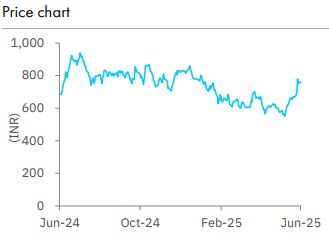

Company Update : Schneider Electric Infrastructure Ltd by Elara Capitals

Huge capex to bolster sales, exports

Schneider Electric Infrastructure (SCHN IN, Not Rated) witnessed robust topline growth in Q4 and FY25, led by efficient execution of a growing orderbook. EBITDA margins declined due to higher operating costs, but the management expects improvement hereon. Inflows continued to grow for SCHN despite an overall slowdown in order inflows in the industry in Q4, with a healthy QoQ growth in orderbook. SCHN also announced a massive capex to boost domestic and export sales.

SCHN is poised to be a key beneficiary in the Power Transmission & Distribution (T&D) space in India, with strong demand for T&D equipment due to addition of new lines as the government looks to rapidly electrify India. SCHN is well placed with its diverse product portfolio, energy efficient products, innovative EcoStruxure platform and presence pan-India to cater to growing demand of electrical equipment in data centers, semiconductor fabs, nuclear plants, renewable, steel and chemical industry.

Revenue surges on robust execution: Q4FY25 revenue surged 24% YoY to INR 5.9bn, led by strong sales growth in transactions and services segment, on the back of a robust orderbook with efficient execution (including execution of certain large-ticket orders). FY25 sales grew 20% YoY to INR 26bn in the year and SCHN introduced new products and solutions for energy and chemicals, cell manufacturing and RE. It is also targeting products to cater to the Small Modular Reactors (SMR) industry.

Inflows rise despite overall slowdown: Order inflows rose 11% YoY to INR 7.6bn in Q4, and 13% YoY to INR 27bn in FY25. Order backlog was up 15% QoQ to INR 12.5bn, despite rapid execution in Q4. In the quarter, SCHN won key orders from Energy & Chemicals, Metals, Mining and Minerals, Metro, and Power & Grid. Despite signs of a slowdown in ordering from public capex and delay in revival of private capex, SCHN continues to see momentum in ordering led by strong brand name and parental support in group orders.

Margins fall on higher other expenses: Gross margins declined by 210bps to 38% in Q4, due to higher raw material costs. Employee cost rose 19% YoY and other expenses grew 15% YoY due to higher sales-related expenses and marketing costs. EBITDA margin fell 70bps YoY to 14.8% on higher costs. However, FY25 EBITDA margin expanded 110bps YoY to 14.5%, led by operating leverage and internal efficiency. The management aims for further improvement, led by product mix and operating leverage.

New capex announced for domestic and exports demand: SCHN announced a massive capex plan of INR 2bn to increase capacity of panels for its switchgear plant by 6,000 and for its breakers plant by 9x versus current capacity. Both of the plants are currently operating at 90% utilization each. SCHN aims to utilize breakers capacities for both domestic and export demand (breakers exports are margin-accretive and more feasible to make in India). The company aims to fund capex through internal accruals and some amount of borrowings. These are expected to commence in FY27.

Please refer disclaimer at Report

SEBI Registration number is INH000000933