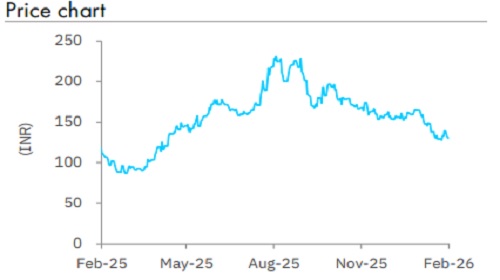

Buy Paradeep Phosphates Ltd For Target Rs 247 By Elara Capital

Current valuation offers huge margin of safety

Paradeep Phosphates (PARADEEP IN) reported slightly weak results as raw material s headwinds weighed on EBITDA growth. Manufactured phosphatic fertilizer volume grew 11% YoY and PARADEEP continues to operate at peak utilization. The company is investing heavily in capacity expansion through debottlenecking as well as Brownfield expansion. A significant part of capex will commercialize in FY29 ,which enables it to deliver >50% EBITDA growth by FY30 over FY28. Unt il then , EBITDA may remain flat , as current capacit y is fully utilized and benefit s from 0.2mn tonn e phosphoric acid plant will be offset by erosion of urea business profitability due to expiration of special incentives . However , current valuation at 10.3x TTM EPS of INR 12.8 has already factored in subdued earnings growth and provide s huge margin of safety . We re tain Buy with a higher TP of 247 based on 11.5x H1FY28E EV/EBITDA.

Capacity expansion underpins the next phase of growth: PARADEEP outlined a capex of INR 36bn, includes INR 8bn for a 1.0-mn tonne granulation capacity, and INR 15bn toward backward integration, comprising 0.25mn -tonne phosphoric acid and 0.75mn -tonne sulphuric acid capacity at the Odisha site . Around INR 11.5bn is earmarked for phosphoric acid (0.25mn tonne) and sulphuric acid (0.75mn tonne) capacit y at the Mangalore plant. Environmental clearance (EC) for the acid plants at PARADEEP is already in place, wh ile EC applications for Mangalore are expected to be filed shortly . For the granulation expansion, the EC process is underway, with public hearings expected shortly and clearance likely by August – September. Management says technical discussions with key equipment suppliers are advanc ing , with commercial finali zation and order placement targeted by March – April. These projects are set to be commissioned by FY29 , leading to an incremental EBITDA contribution of INR 14bn (includes debottlenecking initiatives) by FY 30 over FY28.

Debottlenecking initiatives to support margin: Phosphoric acid capacity of 0.2mn tonne is being added by debottlenecking some processes, with 0.1mn tonnes likely to be commissioned in Q2FY27 and the balance in Q4FY27. In addition, granulation capacity of 0.2mn tonne is being added via debottlenecking by FY28, which should support higher downstream utili zation. At Mangalore, a 300 -tonne per day sulphuric acid expansion is underway, further strengthening backward integration. These debottlenecking initiatives are likely to support margin and improve operating leverage benefit s

Retain Buy with a higher TP of INR 247: The combined entity post the merger benefits from scale, sourcing, distribution reach and a wider product portfolio. After operationalization of new capacit y in FY29, PARADEEP will morph into a fertilizer behemoth. The journey from until FY29 E may yield limited profit growth but current valuation at 10.3x P /E based on TTM EPS is already factoring it and provide s huge margin of safety. We slightly increase our EBITDA estimates by 4% for FY26, by 2% for FY27 and 3% for FY28 . We re tain Buy with a higher TP of 247 from INR 238 based on 11. 5x (unchanged) H1FY28E EV/EBITDA. Lower nutrient based subsidy and rising debt are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933