Traders should remain cautious and adopt a long–short combination approach until the index stabilizes above 26050 - Tradebull Securities

_Securities_(600x400).jpg)

Nifty

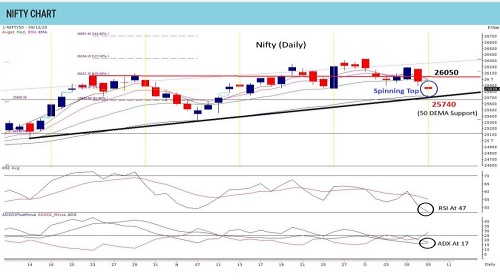

Monday’s decline was sharp and triggered unwinding of long positions, with a continuation of that weakness seen in yesterday’s session as well. Price action remained soft in the first half, though the weekly expiry event induced a meaningful pullback later in the day. The index eventually rebounded from its 50-DEMA support at 25740 and closed near 25840, forming a ‘Spinning Top’ candle. Trend indicators also echoed the weakening structure—RSI slipped below the neutral 50 mark, and ADX eased to 16, signalling a drop in directional strength. The index continues to hold a strong base near 25900, but this zone is being retested. A follow-through close below 25900 could further dent sentiment and open the gates for a slide towards 25700, and potentially even 25440. On the upside, only a sustained move above 26050 would revive bullish momentum and realign the index toward 26330–26500. Options data suggests firm boundaries at 26000 (resistance) and 25800 (support), with positioning concentrated near 25950. The PCR OI at 1.02 indicates the market is not yet in oversold territory, leaving room for additional downside if selling resumes. Traders should remain cautious and adopt a long–short combination approach until the index stabilizes above 26050. Fresh averaging is best avoided until clear directional strength re-emerges above this threshold.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838