Buy Rategain Travel Technologies Limited for Target Rs .757 by Religare Broking Limited

Transformative Q3 Led by Sojern Consolidation: RateGain delivered a landmark Q3 FY26, termed a “transformative quarter” driven by the integration of Sojern. Consolidated revenue surged 94% YoY to Rs. 540 crore, the highest ever, with Sojern contributing two months of performance. While reported PAT declined due to acquisition-related costs, the underlying business remained healthy, with adjusted PAT growing 8% YoY. Management reiterated its long-term ambition of scaling revenues to $1 billion by 2030, supported by stronger platform depth and global expansion opportunities.

Strong Revenue Growth with Healthy Profitability Metrics: Organic revenue for RateGain stood at Rs. 290 crore, growing 4.1% YoY, though some billing was deferred from late December into January. Importantly, 9-month bookings rose 30% YoY, indicating strong demand momentum. Consolidated EBITDA increased 42% YoY with margins at 16.1%, while RateGain’s standalone margin remained higher at 17.5%. Reported PAT was Rs. 26.5 crore, but adjusted PAT improved to Rs. 61.1 crore after excluding Rs. 34.6 crore of one-time M&A and finance-related expenses.

Sojern Integration Ahead of Schedule with Synergy Gains: Sojern integration is progressing faster than expected and is already delivering profitability in Q3, aided by marquee account wins and cost alignment. Management executed ~$12 million in annualized cost savings within the first 100 days, largely permanent reductions in G&A, with full benefits visible from Q1 FY27. Investors were cautioned that November–December are seasonally weak for Sojern. The Adara–Sojern combination positions RateGain as the dominant provider for DMOs, a $90 million opportunity

Growth Engines Expanding Across Martech and DaaS: RateGain continues to scale through Martech and Data-as-a-Service. Demand Booster and Sojern offerings are being merged into a unified commercial stack, enabling hotels to optimize marketing performance, audience intelligence, and direct bookings. A major customer returning through a pilot highlights strong platform ROI. In DaaS, Navigator has evolved from dashboards into AI-assisted commercial clarity, providing actionable pricing and market-share insights. Singapore Airlines extending its partnership reinforces RateGain’s credibility in parity intelligence and embedded data solutions

Integrated AI Stack Driving Product Differentiation: Management emphasized RateGain’s strategy of building an integrated AI-powered stack rather than standalone tools. Uno Viva, an AI voice agent, has already shown measurable booking conversion impact, especially relevant in labor-short markets like the US and Europe. AI Concierge from Sojern automates up to 80% of guest queries and has delivered up to 300% improvement in ancillary revenues for hotels. Internally, AI adoption is accelerating, with nearly half of RateGain’s code now AI-generated, improving productivity and automation across functions.

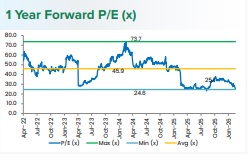

Outlook, Margin Trajectory and Balance Sheet Strength: Management expects double-digit organic growth in Q4 FY26 (excluding Sojern) and has reaffirmed FY26 guidance of 6%+ organic growth with EBITDA margins of 17.5–18%. Sustainable margins are targeted at 18–20%, with any excess above 20% planned for reinvestment into GTM expansion to support the $1 billion revenue goal. The company repaid approximately $25 million of acquisition debt within 90 days; net debt stands at ?880 crore with ?360 crore in cash, and management aims to become net debt positive within 30 months. Cross-sell potential across ~17,000 customers remains a key upside driver into FY27. On the financial front, Revenue, EBITDA, and PAT are estimated to grow at CAGRs of 14.8%, 7.8%, and 8.9%, respectively, over FY25-27E. Consequently, we revise our rating to BUY with a target price of Rs. 757.

Key Highlights:

* Seasonality Impact in Sojern Business Model: Management highlighted that Sojern’s business has a structurally seasonal profile, with November and December being the weakest months of the year. This is because Sojern’s property-led revenue stream, which contributes meaningfully to its annual pipeline, tends to soften during this period. As a result, the first two months of consolidation may not fully reflect the normalized earnings power of the acquired entity. Management expects this seasonal drag to reverse in Q4 and improve further into FY27. Investors were advised to interpret near-term volatility in consolidated performance with this seasonality in mind.

* Revenue Recognition Shift Toward Gross Reporting: The company clarified that Sojern reports revenues on a gross basis, consistent with Adara and RateGain’s Martech segment. This accounting approach is important as it impacts reported topline scale and comparability across business lines. Management emphasized that this alignment ensures consistency in financial reporting going forward, especially as Sojern becomes fully consolidated. Investors tracking growth trends will need to adjust for this reporting structure, since gross revenue recognition can inflate topline numbers relative to net reporting peers. Overall, the clarification improves transparency and helps set clearer expectations for future segment disclosures.

* Massive Customer Base Unlocks Cross-Sell Opportunity: A key strategic takeaway was the scale of Sojern’s customer network, which includes approximately 13,000–14,000 clients compared to RateGain’s ~3,200 customers. Importantly, management noted that customer overlap is less than 5%, creating a significant opportunity for cross-selling RateGain’s broader tech stack into Sojern’s large installed base. The company is currently harmonizing customer reporting methodology, with unified disclosures expected from Q4 onwards. Management believes this expanded reach strengthens distribution, accelerates platform adoption, and provides a long runway for incremental revenue synergies through deeper penetration across hotels and travel partners globally.

* Margin Strategy Balances Growth vs Profitability: Management reiterated that RateGain’s margin strategy will prioritize long-term market leadership over short-term profitability maximization. While the business is capable of delivering EBITDA margins above 20%, leadership stated that any excess margins will likely be reinvested into growth initiatives, particularly Go-To-Market expansion. The sustainable consolidated margin band remains 18–20%, with management comfortable operating within this range as integration benefits flow through. This approach reflects a deliberate balance between profitability discipline and capturing white-space opportunities in a rapidly evolving travel-tech landscape, supporting the company’s ambition of scaling aggressively toward its $1 billion revenue goal

* GTM Hiring Cycle Near Completion, FY27 Growth Visibility Improves: Management provided important commentary on the company’s increased GTM investments, clarifying that the bulk of spending has been directed toward payroll and hiring of new sales teams rather than one-time marketing expenses. These teams typically require 6–12 months to reach full productivity, meaning the revenue payoff is expected to accelerate into FY27. Management noted that ROI is already visible through the expanding order book and 30%+ booking growth over nine months. With most of the hiring cycle nearing completion, margins are expected to improve sequentially in Q4, while organic growth momentum strengthens further next year.

* Active M&A Pipeline Beyond Sojern: RateGain confirmed that it continues to maintain an active acquisition framework even after the transformational Sojern deal. Management emphasized that M&A remains a strategic lever to expand capabilities, strengthen platform depth, and accelerate global scale. The company is constantly evaluating targets, generally focusing on businesses with revenues above $5 million that can add complementary technology or customer reach. While no immediate deal was announced, leadership indicated the acquisition engine remains operational. Supported by healthy cash generation and improving leverage, RateGain retains flexibility to pursue further bolt-on opportunities aligned with its long-term $1 billion revenue ambition.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ00017433

.jpg)

.jpg)

2.jpg)