Buy VIP Industries Ltd for the Target Rs. 475 by Motilal Oswal Financial Services Ltd

Strategy reset, more work to be done; turnaround in FY27

VIP Industries’ (VIP) 3QFY26 print was below our estimates. Consolidated revenue declined 9.4% YoY to INR4.5b, while EBITDA and PAT witnessed losses. The revenue decline was on account of: 1) heavy discounting in the Carlton brand, according to our channel checks, 2) elevated competition in the MT/GT channels, and 3) lower realization. VIP cut inventory by INR1.2b in 9MFY26, and we expect the company to introduce new designs over the next quarter. In addition, the company reported a one-time exceptional gain of INR712m from the sale of non-core assets. We expect the company’s strategic focus on clearing old inventory and selling non-core assets to result in a stronger balance sheet. While the inventory provisioning reflects proactive cleanup and improved supply chain discipline, renewed brand investments and rationalized discounting should aid in sustainable growth. With Mr. Atul Jain’s leadership and ongoing premiumization trends, VIP is poised for margin recovery and market share gains, in our view.

Subdued performance: Higher discounting across GT/MT channels

VIP’s 3QFY26 consol. revenue declined 9.4% YoY to INR4.5b. 3Q saw a strong pickup in GT/MT and retail channels, resulting in higher discounting. We highlight that, amid ongoing litigation related to the Carlton trademark, we expect VIP to focus on liquidating system inventory within the stipulated period (six months). Our channel checks indicated that VIP ran 50% discounts on Carlton brands across EBOs, MT outlets, and select retail kiosks. In addition, despite lower saliency, e-commerce contributed to some volume uptick. VIP cut inventory by INR1.2b in 9MFY26, and we expect the company to introduce new inventory over the next year. With inventory cleanup underway, we believe the company is well-positioned to scale up revenues in FY27, supporting the topline growth of over 14% in FY27-28.

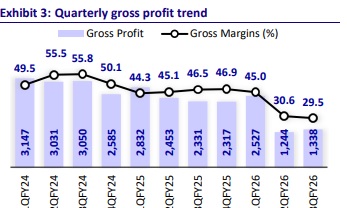

Gross margins contract to 29.5% due to higher provisions

Gross margins contracted to 29.5% (-1,707 bp YoY and 117bp QoQ), impacted by an INR543m soft inventory provision taken in 3Q. EBITDA loss came in at INR768m, settling EBITDA margin at -16.9% (-2263bp YoY and +926bp QoQ), led by employee costs (+3.2%) and other expenses (+2.9%). Adjusting for a one-time inventory provisioning cost of INR543m in COGS, EBITDA loss came in at INR225m (-179% YoY). In addition, the company reported a one-time exceptional gain of INR712m, mainly on account of the sale of non-core assets. With the new management focusing on inventory cleanup and re-establishing price discipline, we anticipate a strong recovery in EBITDA in FY27.

Valuation and view: Reiterate BUY; expect turnaround in FY27

We expect VIP to gain market share and deliver industry-beating growth, supported by strategic drivers that include: 1) a celebrity-led campaign to drive brand recall, 2) product upgrades with distinctive features, such as the Smart Bag-Tag, 3) store rationalization through the closure of low RoI EBOs, and 4) the Bangladesh plant’s turnaround. Despite near-term weakness in performance, we are optimistic about VIP’s growth story. Considering the 9MFY26 performance, we have trimmed our earnings estimates for FY26E/FY27E. We reiterate BUY with a revised TP of INR475 (implying 40x FY28E EPS). Risks: local competition, significant rise in input cost, and prolonged disruption in the Bangladesh facility (refer to our IC note dated Sep’25).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412