Equity Market India Outlook 2026 : Key Drivers of 2025 & Sectoral Overview by HSBC Mutual Fund

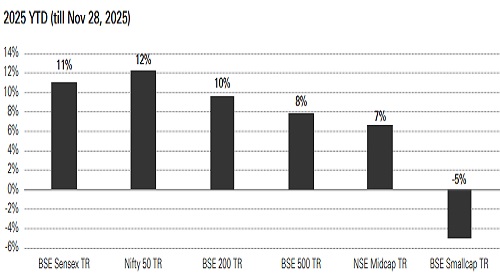

2025 has seen significant divergence in performance. While Nifty TRI is up 12% till November on a Total return basis, NSE Midcaps are up 6.5% and whereas the BSE Smallcap index is down 5%.

While 2025 has witnessed low earnings growth for the Nifty and tepid equity market performance there have been several positives on the economic front which may support market performance in 2026

Key Drivers of 2025

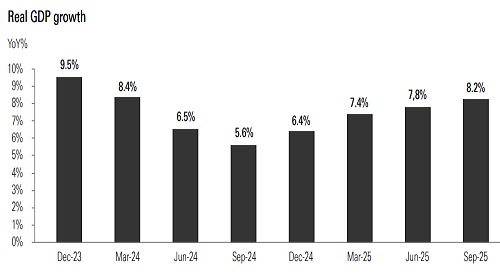

1. India’s economic growth momentum has continued to surprise on the upside underscored by the recent real GDP growth of 7.8%/8.2% (YoY) for Q1 and Q2FY26 respectively.

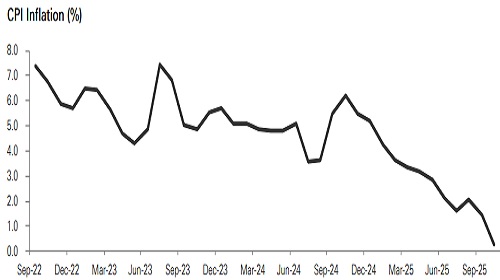

2. RBI changed its policy stance early in the year, eased liquidity significantly and has reduced repo rates by 125 bps till now. We are now starting to see signs of improvement in credit growth as a result of the same. In our view, benign inflation trends have opened up room for further interest rate cuts.

3. In a major reform, government undertook simplification of GST rates by moving to 3 GST slabs from 5. The benefit of reduction in GST rates for several categories of products and services is likely to be visible in second half of current fiscal and beyond. Government also put more money in the hands of the middle class by reducing income tax rates in the Union Budget 2025.

4. Good monsoon and low inflation have boosted rural consumer confidence and bode well for future demand.

All these factors could help drive a mid-teens earnings growth for the Nifty in FY27 after a potentially single digit growth in FY26.

Sectoral Outlook

We are overweight on Banks and NBFCs – Net Interest Margins for banks have bottomed out in FY26 and will improve in FY27. Asset quality of private banks will also improve driving a mid-teens earnings growth in FY27 after a slow FY26. NBFCs are delivering strong earnings growth driven by strong credit demand and improving margins on the back of decline in interest rates.

We are also overweight on Consumer Discretionary sector. Segments like Internet platforms which continue to benefit from strong shift in consumer behaviour towards Quick commerce and e-commerce. Jewellery, Autos and travel related segments are also likely to benefit from recent government measures boosting disposable income for consumers.

Electronic manufacturing services remains a structural theme in our view driven by strong government focus to build an electronics manufacturing value chain in India.

We are Neutral on IT – we expect FY27 earnings growth likely to be near double digits supported by increased Gen AI adoption related workflow and INR depreciation. Valuations are more supportive.

We are Neutral on Industrials. We believe increased allocation for capex in Budget 2026 would be a key catalyst to watch out for.

While we see upside risks to Aluminium and Steel price, we feel a significant part is already captured in the valuations. We, therefore, remain underweight on metals.

Outlook for 2026

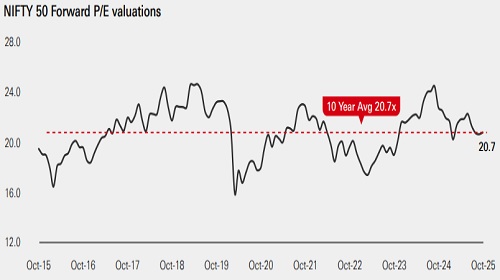

Overall, we remain constructive on the equity markets for 2026. Nifty valuations at 20.5x 1-year forward PE are in-line with its 5-year average and at a modest premium to 10-year average.

Above views are of the author and not of the website kindly read disclaimer

More News

Bank Nifty ended the day on a positive note at 60669, up 0.9% - ICICI Direct