Buy Varun Beverages Ltd for the Target Rs.550 by Motilal Oswal Financial Services Ltd

Delivering growth on two fronts: International and domestic

Varun Beverages (VBL) has been one of the fastest-growing domestic FMCG companies, registering a revenue CAGR of 20% over the last 10 years. This growth is driven by an agile management team focused on expanding operations through product diversification, geographic expansion, and entry into newer segments. On this front, VBL’s international expansion is emerging as a gamechanger for the company’s next phase of growth. The international market offers scale and high-growth business vs modest growth in the domestic beverage market (due to increasing competition and seasonal headwinds)

* Apart from growth in countries adjacent to India, Africa offers meaningful scale, with beer expanding ~6% CAGR (over CY24-33) and CSDs adding stable volumes (2.8% CAGR). With PepsiCo underpenetrated vs Coca-Cola, VBL’s execution and distribution strength create a clear path to growth.

* After taking its first step in 2013 and recently expanding further through the acquisition of The Beverage Company (BevCo) and Twizza (regulatory approval pending), VBL has built a decent footprint in Southern Africa. The company has now established a presence (manufacturing and distribution) in both the beverages and snacks segments across the Democratic Republic of Congo (DRC), Zambia, Zimbabwe, Namibia, Mozambique, Madagascar, Botswana, and majorly South Africa. It also has a presence in Morocco.

* South Africa, being the largest beverage-consuming market in Africa, represents a key growth lever. VBL’s next leg of expansion, through Carlsberg’s alcobev distribution deal and the acquisition of Twizza, will further strengthen its South Africa footprint (combined market share of ~27%).

* The two recent deals unlock multiple synergies. VBL’s growing distribution and cold-chain infrastructure, along with its scalable African manufacturing base (including underutilized Twizza capacity), position it to drive rapid, lowcapex premium beer expansion. These capabilities also enhance logistics efficiency and provide optional future localization or co-packing (for beer) across the African markets.

* International markets are driving VBL’s growth, with volume share rising from 18% in CY19 to 31% in CY25, and expected to sustain. Africa-led expansion across CSDs, snacks, and alcobev strengthens scale, despite currency, tax, and competitive risks.

* Amid an unprecedented competitive environment in CY25, marked by aggressive industry-wide discounting and adverse weather conditions, VBL adopted a disciplined and differentiated strategy anchored in pack optimization and surgical market interventions. Looking ahead, strategic innovation, capacity investments, and premiumization initiatives position VBL to deliver double-digit domestic volume growth in CY26, with margins expected to stabilize near current levels despite near-term realization pressures.

* We expect a CAGR of 13%/13%/16% in revenue/EBITDA/PAT over CY25-27. We value the stock at 45x CY27E EPS to arrive at a TP of INR550. We reiterate our BUY rating on the stock

Africa provides the next leg of scalable growth for VBL

* After covering over 90% of the domestic PepsiCo market, VBL has focused on strengthening its international presence (mostly in Africa).

*- The company’s international business has evolved from being a peripheral South Asia adjunct to India into a second structural growth engine centered on Africa. The strategy has three layers: 1) build a scaled PepsiCo bottling and distribution platform across underpenetrated, high?growth beverage markets (primarily in Africa); 2) leverage this platform to add adjacencies–notably snacks and now alcobev (Carlsberg); and 3) over time, position the international business as a material contributor to growth, diversification, and valuation, rather than just a satellite to India.

* As part of its first strategy, VBL is strengthening PepsiCo bottling operations via distribution alliances, greenfield manufacturing, and the takeover of local beverage companies such as BevCo and Twizza, enabling the company to unlock idle capacity for PepsiCo bottling while maintaining local brand sales.

* The African beverage market offers both size and growth, with beer significantly outpacing CSDs in expansion. Beer demand is expected to expand at ~6% CAGR (the market stood at ~USD44.1b in 2024, accelerating to ~USD74.7b by 2033), while CSDs provide stable, recurring volumes (market valued at ~USD24b in 2024 and projected to reach ~USD30.8b by 2032, i.e. 2.8% CAGR). VBL is positioned to aggressively scale PepsiCo’s underpenetrated footprint against a Coca-Cola-led market, leveraging its distribution and execution strengths.

* South Africa dominates both categories regionally, representing the largest CSD market in Southern Africa and accounting for over 30% of Africa's beer market. The continent's young, urbanizing population, combined with rising disposable incomes and underpenetrated beverage consumption, creates sustained demand drivers across both categories.

Entered in 2012, Africa emerges as a key geography for growth

* VBL entered the African market through a franchise/distribution model in Morocco, Zambia, Zimbabwe, along with a few smaller markets, over 2012- 2018. It also acquired select plants in Southern and Northern Africa, primarily focused on CSD and Water (strategy: existing business; new region).

* A major step in VBL’s Africa expansion was the acquisition of BevCo in South Africa in Mar’24 (deal announced in Dec’23). The company paid INR13b, along with follow-on equity infusion and debt support to the entity. The BevCo acquisition strengthened VBL’s footprint in the South African market, adding five plants with a combined capacity of ~3600bpm (bottles per minute).

* This acquisition is expected to help widen VBL’s distribution coverage to other regions, such as Lesotho, Eswatini, Namibia, Botswana, Mozambique, and Madagascar. ? Beyond strengthening manufacturing and distribution capabilities, the BevCo acquisition positioned VBL as the #2 player in the South African CSD market (Pepsi share is mid-teens; Coca-Cola remains dominant).

* With its African market strategies proving successful, VBL has focused on consolidating and deepening its presence across the continent. It has set up a greenfield plant in the DRC with a capex outlay of ~INR6b.

* It also entered the adjacent snacks manufacturing category in Morocco, Zimbabwe, and Zambia (each plant capex will be ~USD7m, with ~5,000MT annual capacity) through a partnership with PepsiCo (Simba/Simba-type brands).

* The major rationale for entering an entirely new category was to leverage the existing route?to?market to sell salty snacks (a classic CSD complement), improve route economics, and begin building a food pillar.

Second leg of Africa expansion begins with two major deals

* In line with its African expansion strategy, VBL recently entered into two major deals: 1) an exclusive alcobev distribution agreement with Carlsberg Breweries A/S for its Carlsberg brand; and 2) the acquisition of South Africa’s fourth largest soft drink player, Twizza, in Dec’25.

* This exclusive distribution agreement with Carlsberg Breweries A/S for its Carlsberg brand marks a pivotal step in VBL’s transition into a full-fledged beverage company (addition of alcobev). The partnership creates compelling synergies across multiple dimensions, leveraging VBL's extensive African infrastructure to accelerate Carlsberg's market penetration without the need for capital-intensive brewery investments.

* To further strengthen its Africa operations, VBL acquired South Africa’s fourthlargest soft drink player, Twizza, in Dec’25 for consideration of ZAR2.1b (INR11.2b valued at ~1.2x EV/sales). The transaction is expected to close by Jun’26, subject to regulatory approvals. This acquisition will complement VBL’s existing operations (BevCo) in the region, enhance its South Africa presence, increase its volume share to over 20% (from ~14%), and enhance its manufacturing scale.

Prominent synergies with the two deals

* The key synergy in the Carlsberg deal will be VBL’s existing distribution network, which Carlsberg can leverage effectively. VBL’s growing distribution network across Africa provides Carlsberg with instant, deep last-mile access to traditional and modern trade channels. By leveraging existing routes, Carlsberg can avoid years of build-out and heavy capex, enabling rapid premium beer penetration across multiple markets.

* Within the distribution network, the cold chain plays a vital role for cold beverages. VBL’s investment in cold-chain infrastructure, including visi-cooler manufacturing, ensures optimal beer storage and display. Using the same refrigeration assets for both soft drinks and beer improves utilization, preserves product integrity, and lowers per-unit fixed costs across retail points in Africa.

* Manufacturing presence to strengthen with Twizza’s acquisition: Founded in 2003, Twizza operates three well-spread manufacturing facilities in South Africa with an installed capacity of 100m cases. In addition, VBL’s strong existing manufacturing presence in Africa (capacity established through the Bevco acquisition and greenfield plants in DRC, Zimbabwe, and Morocco) offers Carlsberg future optionality for localized brewing or co-packing. Its beverage manufacturing capabilities closely mirror beer requirements, enabling faster, lower-risk production localization vs greenfield brewery investments.

* These key synergies are expected to drive cost optimization through shared infrastructure, such as shared warehousing, logistics, trucking, import expertise, and regulatory capabilities, materially reducing Carlsberg’s operating costs. This asset-light partnership model aligns with Carlsberg’s SAIL’27 strategy, accelerating market entry while minimizing capital.

International performance picks up amid domestic slowdown

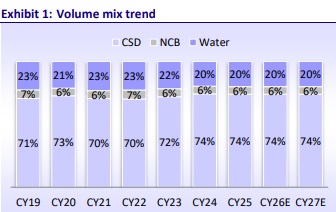

* The international market is currently growing faster than India and is increasingly driving incremental volumes, although margins remain lower than the mature India CSD market. The volume share of international business has increased to 31% in CY25E vs 18% in CY19. International volumes have grown in mid- to high?double digits in recent quarters, even as India has occasionally witnessed flattish quarters due to monsoons, competition, or base effects. We expect international volumes to sustain this volume share of ~31% by CY27.

* The company is expected to continue its organic and inorganic growth in the African market across three distinct but adjacent categories of CSDs, snacks, and alcobev. According to industry sources, VBL currently holds a market share of ~20.5% with BevCo, which is expected to increase to ~27% post the acquisition of Twizza (~6%). This will take VBL a step closer to the market leader, CocaCola, which holds a 52.2% market share in South Africa. ? Key risks in these markets include currency volatility, excise taxation pressure, and intense competition from global giants (AB InBev, Heineken, Coca-Cola), which could constrain profitability.

Realigning strategies in the domestic market to shield growth amid heightened competitive scenario

* The domestic market witnessed unprecedented competitive intensity in CY25, characterized as ‘the worst season’ due to adverse weather conditions and aggressive competitor discounting.

* Rather than engaging in price-based competition, amid rivals’ aggressive promotional liquidation, VBL adopted a differentiated approach, focused on strategic pack optimization and precise market interventions.

* VBL’s Indian business delivered 10.5% volume growth YoY in 4QCY25, despite muted value expansion, primarily driven by tactical pack upsizing rather than margin-dilutive discounting. The flagship INR20 pack was upsized from 250ml to 400ml, with all portfolio upsizing completed in 4QCY25.

* This strategy preserved consumer value perception while maintaining unit economics, contrasting sharply with competitive deep-discounting tactics.

* Additionally, the INR10 price-point SKU deployment remains strategically surgical, limited to West Bengal and Northeast markets, with the portfolio capped at 5-7% of overall volumes.

* With these efforts, we expect VBL’s Indian business volumes to grow in double digits in CY26. However, realizations may decline. Despite this, we expect value growth to be in double digits, which we believe is healthy considering the competitive intensity.

* Despite the anticipated volume growth, Indian margins are projected to stabilize near current levels of ~26% (CY25), underpinned by operating leverage, variable cost optimization (such as route optimization, packaging weight reduction, and backward integration into preforms/closures), and strategic formulation adjustments. These levers are expected to limit the profitability impact to under 10% on price-sensitive volume segments, reflecting a disciplined pricing architecture rather than broad-based discounting strategies

* Additionally, innovation serves as the primary competitive moat: Expansion in the Energy category (Ad Rush with ATL support), the launch of Nimbooz Jeera (Mar’26), and the growth of the health-conscious portfolio (59% low/no-sugar mix) position the company for premiumization-led growth rather than commoditized price competition, ensuring sustainable margin expansion alongside volume momentum.

* Key volume growth levers include energy drink expansion, bottle upsizing initiatives, and small SKU launches across selected markets. While volume growth remains the primary focus, realization pressures will persist in the near term due to competitive market dynamics. VBL has added ~40-50% capacity over the last two years and has sufficient manufacturing capacity, as of Dec’25, to support projected growth.

Valuation and views

* Africa has emerged as VBL’s next scalable growth engine, evolving from a franchise-led presence into a structurally important international platform. With domestic PepsiCo seeing modest growth, Africa offers a compelling mix of size and growth across CSDs, snacks, and now alcobev.

* Strategic moves such as the BevCo acquisition, greenfield investments, and entry into snacks have built a strong manufacturing and distribution backbone. The recent Carlsberg partnership and Twizza acquisition mark the second phase of expansion, unlocking portfolio depth, operating leverage, and cost efficiencies. This Africa-led growth is set to meaningfully drive diversification, earnings momentum, and mid-term growth.

* For India, VBL's disciplined strategy prioritizes sustainable growth over aggressive pricing. By focusing on innovation, portfolio optimization, and selective market interventions, the company is well-positioned to deliver strong volume growth while maintaining healthy margins in CY26. With sufficient capacity and a premiumization-focused portfolio, VBL demonstrates resilience against competitive pressures while preserving long-term profitability.

* We expect a CAGR of 13%/13%/16% in revenue/EBITDA/PAT over CY25-27. We value the stock at 45x CY27E EPS to arrive at a TP of INR550. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412