Navigating the Oil Surge: Scenarios and market implications by Choice Broking Ltd

What just happened: Oil prices have surged 10% this morning, with Brent trading near US$77/bbl, after Israel launched an attack on Iran’s nuclear facilities—a dramatic escalation that has jolted energy markets.

What could happen next?

Short-term risk scenario: If tensions between Iran and Israel continue to escalate, we could see 1.6–1.7 million barrels per day (mbd) of Iranian crude effectively removed from the global market, ~2% of total supply. This outcome would align with the United States’ strategic goal of curbing Iran’s shadow crude oil trade through tighter sanctions enforcement.

However, the devil lies in the details: OPEC+ is planning to fully unwind its 2.2 mbd production cut, but supply disruptions from Iran could offset the impact of the overall increase, keeping the market tight. If the U.S. further increases sanctions on Venezuela, potentially removing ~0.8 mbd of supply, it could provide additional upward momentum to oil prices

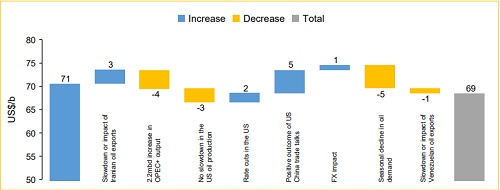

Chart 1: Catalysts for Brent price for rest of the CY25

While geopolitics remain a key driver, several other market catalysts are also shaping the near-term oil price outlook:

Potential upside catalysts:

• Anticipated rate cuts in the U.S., supporting broader risk assets and commodity demand

• A positive resolution to the U.S. and China trade talks, improving sentiment and trade flows

• Favorable foreign exchange trends, especially USD weakness, supporting oil demand.

Negative catalysts:

• No significant slowdown in U.S. oil production

• Seasonal decline in global oil demand in the second half of CY25

• A projected softening in China’s oil demand growth

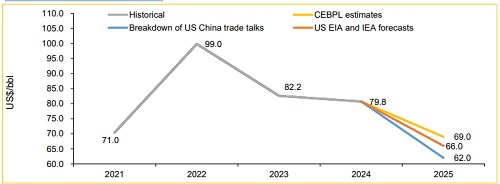

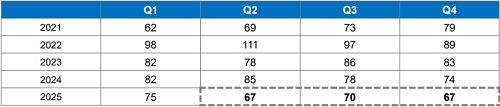

Broader view: We currently estimate Brent crude to average US$69/bbl for CY25. In comparison, both the U.S. EIA and IEA forecast an average of US$66/bbl for the year. We expect Brent prices to remain elevated in 3QCY25 on the back of catalysts as highlighted in the Chart 1 at an average of US$70/bbl. However, on the back of seasonal downtrend, we expect the prices to average US$67/bbl in Q4CY25.

However, we note the downside risk tied to the U.S. and China trade relations. In the event of a breakdown in the broader trade talks between the two countries, we expect Brent prices could average closer to US$62/bbl for CY25.

For CY26, we estimate Brent price to average at US$65/bbl due to reduced overall demand as well as economic slowdown.

Chart 2: Brent Price Estimate for CY25

Chart 3: Quarterly Oil Price estimate for CY25

Above views are of the author and not of the website kindly read disclaimer

.jpg)