Report on Trends to Watch in the Mutual Fund Industry in 2026 by The Wealth Company Mutual Fund

Domestic Markets That Made Headlines

* Nifty is slated to end higher for the 10th straight year, a streak that has never been witnessed before

* The 50-member index is outperforming the Nifty Smallcap 250 by the widest margin since 2019

* Domestic mutual funds saw 57 straight months of inflows in November, a record streak

* Foreigners are on track to withdraw $18 billion from India’s equity markets, which if it were to happen, would mark the worst year of outflows in two decades – the second worst was -$17 billion, in 2022

* Domestic investors, however, bought stocks worth $83 billion, 42% higher than the CY 24 reading

* The Nifty’s largest daily gain of ‘25 so far has been the 3.8% surge seen on 12th May, on the India-Pakistan ceasefire

* The Rupee is set to end lower against the US dollar for the eighth straight year. This will be the first such losing streak in 50 years

* The RBI cut rates four times this calendar year totaling a cumulative 125 bps from 6.5% to 5.25%; the last time they cut rates so aggressively was during 2019 – 2020

* The 40-member NSE Energy index is on the verge of having its first down year in at least a decade

Global Markets That Made Headlines

* The Dollar index is down 9.1% YTD, its worst-such performance in eight years

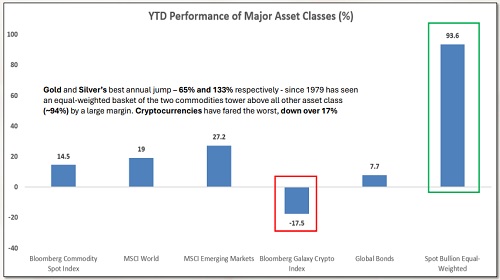

* Spot Gold has surged 65% for the year, its best annual run since the 126% spike in 1979; Silver has jumped about 133%, its best annual performance since the 435% advance witnessed 47 years ago

* Brent crude prices are down for the third year in a row, the first time we are seeing this since 2015

* Nvidia became the first company ever to achieve a $5 trillion market capitalization

* US mega-tech firms (“Mag 7”) collectively lost half a trillion dollars in market capitalization on January 27 when Nvidia lost $590 billion in a single session – the largest ever intraday slump for any stock in history

* In May, Moody’s became the last of the three big ratings companies (after S&P and Fitch) to downgrade the credit rating of the US from the “perfect” AAA status it enjoyed

* The S&P 500 recorded its fastest ever 15% rebound from its lows this year, hitting an all-time high by mid 2025

* The Fed cut rates thrice in 2025 but that didn’t push the 10-year yield lower

* The Bank of Japan hiked its policy rate to 0.75%, the highest level in 30 years

The Year of Bullion by a Long Shot

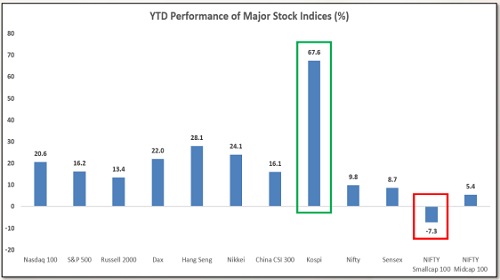

Equities: Korea Clear Winner, India Rotation Underway

* Korea’s Kospi has been the best performing market of all major stock indexes globally.

* The ~68% surge it has seen has been fueled by a rally in semiconductor stocks, foreign flows, a reform-focused government coming to power and moderate inflation, among other things.

* Meanwhile, India has gone from “everything higher” to “large caps favoured”. Mid- and small-caps are underperforming the nifty, which shows that the liquidity-driven beta has vanished, sending the Nifty Smallcap 100 down over 7%.

* Overall, for stocks, the year has been all about AI + semis + quality growth v/s policy overhang.

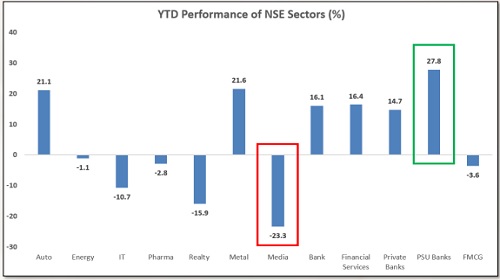

NSE Sectors: PSU Banks Surge, Media Goes South

* PSU banks have been the best performing sector, with its ~28% gains for the year driven largely by a sharp improvement in NPAs and a recovery in credit growth.

* Metals have been second-best, driven by hopes of a global recovery, stimulus in China, and firmer commodity prices that benefited primarily from the dollar’s downtrend.

* Media stocks have fallen the most (-23%) due to weak advertising spends in an uncertain macro environment that hit broadcaster and digital ad revenues.

* Overall, sector performance shows that consumer spending is strong, but structurally challenged areas such as IT and real estate have found the going tough.

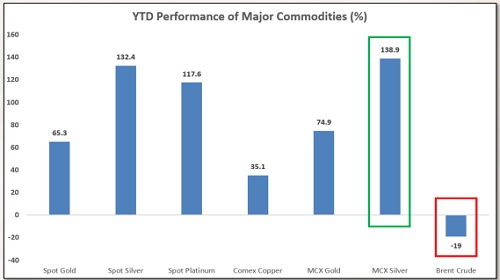

Commodities: Shiny Gets Shinier, Brent Bulls Missing

* Speaking commodities, and 2025 has been the year of the “uncertainty premium”.

* Gold and Silver have rallied hard thanks to a perfect storm of a softening dollar, increasing geopolitical upheavals and largely lower US yields as the Fed turned dovish on monetary policy.

* Copper (+35%) has benefited from increasing demand for AI data centers and China’s much-needed stimulus.

* Brent (-19%) has been the outlier (despite OPEC+ production cuts), on demand fears due to more EV adoption and investments in renewable energy; also, the geopolitical “war premium” has not stuck long enough to disrupt supplies.

Above views are of the author and not of the website kindly read disclaimer

More News

Weekly Derivatives Insights 07 July 2025 - Axis Securities