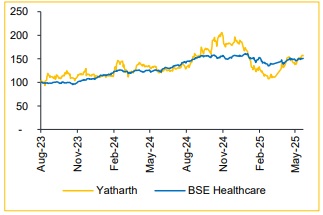

Buy Yatharth Hospitals Ltd For Target Rs. 640 - Choice Broking Ltd

Delhi-NCR Leadership Through Specialties:

Yatharth’s focused expansion in the underserved Delhi-NCR region, combined with high-end super-specialty services, drives superior ARPOB and sustained margins, reinforcing its leadership in advanced tertiary care.

View and Valuation:

We maintain our 'BUY' rating with a target price of INR 640 (from INR 630), valuing the company at an EV/EBITDA of 14x on FY27 basis. We expect growth to be driven by an increase in ARPOB, improved occupancy (targeting 70% across old facilities), strategic acquisitions, continue its current revenue growth trajectory (~30%), and a higher share of super-specialties, which is expected to contribute more than 10% of total revenue.

Revenue & EBITDA beats estimates, however PAT came marginally below estimates

* Revenue grew by 30.4% YoY and 5.8% QoQ at INR 2.3 Bn (vs consensus estimate of INR 2.2 Bn), driven by higher occupancy, ARPOB growth, and an increased share of high-specialty therapies, including oncology.

* ARPOB grew by 7.4% YoY to INR 31,441, with occupancy at 61, compared to our estimate of INR 30,800 with 60% occupancy.

* EBITDA grew by 22.6% YoY and 3.9% QoQ at INR 0.6Bn, with margin contracting 157bps YoY and 45bps QoQ at 24.6%(vs consensus estimate of 25.1%).

* PAT remained flat on YoY and grew by 27% QoQ to INR 0.4 Bn (vs consensus of INR 0.4 Bn).

Despite Lowest ARPOB (refer exhibit 1), it continuous to grow above peers (+10% every year)

Despite having one of the lowest ARPOB levels in the sector, Yatharth Hospital continues to grow over 10% annually. In FY25, volume surged 16% YoY, while newer hospitals like Greater Noida contributed INR 426Mn within 10months. We expect that the company will focus on expanding high-margin specialty services, reducing government mix (e.g., only 20% in newer facilities), and maintaining 70%+ cash conversion ensures sustainable growth despite lower pricing metrics.

Yatharth Set to Surpass 3,000 Bed Capacity Target by FY28; with Strategic Expansion in Underserved Market

Yatharth is on track to exceed 3,000 beds by FY28, supported by strategic capacity expansion and strengthens its presence in the high-growth Delhi-NCR region. These hospitals will offer super-specialty services from day one, supporting higher ARPOB and faster ramp-up. With EBITDA breakeven expected within 12–15 months, the expansion is set to drive strong volume growth and operating leverage. As of FY25, it added 200 beds at Greater Noida, which alone contributed INR 426Mn in 10 months, accounting for 9% of Q4 revenue. Two new hospitals (400 and 300 beds) are expected to be fully operational within six months of launch. Additionally, brownfield expansions in Greater Noida and Noida Extension will add 250 beds each. We expect that with average occupancy exceeding 60% these additions are expected to significantly boost topline and patient volumes in North India.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131