Cement & Building Materials Sector Report : Volume grew by 10.2% YoY and remained in line with market expectations by Choice Broking Ltd

Volume grew by 10.2% YoY and remained in line with market expectations

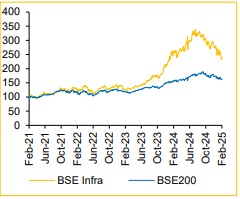

In Q3FY25, cement companies in our coverage delivered healthy volume growth, driven by the government’s strong infrastructure push and sustained demand recovery. Sales volumes expanded by ~10.2% YoY and ~10.8% QoQ, reflecting improved execution of infra projects and steady traction in the housing sector. Companies expect this positive momentum to continue in 4QFY25 and extend into FY26, supported by higher government spending, a pickup in housing construction, and pent-up demand.

Among key players, Ambuja and ACC led the volume growth in our coverage, reporting a strong ~23.2% and ~20.5% increase on YoY, respectively, followed by Nuvoco at ~17.5% and Ultratech at ~11.4%. However, JK Lakshmi, Dalmia Bharat, and Shree Cement underperformed, posting YoY volume degrowth of ~4.3%, ~1.5%, and ~1.1%, respectively.

Realizations remained under pressure on a YoY basis, but price hikes are anticipated in the near term: In Q3FY25, cement prices exhibited positive momentum, with a recovery supported by strong demand. The price hikes of ~INR10-15 per bag in November and December were well absorbed by the market. Exit prices in December 2024 have largely sustained, with regions like the North, West, and Central witnessing a further ~INR5-10 per bag increase in January and February 2025.

For our coverage companies, realizations declined ~9.0% YoY but improved ~1.3% QoQ, aided by all-India price gains. While we expect further price hikes may be challenging until March 2025 due to the year-end volume push, we believe a reasonable price increase—especially in the South and East—will be crucial from April 2025 to protect margins.

Flattish revenue on YoY; EBITDA down by ~27% YoY but improved ~30% QoQ: Cement companies in our coverage reported flattish revenue growth YoY, as a 10.2% YoY volume increase was offset by a 9.0% drop in realizations. Despite better prices in Dec’24, expected 2-2.5% QoQ realization growth fell short, with some companies seeing a sequential decline. Operating costs declined ~3.8% YoY and ~2.7% QoQ, driven by lower freight and power & fuel expenses, aiding cost control.

Lower pricing impacted EBITDA/t, which declined by 29.4% on YoY, expecting cost reduction initiatives to improve profitability in coming quarters: In Q3FY25, EBITDA/t for our coverage companies declined 29.4% YoY but showed a strong 29.1% QoQ recovery. The average EBITDA/t stood at INR780/t in Q3FY25, down from INR1,104/t in Q3FY24, impacted by lower realizations and higher discounts aimed at driving volume growth. Looking ahead, cement companies are prioritizing cost reduction initiatives, which are expected to support profitability improvement in the coming quarters.

Outlook- Cement companies have guided for ~4% YoY industry volume growth in FY25 and a stronger 7-8% YoY growth in 4QFY25. Demand is expected to be driven by pent-up demand, rising construction activity, infrastructure projects, and steady demand from IHB and real estate segments. Improved cement demand has also supported price hikes in Q3FY25, with current prices up ~1-2% from the quarter’s average. Companies are concentrating on refining pricing strategies, boosting the market share of premium products, and emphasizing cost-reduction initiatives. Companies like Ultratech and Ambuja aim to lower their total cost per ton by 200-300/t and 500-530/t, respectively, over the next 3-4 years.

Our high conviction picks of the quarter are- Ultratech Cement and JK Cement.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131