Indian Sensex Index to reach 115,836 level by FY28: Ventura

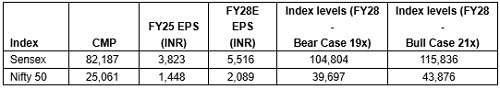

According to Ventura, a full-service stock broking platform, Nifty to oscillate within a well-defined PE band in the 3-year period with projected robust earnings growth with estimated FY28 EPS CAGR of 12-14%. By FY28, Ventura values Indian index levels at a PE of 21x (bull case) and 19x (bear case) with an estimated EPS of 5,516 for Sensex and 2,089 for Nifty 50.

In a bull case scenario, Ventura expects Sensex level to reach 115,836 and Nifty 50 level at 43,876 by FY28. In a bear case scenario, Sensex is projected to reach 1,04,804 and Nifty 50 at 39,697 by FY28.

Q1FY26 Mid-Season Results: Sectoral Strength and Momentum

As of the mid-season point, 159 companies have reported Q1FY26 results, revealing broad-based strength across key sectors. Engineering/manufacturing and services sectors have led the pack, while consumption, commodities, and pharma show steady performance. The diversity of positive earnings surprises across verticals such as BFSI, IT, healthcare, and logistics underscores India Inc.'s adaptability and ongoing business recovery, setting the tone for a resilient earnings season and sustained investor optimism.

India Emerges as the World's Most Promising Investment Destination

In an increasingly uncertain global economic landscape, India stands out as the only large growth market with a unique combination of strong GDP growth (6.5%), moderate debt levels (Debt-to-GDP ratio of 80%), and comparatively benign bond yields. While developed economies like the USA and Japan grapple with staggering debt burdens and slowing growth, India offers investors a compelling macroeconomic profile powered by demographic dividends, economic resilience, and long-term reform orientation. These fundamentals position India as a magnet for global capital in the decade ahead.

Vinit Bolinjkar, Head of Research, Ventura said “In the last 10 years, Indian economy has demonstrated resilience and clocked highest GDP growth as a large economy despite global headwinds of NBFC crisis, Covid 19, Russia-Ukraine war and the recent uncertainty on Trump tariff. The risk mitigation influencers will outweigh the current challenges which will usher Indian GDP growth to 7.3% by FY30(E). We anticipate significant wealth creation aligned with India's structural reforms and macroeconomic stability.”

India's Resilience: Overcoming Decade-Long Economic Adversities

Over the past ten years, India has demonstrated extraordinary resilience by navigating a series of unprecedented disruptions without compromising its growth trajectory. From the "Fragile Five" designation to demonetization, GST implementation, a crippling NBFC crisis, and the dual shock of COVID-19 waves, India has withstood and adapted to adversity. Even global headwinds like the Russia-Ukraine war and Trump-era tariffs have failed to derail its momentum, underlining the robustness of the Indian economy.

Challenges Ahead Are Manageable: The Future Looks Brighter

While challenges persist, they are far less daunting than those India has already overcome. Strategic developments like the Andaman oil discovery, domestic gold monetization, import substitution initiatives, and a multipronged national security strategy (including Operation Sindoor) strengthen India's long-term fundamentals. The market has yet to fully price in these transformative shifts, which support growing forex reserves, sustainable debt levels, and the potential for lower long-term interest rates - all of which suggest a more favourable investment climate going forward.

Above views are of the author and not of the website kindly read disclaimer

.jpg)