Company Update : Latent View Analytics Ltd Prabhudas Liladhar Capital Ltd

.jpg)

Leveraging data & analytics for better decision making…

Quick Pointers:

* Aims to double revenue to USD200-220 mn by FY27/FY28

* Making significant investments in Databricks partnership & AI-driven analytics

We interacted with the CFO of LATENTVIEW (LV). The management is confident of achieving high teens revenue growth with steady margin in FY26. The company is doubling down on scaling focused accounts, especially in the band of USD1mn to USD6mn. The investments in hiring senior personnels and account managers were put in place to connect direct decision makers and CXOs of Fortune 500 clients. The intent is to drive referrals, touch upon multiple business functions, and co-create client solutions with focused accounts, instead of pursuing RFP-led engagements. LV expects the momentum within Financial Services to support growth in FY26, while Consumer/Retail to pick up pace over Q1FY26, aided by Decision Point. The Databricks partnership maintains its healthy state, and LV remains focused on acquiring capabilities around data engineering to achieve broader revenue stream. The investments in hiring senior personals/account heads are largely in place, FY26/FY27 should be the year of reaping benefits of those investments and derive operating leverage. The management has retained its aspiration to achieve revenue of USD200-220mn by FY27-28 (translates to 26%-30% CAGR). The stock is currently trading at a P/E multiple of 46x FY27E & 36x FY26E/FY27E consensus.

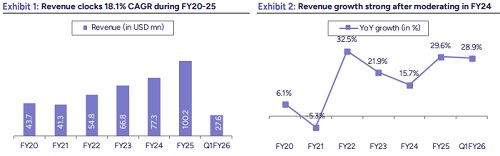

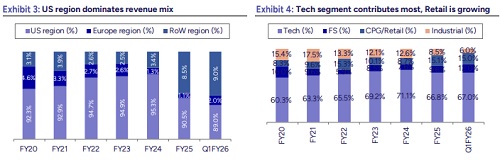

Aiming for USD200mn revenue by FY27/FY28: LV reported revenue of USD100mn in FY25 and USD106mn in LTM Q1FY26, with 85–90% contribution from Fortune 500 clients. The management has set an ambitious goal of doubling revenue to USD200mn over the next 2–3 years. Majority of growth is expected to come organically by scaling 27 identified focus accounts, most of which are Fortune 500 companies with high data analytics maturity and long-standing relationships with LV. While some top clients may grow at a relatively slower pace due to a higher base, they remain strategically important in enabling the company to achieve its revenue target at the earliest.

Investments for strong growth: The management has earmarked ~USD2mn to expand sales and CoE teams, in order to strengthen client mining and services breadth. A key growth lever will be its deepening partnership with Databricks, for which LV is building a dedicated CoE, positioning the company to capture rising demand for advanced data engineering and AI-driven analytics.

Deploying cash for strategic investments: LV had cash, cash equivalents & investments (CC&E) of Rs12.8bn as of Mar’25. With positive operating cash flows, the company plans to deploy this surplus towards business growth. The priorities include: (1) pursuing inorganic opportunities in data engineering, Databricks, or GenAI-based analytics businesses; (2) making small investments to gain technology access and enhance service offerings; and (3) funding large transformation deals. The management emphasized that cash will not be used for investor payouts at present but will be retained to drive business expansion.

Above views are of the author and not of the website kindly read disclaimer