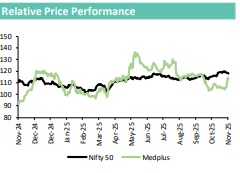

Company Update : Medplus Healthcare Services by ARETE Securities Ltd

MEDPLUS reported a steady quarter with healthy topline growth and strong profitability despite a marginal revenue miss versus estimates. Consolidated revenue grew 6.5% YoY / 8.9% QoQ to Rs.16.8 bn, supported by new store additions and an increasing private-label mix. Gross margin expanded 240 bps YoY to 26.1%, aided by higher private-label contribution and efficient procurement. EBITDA rose 22% YoY to Rs. 1,488 mn, with margins improving 130 bps YoY to 9.9%, reflecting operating leverage and cost discipline. PAT grew 43% YoY to Rs. 555 mn, with margin expansion to 3.3%. Operating cash flow remained strong at Rs.1.26 bn, translating to 142% of EBITDA, while ROCE improved to 22.5%. The company added 117 net stores during the quarter, taking the total to 4,930 stores across 13 states and 1 UT. Mature stores (12+ months) continued to deliver robust profitability with 11.8% store-level EBITDA margin and 68.6% ROCE. Private-label portfolio expanded to over 1,450 SKUs, further supporting margin resilience. Overall, MEDPLUS continues to strengthen its position as a leading omni-channel pharmacy retailer through cluster-based expansion, higher-margin private-label growth, and efficient capital deployment.

Management call highlights

* Added 10 new warehouses in the last 18 months (6 operational) to strengthen backend infrastructure; fill rates improved with incentive-linked execution.

* Opened 145 new stores (net 117 adds) in 2QFY26; 23 closures in 1Q (8 franchise). FY26 guidance of 600 new stores (100 franchise) maintained. 2HFY26 likely to remain flat YoY. Average store size: 528 sq ft.

* Pharmacy GMV grew 8% YoY; PL pharma share stood at ~19.5% on a GMP basis.

* EBITDA margin for stores older than 24 months was at ~11%, and for stores older than 13-24 months at 6-9%, and stores >12 months at 10.9%.

* Active plan renewal rate at 24% in Q2; scale-up targeted post reaching 250,000 subscriptions.

* Subscriptions: 4 million MEDPLUS pharmacy subscribers.

* GST impact: 100% GST benefit passed on to customers; input tax credit accumulation up 7%. Negotiated extended credit terms with suppliers to offset temporary ITC blockage. Positive nearterm GST impact expected to normalize gradually.

* SSSG outlook: Expected to improve gradually to high single digits over the next two years.

* Employee initiatives: Introduced retention scheme-Rs.18,000 after 1 year, rising to Rs.50,000 for longer tenure. Training period: 1 month. Attrition reduced by ~15% in year 1; employee cost growth to moderate YoY.

* Non-pharma initiatives: Redesigned outlets with open-shelf layouts to drive impulse purchases. PL gross margins: 75- 78% (pharma) and ~34% (non-pharma). Consumer uptake driven by pricing and first-use experience, particularly in categories like toothpaste.

Valuation and outlook

We view MedPlus as a steady compounder in India's organized pharmacy retail space, supported by its scale advantages, growing private-label penetration, and prudent capital deployment. The company's high-margin private-label portfolio (~19.5% of GMV) is expected to reach ~30% over the next 12-18 months, driving sustained gross margin expansion. Strong unit economics from mature stores and improving backend efficiency provide structural margin tailwinds, while healthy free cash generation (~Rs.4.8 bn in FY25) enables self-funded growth.

We estimate Revenue / EBITDA / PAT CAGR of 10% / 18% / 28% over FY25-28E. Rolling forward to September FY28E EBITDA of Rs.7.6 bn and assigning a 20x EV/EBITDA multiple, we derive a target price of Rs. 1,204, implying ~48% upside from the CMP of Rs. 815. The premium valuation is justified by MedPlus's consistent execution, improving mix quality, and scalable clusterbased expansion model. With private-label traction, cost discipline, and internal funding of growth, MedPlus remains well placed for sustained value creation and margin-led compounding.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127

.jpg)