Commodity Morning Insights 21st Nov 2025 by Axis Securities

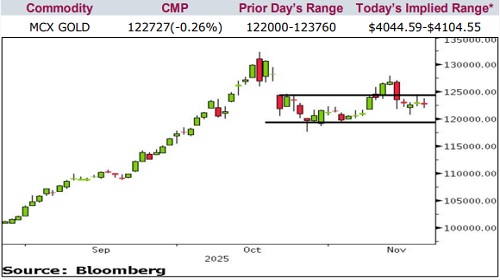

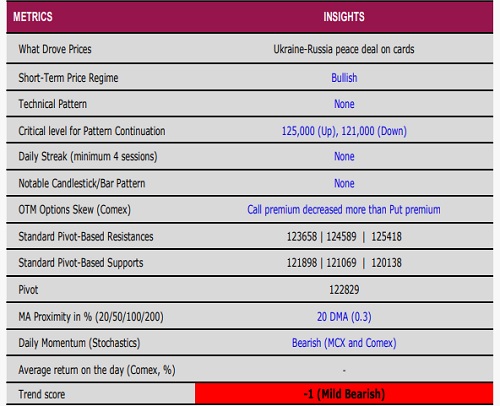

* Comex Gold settled lower in the previous session as prices remained volatile amid the release of key U.S. economic data that had been delayed for over a month. The much-anticipated Non-Farm Payrolls report came in stronger than expected, reducing the likelihood of an imminent Fed rate cut and pressuring bullion prices. We expect gold to trade sideways with a mild bearish bias in the near term

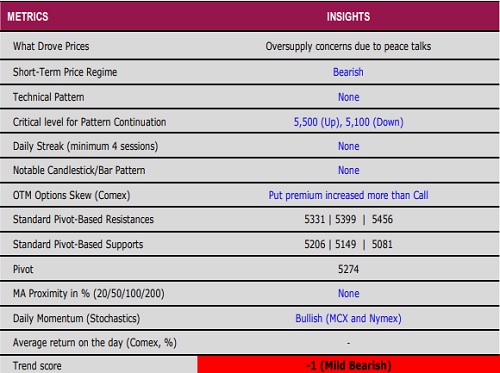

* Nymex Crude Oil extended its decline for the second consecutive session, ending more than 1% lower. Strong U.S. jobs data further diminished rate-cut expectations, while geopolitical risk eased after Ukrainian President Zelenskiy signalled willingness to engage in a peace plan drafted by the U.S. and Russia. Immediate support is seen near the $58 level; a breakdown below this zone could open downside potential toward $55

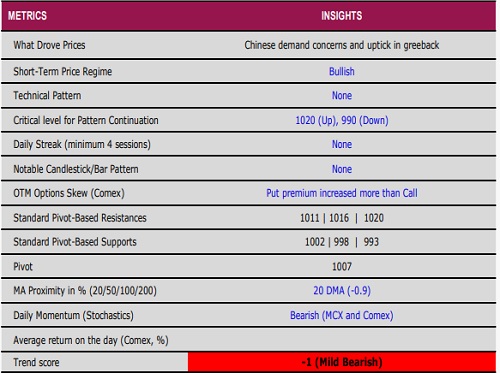

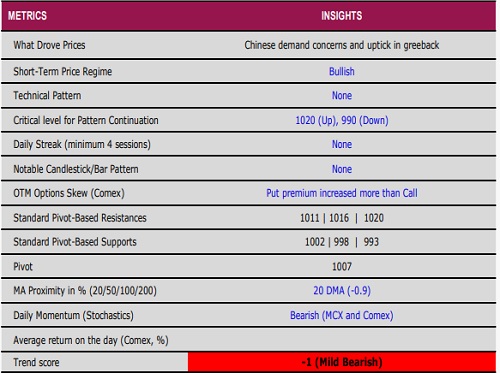

* Comex Copper fell over 1.5%, with the $5 mark continuing to act as a stiff resistance. A stronger U.S. dollar and persistent concerns over Chinese demand triggered profit booking in the base-metal complex

* Nymex Natural Gas surrendered earlier gains and closed nearly 2% lower after inventory data came in broadly as expected. However, a shift in weather forecasts toward warmer-than-normal conditions for the first week of December weighed on sentiment

Gold

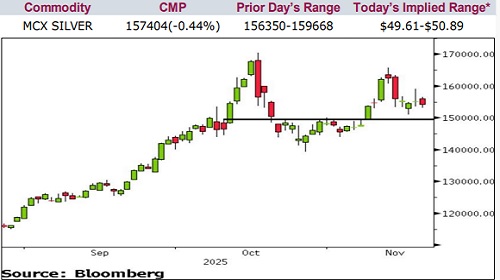

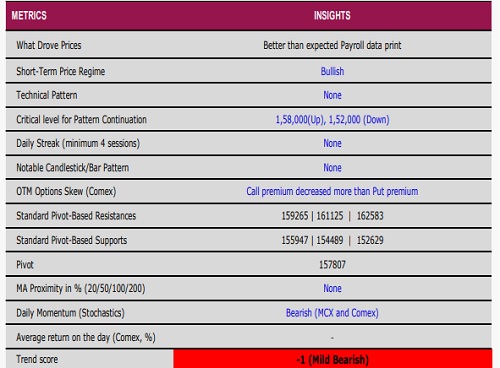

Silver

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633