-to-Put Volume Ratio, which has driven up Implied Volatility (IV) and made option premiums expensive for new long positions; however, this intense call buying is often a contrarian signal, suggesting that the current trend may be approaching a point of exhaustion or a short-term peak, similar to the inflated IV and potential trend fatigue seen from speculative Call buying near annual highs in NMDC and GMR Airport. Conversely, Auropharma and Voltas Ltd reflect a defensive stance with heavy Put volumes and concentrated Put Open Interest (OI) at lower strikes, creating gravitational pressure toward support, a condition mirrored in Biocon Ltd and CAMS, where concentrated Put OI near 52-week highs exerts downward pressure; critically, for all these defensively positioned stocks, any price consolidation or stabilization could swiftly unwind these concentrated hedges, potentially triggering a sharp short-covering rally. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In Index Futures, the cumulative shift of 19,956 contracts was precisely mirrored by the precipitous reduction of 19,956 contracts in Client short positions, a significant liquidation suggesting a pronounced capitulation or risk aversion. This massive outflow from retail was counterbalanced by the measured accumulation of 2,006 contracts by Foreign Institutional Investors (FIIs), signaling a tentative, yet discernible bullish bias, while Proprietary Traders exhibited a decisive risk appetite, strategically increasing their net long exposure by 5,814 contracts. Conversely, the 44,516 contracts volume change in Stock Futures revealed an inverse behavioral pattern as Clients demonstrated a bold, directional inclination by aggressively augmenting their long holdings with 15,722 contracts; simultaneously, FIIs expressed a moderate conviction through an addition of 7,326 contracts, primarily signifying stock-specific conviction or hedging requirements. However, the Proprietary Desk executed a sweeping de-risking maneuver, initiating a substantial and complete divestment equivalent to the entire change in open interest of 44,516 contracts, thereby exhibiting a strong underlying defensive posture in the single-stock segment.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Daily Derivatives Report 27th November 2025 by Axis Securities Ltd