Company Update : Happy Forgings Ltd - Yes Securities Ltd

Highlights of Happy Forgings (HFL) plant visit and management interaction

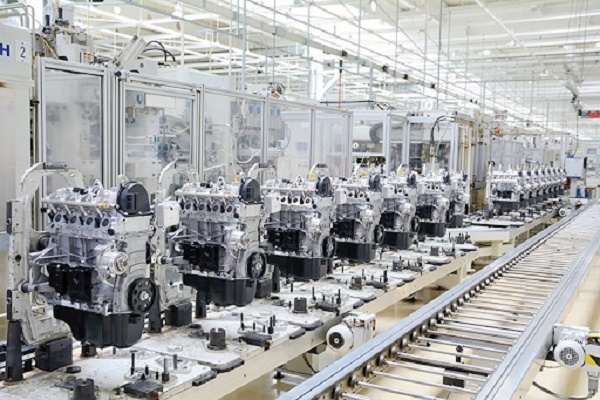

1) Sound engineering capabilities, as reflected in HFL’s rapid diversification and delivery of complex forged/ machined components to auto/industrial segments, has fetched significant market share gains. 2) Focus on complex/critical parts and recent product additions will open up new opportunities: capability step-up from addition of 14k ton press line (in 3QFY23) helped expand product offerings from up to 90kgs to complex parts up to 250kg. Ongoing Brownfield expansion for 3.1k ton (dedicated to PV), 6.3k ton and 10k ton press lines will help rebalance production and augment further capacity. 3) New order wins in PV and industrials will help de-risk dependance on CV/tractors (~73% of revenues). Further, HFL intends to work on light weight forgings to support growth. 4) Structural demand drivers like opening of India-centric global supply chain and low revenue share of industrials and exports (vs peers) should help outperformance. Street has built in standalone revenue/EBITDA/Adj.PAT CAGR of 21%/24%/30.7%. Although execution and continued revenue diversification are critical success factors, we believe valuations at 24.2x/18.9x FY25/26 bloom standalone EPS partially price in the positives. Not rated.

A closer look at key takeaways

* Sound engineering capabilities help rapid revenue diversification and market share gains: HFL’s management and engineering capabilities have helped it quickly diversify revenue base in 9MFY24 (YoY) as 1) contribution of machined products increased to 84% (vs 78%), 2) share of industrials and exports increased to 13% (vs 4%) and to 20% (vs 13%). ~47%, revenues are from Crankshafts, wherein HFL has large market share of ~45%/35% in CVs/tractors, given high tolerances of product design and manufacturing capabilities, causing high entry barrier and limited competition.

* Focus on critical parts and recent products addition to open up opportunities: HFL is looking to add capacity in forging (brownfield expansion is underway for 6.3k ton press by 2QFY25 and 10k ton press line) and machining owing to high demand. Machining capacity utilization is (~85%) 50k tons currently; it is expected to move up to 61k-62k tons in phases (delayed by couple of months due to Red Sea issue). Front axle beam (new product) supplies are expected to start soon, and target is ~5k beams per month by end of FY25E (to start with 1-2k units p. m. and ramp up subsequently), vis-à-vis total industry demand of ~30k beams p.m.

* New order wins in PV and industrials to help de-risk dependance on CV/tractors: - HFL expects PV segment to contribute 5-6% by FY25E and >10% of the overall revenues in 3-4 years, led by ramp-up with existing customer (crankshaft and suspension parts) and new order win from North American customer, slated to start in FY26E. HFL is setting up 3.1k tons press line dedicated to PV segment while ramping-up SUV crankshaft supply to domestic customers, where it has 34- 35% share of business for a single platform.

* Opening up of global supply chain for India, a structural demand driver: With installation of 14k tons press line (in 3QFY23), HFL experienced a major influx of new order wins from the Industrial segment. The current utilization of this press line is 35-40% and it plans to ramp it up to 75-80% over 12-16 months on the back of new order wins. HFL has made significant progress in exports as well by crossselling products and expanding into new locations. HFL expect the share of exports in revenues to increase to >30% over 2-3 years (vs ~8%/20% in FY21/9MFY24).

Other takeaways:

* Growth guidance: HFL expects revenues of Rs20-23b (vs ~Rs10.2b in 9MFY24) in 2-3 years. This will be led by organic growth; inorganic growth would be over and above the started target. HFL expects EBITDA per kg to stay stable.

* Crankshaft: PV has high margins & capex over other segments - share of business for SUV with a leading domestic customer is 34-35% (for single platform). Ramp up of supply to existing platform and proposed multiple platforms will eye further share of business.

* Light weight forgings – they are working on other alloys but not only Aluminum. (India uses Aluminum castings and not Aluminum forging) Additional investment will be needed only for heating treatments, press will remain the same in case opportunity arises for Aluminum light weighting components.

* No plans to enter connecting rods business, given high competitive intensity.

* Exports forms ~20% (of which 8-9% is deemed exports). Expect exports to be >30% over 2- 3 years (vs ~8%/20% in FY21/9MFY24). Indicated exports margins are 4-5% more than domestic supply.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632