Company Update : KEI Industries By Emkay Global Financial Services Ltd

Structurally wired for ~20% revenue CAGR till FY30

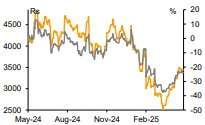

We recently met the top management of KEI Industries, to assess future growth prospects in the W&C space and KEI’s position in this high-growth area. KTAs: i) Retained guidance of +20% revenue CAGR till FY30, driven by strong demand across renewables, T&D, data centers, EV ecosystem, and industrial capex; gave guidance of 18% growth in FY26 (limited by capacities). ii) Phase 1 (LT/HT) at Sanand is on track to commence production by Q1FY26-end, while FY26 margin is seen to be stable (~10.5–11%), and ~50–100bps margin expansion is expected from FY28 as it scales up/EHV mix rises. iii) Wires gained traction (B2C mix at 52%) via deeper channel financing (~70% of dealer revenue) and expansion in new markets (East/South); Exports (~13% of revenue; targets ~17–18% by FY28) will benefit from easing freight bottlenecks via Sanand. On competition, the management believes robust sectoral growth tailwinds (~12– 13% CAGR) would absorb incremental supply from new entrants like Birla/Adani without materially disrupting incumbent players. KEI currently trades at ~50x FY25 TTM PER (Consensus: FY27E PER of ~34x).

Guidance for over 20% revenue CAGR till FY30

The mgmt reiterated its FY30 growth guidance of over 20% (Rs250bn by FY30), driven by robust demand in renewables, thermal power, T&D infra, data centers, EV ecosystem, and industrial capex; however, it maintained its guidance at ~18% for FY26, which marks a ramp-up year with new capacities scaling up. Growth will be driven by a well-diversified order book across the domestic institutional, export, and B2C channels. The newly commissioned brownfield capacities at Pathredi and Chinchpada have supported volume growth in FY25 (~20% vs earlier guidance of ~18-19%), and the upcoming Sanand facility is expected to be a key inflection point (expects +20% revenue CAGR till FY30)

Sanand ramp-up to unlock margin expansion from FY28

Phase 1 of the Sanand facility (LT/HT cables) is on track to commence operations by endQ1FY26, with planned capex outlay of ~Rs13bn in FY26; this will potentially unlock ~Rs55-60bn revenue, while Phase 2 (HVDC/EHV) will open high-value export opportunities. The mgmt. expects FY26 EBITDA margin to be stable at ~10.5–11%, with margin expansion of ~50–100bps anticipated from FY28, supported by operating leverage benefits at Sanand and improved product mix (higher EHV mix).

Strong industry growth to limit impact from competition; growth levers intact

The management believes the robust sectoral growth (~12-13% CAGR) is likely to absorb incremental supply from new entrants like Birla/Adani without materially disrupting incumbent players. The fragmented nature of the W&C market and long approval timelines (typically 5–7Y for institutional cable segments) also act as natural buffers. The wires business continues to outpace peers’, on rising presence in East/South, with B2C revenue mix now at ~52% in FY25 (vs 27% in FY17). Exports (~Rs13bn in FY25; ~13% of revenue) are a structural growth lever for KEI (targets 17-18% revenue by FY28). Also, the EHV segment is expected to recover in FY26, backed by easing execution delays.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354