Weekly Derivatives Insights 07 July 2025 - Axis Securities

NIFTY Index Highlights:

Nifty futures ended Friday at 25,540.1, down 0.8% (210.1 pts), with a 5% drop in open interest—signaling long unwinding.

Bank Nifty futures settled at 57,293.8, dropping 0.6% (354.4 pts), with an 11.2% reduction in open interest—indicating long unwinding.

India VIX eased to 12.31% from 12.39%, slipping 0.6%, signaling slightly lower market volatility.

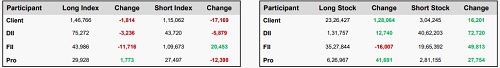

FII Index futures long-short ratio slid from 0.62 to 0.40, reflecting a rise in bearish bets with more shorts and fewer long positions.

Total outstanding open interest in Nifty and Bank Nifty futures were 1.58 cr units (prev: 1.65 cr) and 0.23 cr units (prev: 0.25 cr), respectively.

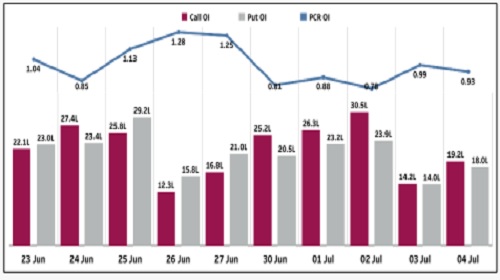

Nifty PCR OI:

Nifty PCR dropped by 0.32 this week, as call option positions outpaced puts, hinting at a tilt toward bearish sentiment.

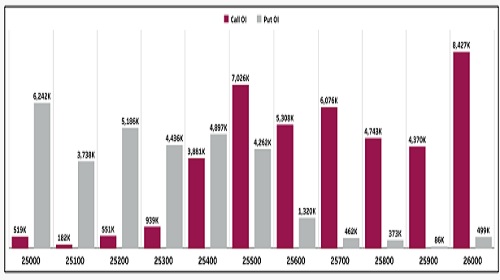

Open Interest Analysis:

The strike-concentration for the upcoming expiry on July 10 shows that the Nifty has strong supports at 25,300, 25,200 and 25,000, while resistance can be seen near 25,600, 25,800 and 26,000.

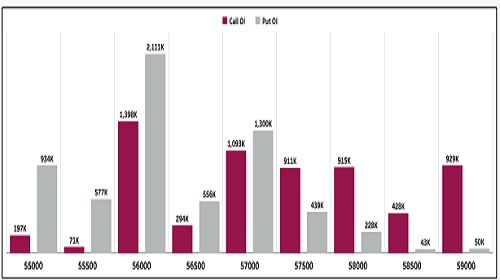

The strike concentration for the June expiration shows that the Bank Nifty has strong supports at 56,000, 55,000, and 55,500, while resistance rests at 56,500, 57,000, and 57,500.

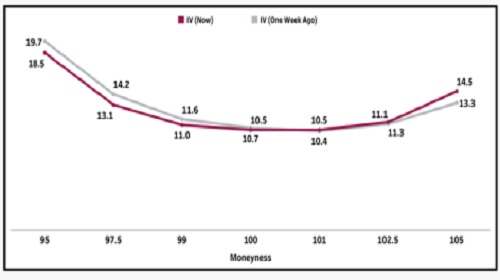

Volatility Analysis:

The implied volatility curve shifted lower for puts last week but went higher for calls, on expectations that the market will recover from its ongoing short-term retreat and recover.

This can be seen for the 2.5% OTM put whose implied volatility has become cheaper while the similar-distance call has become slightly expensive due to rising demand on expectations of a rally, at least for the coming week.

FII total open interest in Index Futures stood at 29,592 cr, an increase of 1,521 cr from last week.

Foreigners had 1,53,659 index futures contracts open, up a net of 8,737 contracts from the previous week. Nifty Futures saw an addition of 7,884 contracts, while Bank Nifty saw an addition of 1,582 contracts.

Trade Ideas:

Buy KALYANKJIL July Futures in the 589 – 582 range | SL 575 | Targets 617 & 631 (Long Build Up).

Buy BHARAT FORGE July Futures in 1321 – 1305 range | SL 1295 | Targets 1373 & 1399 (Long Build Up).

The Week That Was:

* Nifty futures ended Friday at 25,540.1, down 0.8% (210.1 pts), with a 5% drop in open interest—signaling long unwinding.

* Bank Nifty futures settled at 57,293.8, dropping 0.6% (354.4 pts), with an 11.2% reduction in open interest—indicating long unwinding.

* India VIX eased to 12.31% from 12.39%, slipping 0.6%, signaling slightly lower market volatility.

* FII Index futures long-short ratio slid from 0.62 to 0.40, reflecting a rise in bearish bets with more shorts and fewer long positions.

* Total outstanding open interest in Nifty and Bank Nifty futures were 1.58 cr units (prev: 1.65 cr) and 0.23 cr units (prev: 0.25 cr), respectively.

Nifty Open Interest Put-Call Ratio

* Nifty PCR dropped by 0.32 this week, as call option positions outpaced puts—hinting at a tilt toward bearish sentiment.

Volatility Analysis

* The implied volatility curve shifted lower for puts last week but went higher for calls, on expectations that the market will recover from its ongoing shortterm retreat and recover.

* This can be seen for the 2.5% OTM put whose implied volatility has become cheaper while the similar-distance call has become slightly expensive due to rising demand on expectations of a rally, at least for the coming week

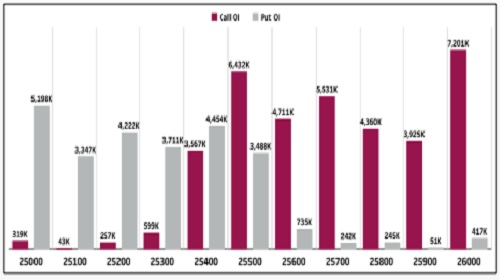

Nifty Open Interest Concentration (Weekly)

* The strike-concentration for the upcoming expiry on July 10 shows that the Nifty has strong supports at 25,300, 25,200 and 25,000, while resistance can be seen near 25,600, 25,800 and 26,000.

* Speaking of open interest changes, the 26,500-strike call and 24,000 strike put saw the maximum addition, alongside the 24,500-strike put and the 26,000-strike call.

* Based on the data, we project the Nifty to trade between 25,000 and 26,000 in the week ahead.

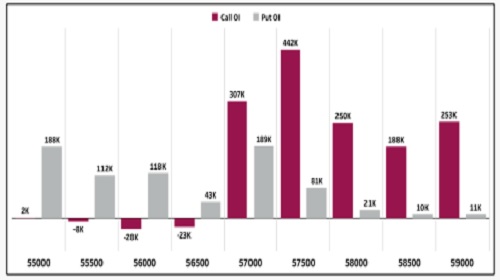

Bank Nifty Open Interest Concentration (Monthly)

* The strike concentration for the June expiration shows that the Bank Nifty has strong supports at 56,000, 55,000, and 55,500, while resistance rests at 56,500, 57,000, and 57,500.

* Speaking of open interest changes, the 57,000-strike put saw the maximum addition, while the 57,500- strike call saw the largest addition.

* Based on the data, we project the Bank Nifty to trade between 56,000 and 58,000 in the coming week, with 56,000 acting as a pivotal level.

Nifty Change in Open Interest (Weekly)

* Using the monthly expiration cycle, notable addition in calls was seen at the following strikes - 26,000 (9.6 Lc), 25,600 (8.6 Lc), and 25,500 (8 Lc), respectively. There was no significant unwinding observed at any strikes.

* Coming to puts, the 25,500 (6.4 Lc), 25,400 (6.1 Lc), and 25,600 strikes (5.7 Lc) saw considerable addition in open interest. Unwinding was witnessed at the 25,200 strike.

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty - based again on the monthly expiration cycle - notable addition in calls was seen at the following strikes - 57,500 (4.4 Lc), 57,000 (3.1 Lc), and 58,000 (2.5 Lc), respectively. Significant unwinding was observed at the 56,500 & 56,000 strikes.

* Coming to puts, the 57,000 (1.9 Lc), 56,800 (1.3 Lc), and 56,000 strikes (1.2 Lc) saw considerable addition in open interest. There was notable unwinding observed at 57,400 & 57,200 strikes.

Weekly Participant-wise Open Interest (contracts)

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633