Company Update : Solar Industries India Ltd by Prabhudas Lilladher Ltd

Defense to propel future growth

We visited Solar Industries India’s (SOIL) manufacturing facility in Nagpur and engaged with the management discussing the company’s financial and operational performance, capacity expansion plans, and growth outlook. We believe SOIL is strategically positioned for growth driven by strong execution and order prospects across its Defense and Explosive businesses. SOIL has been strategically expanding its global footprint over the years and caters to >91 countries across globe. In the explosives segment, SOIL has positioned itself as a market leader with >25% domestic market share in coal mining. With strong order prospects in Ammunition, UAV’s, Rockets and Missiles from both domestic and international markets, SOIL is aiming to achieve Rs80bn revenue in the next 4-5 years. SOIL’s long-term growth prospects remain strong led by capacity expansion, acquisitions & increasing footprint across the globe, and expanding the Defense portfolio. The management has guided for revenue of Rs100bn with EBITDA of ~27% and capex plan of Rs20bn for FY26. The stock is currently trading at a PE of 55.5x/46.3x on FY27/28E (consensus).

We remain positive on SOIL given, 1) the Defense business driving revenue growth, 2) expanding and gaining market share in international markets for the Non-defense business, 3) its market leadership in the Explosives business, and 4) strong traction for defense products from globe market amid geopolitical tensions.

Key takeaways from management interaction:

* The management has guided revenue of Rs100bn in FY26 driven by 1) scaleup in Defense revenue to Rs30bn (vs. Rs21bn in FY25), 2) 10-12% growth in the Industrial Explosives business, and 3) expansion into new markets to deepen its global presence.

* International business (Non-defense) contributes to 35–40% of total revenue, which the company expects to sustain in the medium term. The company remains focused on commercial explosives and defense products, with operations across 8 global locations and active market development in regions including Zimbabwe, Saudi Arabia, and Kazakhstan. SOIL plans to enter new countries to further broaden its global addressable market.

* Defense business visibility remains robust with an executable order book of Rs155bn, split into (1) Rs80bn of international orders with a 4–5 year execution timeline, and (2) Rs75bn of domestic contracts, largely anchored by the Pinaka program (~Rs60bn) carrying an 8–10 year execution horizon, while the balance (~Rs15bn) comprises smaller systems and ammunition contracts. The company delivered 400 units of the loitering, UAV system Nagastra-1 in FY25, translating into Rs1.6bn in revenue, with repeat order potential remaining strong across UAVs, ammunition and heavy caliber systems.

* Order book stood at ~Rs171bn in H1FY26. Of this, Defense order was Rs155bn (incl. Pinaka order of ~Rs60bn). Industrial Explosives order stood at ~Rs16bn with an execution period of ~3 years. Defense order prospects remain strong given the ammunition shortage across the globe due to geopolitical tensions, creating multi-year opportunity for the company.

* Solar Industries has signed an MoU with the Government of Maharashtra to invest about Rs127 billion over the next 10 years to scale up their defence manufacturing capabilities in Maharashtra. The expansion plan includes highgrowth segments like UAV systems, counter-drone solutions, energetic materials, and next-generation explosives. They are also evaluating new product areas in future defence mobility, including military transport and aircraft.

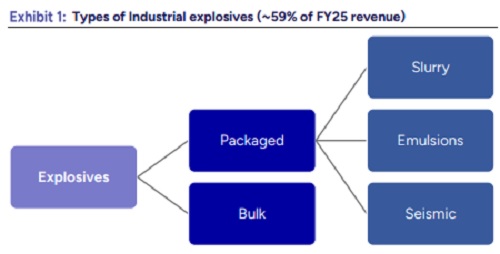

Solar Industries India – Leader in explosives segment

We visited SOIL’s mother plant in Chakdoh, Nagpur. Started in 1995, the plant manufactures and supplies a comprehensive range of packaged, bulk explosives, Initating systems and High energy materials designed to meet diverse requirements across mining, infrastructure, construction, defense and space sectors. SOIL procures 30-40% of ammonium nitrate, the key raw material for explosives, from domestic players like Deepak Fertilizers, GNFC and RFC, and the remaining is imported.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)

.jpg)